I can’t believe how quickly Christmas snuck up on us. Can you? We celebrated the season a little early when we made my daughter’s No. 1 present on her list of things she wanted for Christmas come true: She got a kitten! (Actually it’s for the whole family). You should have seen her face when she picked one out and we told her yes to actually taking it home. I don’t think there’s anything else out there that could have compared. So while the love of an adorable little kitten was enough to keep my kids busy, my wife and I were still faced with the endless “what do you want?” “I don’t know, what do you want?” “I don’t know, what do you want?” routine. Every other day the two of us would say things to each other like “make me a list” … [Read more...] about How the Things I Want for Christmas Are Different Now That I’m An Adult

Getting Serious About Building Up My Multiple Streams of Income in 2014

2013 was a pretty big achievement for me as far as passive income goes. It wasn’t that long ago that I thought that taking advantage of a few free credit card offers or checking account promotions was the way to make some good money on the side. Little did I know, however, that through treating my blogging ambitions more like a business rather than a hobby that I would be able to make more money in a month than I made in a whole year using those methods! … [Read more...] about Getting Serious About Building Up My Multiple Streams of Income in 2014

Make Sure You Know What You’re Getting Into Before Starting a New Career

Sometimes it happens. We think we know what we want to be when we grow up, and we make every honest effort to get there and fit that role. But then reality sets in. The job isn’t quite as glamorous as we thought it would be. The hours aren’t great. The pay or advancement opportunities aren’t really there. And all around everyone seems pretty miserable or complacent. Is this how you really want to spend the next 30 years of your life? Surviving? Fortunately starting a new career isn’t really as tough as some people think it is. In my career I’ve seen engineers leave to become doctors, project mangers become financial advisers, and some people make the move to the greatest profession of all – entrepreneur! But nonetheless … [Read more...] about Make Sure You Know What You’re Getting Into Before Starting a New Career

Niche Website Update 12 – Getting Click-Bombed and Over $600 of Passive Income!

Can you believe the year is almost coming to a close? It seems like just the other day I was writing for the first time about which passive income idea I was going to actively pursue as my next great way to try to increase my side income. Obviously for me I felt that developing a niche site was the option that made the most sense. And so now here we are with almost one year down and three active sites moving along. This November our niche website portfolio had a lot of ups and a few downs. One big event that was a pretty big scare happened right on the first day! More on that story below. But luckily we ended the month with a record-breaking bang! And on that note, let's get down to it starting with the part of these updates … [Read more...] about Niche Website Update 12 – Getting Click-Bombed and Over $600 of Passive Income!

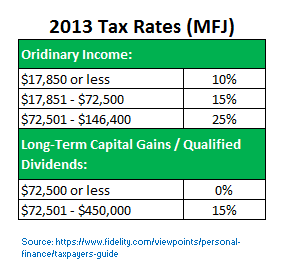

Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

One of the great things about running a personal finance blog like mine is that sometimes you think you’re right about something. So you publish it. And then you find out very quickly from your audience that you could have done a much better job! Just before Halloween, I published what started out as my valiant attempt to challenge the belief that investing in a 401k plan is the better of the retirement income strategies when you compare it to a regular taxable stock-based account. In case you haven’t read it yet, please feel free to check it out here. While I thought I had put forth a good effort, I was humbly delighted to receive a number of comments that pointed out several flaws with several of the assumptions I used to reach … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

You Got That Bad Investment Planning Advice From Dave Ramsey?

As much as we’d like to think that personal finance is a perfect science, it simply isn’t. To some degree there is an extent of art and skill that has to be applied. You have to look at certain metrics, past returns, and other intangibles to make some educated decisions about your investment planning prospects. At times the process can be very subjective. And when things are subjective, that can open us to being misguided or wasting time going down the wrong path. So if that were to happen, you would usually expect that kind of bad advice to come from some two-bit financial planner who doesn’t know what he’s talking about. Or it would come from someone pushing his own agenda. But would you have ever expected bad investment advice … [Read more...] about You Got That Bad Investment Planning Advice From Dave Ramsey?

New Car vs Used Car – Which One is the Better Buy?

Whether you’re looking at buying your first car or replacing a previous vehicle, there’s one decision you need to make right away: new car vs used car? That one decision will determine, to a large degree, where and how you shop for your vehicle. New Car vs Used Car Factors to Consider: While the financial factor of this decision isn’t the only thing to consider, it is a significant factor. Here are some of the basic financial assumptions involved in buying a car: A new car will cost more than a used car. The sticker price on two comparable vehicles, one new and one used, will vary significantly. A new car loses as much as 40% of its value in the first three years (about 15% of that in the first year), and you can expect to … [Read more...] about New Car vs Used Car – Which One is the Better Buy?

Could Early Retirement Planning Be Ruining Me?

In a lot of ways I think that I’m so much better off for being so active in my own finances and early retirement planning. All around me I see people who have not taken control of their financial future - and it devastates them. They are stuck working at jobs they hate until well into their golden years. They have to miss family engagements. They are under the servitude of others until their health no longer allows them or qualifies them to be. It’s a sad way to go out, and it’s not something that I will ever allow for myself or my family. But despite my best intentions to achieve what others feel is unachievable, Is there a dark side to my obsession with planning for an early retirement? … [Read more...] about Could Early Retirement Planning Be Ruining Me?