Not too long ago, I was trying to demonstrate how NOT taking full advantage of your 401k matching contributions offered by your employer was causing you to lose out on more money over the course of your career than you probably thought! While it’s never too late to get your personal finances in order, one simple mistake I see people making all the time that kills me is when they wait as late as 5 to 10 years before they finally get with the program and start contributing enough to their retirement plan to get the full 401k matching from their employer. I beg you - Please don’t waste another year! Remember time is one of your greatest assets as an investor, so don’t squander it! In this post, I’ll show you just how powerful taking … [Read more...] about Why You Need to Get Your Full 401k Matching as Early as Possible

Goal Setting Activities for Your Personal Finances

Very shortly it will be a brand new year and a chance for brand new beginnings. So with that, I ask: What are you going to do differently with your finances than you did last year? Not sure? That doesn’t surprise me. We all want the best for our money and our future, but it’s pretty hard to figure out how to go somewhere if you don’t even know where it is you’re going. To really understand what it is that you want, you need to expand your financial perspective through a series of goal setting activities that help you figure out how you feel about yourself and your money. Once you’ve had the chance to visualize what it is you really want for your money, I think you’ll be surprised by how easily things will come together. Please take … [Read more...] about Goal Setting Activities for Your Personal Finances

A Moment of Silence for the Connecticut School Shooting

I was originally planning to post something fun or entertaining this weekend for my usual wrap up. But given the recent events with the Connecticut school shooting, I really didn’t feel very comfortable doing so. Instead, let’s take a moment of silence to extend our hearts out to those who were affected by this hideous tragedy. … [Read more...] about A Moment of Silence for the Connecticut School Shooting

Budgeting Advice to Help Keep You Motivated

Why do budgets fail? You read through your receipts. You set your goals and limits. And you track your purchases. Yet, even after accounting for every dollar and laying out the best laid money design possible, there is still one thing that could sabotage the whole thing: The motivation to participate. One of the hardest things about keeping your household budget on track is staying motivated. No matter how great your plan is on paper or what kind of budgeting advice you follow, it will all be meaningless and accomplish nothing if the people involved can’t agree to stick to it. People often under-estimate how quickly a low morale can derail your best efforts. But fear not! A few small rewards or signs of success can be just enough to … [Read more...] about Budgeting Advice to Help Keep You Motivated

Figuring Out the Operational Cost for Santa’s Christmas Presents

Do you see that thing over on the left? That is the Lego Star Wars Death Star, and it’s what my son wants for Christmas (among a thousand other things). It’s pretty amazing as far as Lego sets go; capturing several different scenes from the Star Wars movies into one toy. However, it also costs around $380. (It was $400, but they kindly knocked the price down for Christmas). That is pretty ridiculous; even for a Lego set. Plus it is way over the limit my wife and I are prepared to spend for each of our kids. While picking up my kids from school, I tried to explain to my son that I don’t think he’ll be getting a Lego set that costs the equivalent of a car payment for Christmas. To that, he replied “That’s okay, I’ll just ask Santa”. When I … [Read more...] about Figuring Out the Operational Cost for Santa’s Christmas Presents

Building a Special Gift for Your Young Adult Children

While shopping for my kids this Christmas, I’m reminded by just how much you just want to spoil those little stinkers. What parent can deny this natural instinct? There really are fewer things better than waking up on Christmas morning to see how excited your children get when they open their presents. Taking this instinct one step further, it’s also natural for you to want your kids to grow up to be the best adults they can be. You give them chores to do to learn hard work, you give them an allowance to teach them about budgeting, and you help them with their homework to encourage learning. And on the things they can’t do for themselves, you want them to still have every opportunity available to excel. This gets me thinking about a … [Read more...] about Building a Special Gift for Your Young Adult Children

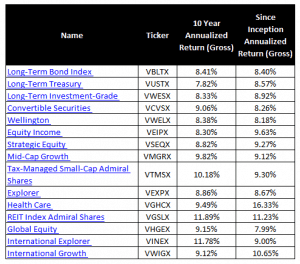

My Picks for Vanguard Mutual Funds for Our Roth IRA

The end of the year is full of things to do: Celebrate the holidays with family, prepare for the winter, get your tax information together, etc. But one very important chore we often forget to perform is re-evaluating our investment portfolios. Unless you review them, how do you know if the investments you own are performing well? Are they still helping you to reach your goals? Are there better choices out there? This is exactly what I’m looking to do with our Roth IRA funds. Both my wife and I both have a Roth IRA through Vanguard which we max out every year. Our belief is that these Roth IRA’s will help us to get tax-free income during retirement or possibly serve as a vehicle to help us fund our early retirement. To a new or … [Read more...] about My Picks for Vanguard Mutual Funds for Our Roth IRA

Ghosts of Personal Finance Bloggers Past

Did we really just quote some Dickens’ to open this post? A Christmas Carol was always one of my favorite Christmas stories, but that’s not what’s got me thinking about this topic. This week I was trying to clean off some of the broken links from my site in hopes of FINALLY raising my Google Page Rank score in the next update. While running the link checker, I kept noticing the same trend of broken links popping up in the results window: Past personal finance bloggers. Yes, if you really want to bum yourself out, go visit your post archive from about a year ago, and look at the names of the people who used to leave you comments. I was finding that a pretty significant number of them no longer visit my site. I decided to find out why. … [Read more...] about Ghosts of Personal Finance Bloggers Past