Taking this instinct one step further, it’s also natural for you to want your kids to grow up to be the best adults they can be. You give them chores to do to learn hard work, you give them an allowance to teach them about budgeting, and you help them with their homework to encourage learning. And on the things they can’t do for themselves, you want them to still have every opportunity available to excel.

This gets me thinking about a much, much larger gift …

The Story of My Great Uncle’s Wedding Gift:

This past summer, one of my great uncles passed away from old age. He was one of my favorite great uncles, and a very positive influence in my Dad’s life.

One of the stories they told at his wake was about how he had given each of his young adult children land for their wedding. They lived in a farming community and fortunately for my great uncle, he had done quite well for himself (though you’d never guess from his very modest lifestyle).

That story and gesture has had me thinking on several occasions:

• How awesome would it be to give your young adult children a wedding gift like a piece of land, a house, or perhaps even just the money to get started with one?

For a moment, let’s forget about our personal finance aspirations like saving for retirement or paying down our debts, and let’s entertain how or if this could actually come true.

A Strategy for Building the Biggest Gift You’ve Ever Given:

Let’s suppose we try to accomplish this by using the stock market. When your child is born, let’s say you put money aside each month in a stock market mutual fund that returns an annualized return rate of 6% after taxes. Assuming you wanted to hit $100,000 by the time your child is age 25, how much would you need to save?

• $144.30 each month

Here is a chart of many different savings options and how much money you’d need to save each month.

Inflation is Always Working Against You:

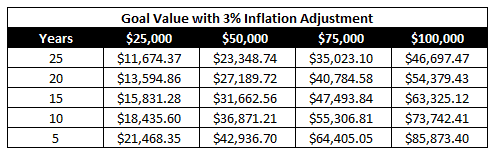

As awesome as it would be to save up and give a gift like this, you’ve still got to remember that inflation is constantly working against you. So for example, even though $100,000 sounds like a ton of money today, what would it’s purchasing power be in 25 years after a 3% inflation rate?

• $100,000 today = $46,697.47 in 25 years.

Here’s what the rest of the savings goals would be like after inflation adjustment:

What About College for Your Young Adult Children?

Obviously we’re playing out this scenario just for fun. A more likely use of such savings for your children and probably more practical goal for most parents would be to save money to help pay for their kids college tuition.

You could use the tables above to accomplish the same thing. For example, let’s say you wanted to save $50,000 within 15 years, your new goal becomes:

• $171.93 each month.

Remember, Your Goals Come First:

Generous aspirations aside, no one can dispute that you’ve got to get your own financial goals in order before you can take on any extra-curricular goals like this. That means paying down your debts, saving for retirement, and reaching your other financial targets. Only after your main goals have been met can you do take on something incredible like this. Like all things with money, it comes down to what your financial priorities are.

Readers – Have you ever thought about doing something extraordinary like this, and running the numbers to see how it would be possible (even just for fun)?

Related Posts:

1) Adding Your Children’s College Savings to the Budget

2) My Cash Flow Plan – September 2012 Update

3) Six Beginner Strategies for 529 Savings Plans

Image Credit: Microsoft Clip Art

I wouldn’t know what to do with such a large gift. I personally like working for everything that I receive and while getting something for nothing would be nice, I would feel better if I had earned it.

I know what I’d do – say Thank You! Making sure it comes at a time when they can appreciate the money would be very key. You don’t need to spoil anyone!

I think giving large sum of money as gifts to your children is perceived differently in different cultures and will also vary from person to person.

Rohit, Do you have an example you can share?

Gosh, I would LOVE to give my children an awesome wedding gift but with the way weddings are going nowadays I think they would be happy if I just helped them pay for it. I would love to give them money for a car, help them pay for their wedding, and help them pay for college. Those are my goals as of right now.

Those are all good, strong goals. The thing I take away from this exercise is that it really wouldn’t take much money to fund the goals for your kids regardless of what they were. Like most things, a little bit of planning and an early start are the key!

We have been saving for our kid’s college since they were babies…but I am so worried about how much it will cost by then. Hopefully it will be enough!

Very good job Holly (and Greg)! I feel your pain. I’ve been saving since mine were in diapers and I’m not totally convinced it will be enough. But we can take satisfaction in at least paying for a year or two if nothing else. That beats taking out 4-5 years in student loans!

That’s an awesome story about your great uncle! I’d love to do something like that for our children, but you have to be practical. Like you say, you generally need to put other things first and right now that is the situation we’re in. We want to be able to help them with college, if that’s what they choose, but will be a couple of years until we can seriously be saving for that.

Definitely right. This was all just for fun and not to be taken literally. Whatever your priorities are is what you should be saving towards. I think for most people, getting their retirement business in order is task 1.

I was always amazed at the power of compound interest. A gift like land or a house can be poisonous if the kid isn’t financially fit. Who would want to work hard, have a career, if the mortgage is already paid for? I think I would like to help my kids towards a bigger downpayment but not just give them the keys to a home at 25.

Oh yes, having them know the value of money first is a must! And there’s no reason it has to be a full mortgage. I would have loved even $1K to help with my down payment!

I love the idea of doing something like this. We did start a 529 the year he was born to save for college, and we contribute to it each month. Like a number of others have said, it’s hard to put “extra” towards a big gift like that when there are so many other priorities of your own like paying off debt and saving for retirement.

Good for you for starting a 529 plan! You’ll look back on that 10 years from now and be very satisfied with the fact that you actually have something saved up. I know how it is. It is very hard to make room for so many extra funds and goals. But like all things, one foot in front of the other.

Rule of 72 is the 8th wonder of the world. Most people don’t believe that you can make million dollars simply by doubling a penny for 30 days. That’s the power of compounding. I’ve purchased 3 acre commercial land for my daughters. It was worth $150K, but I bought it for much less in foreclosure. My idea is to sell it in next 3-5 years and invest that money with sound asset allocation so that my daughters can each get around $500-800K in their 50s just from this investment.

Shilpan, that is amazing! I’m sure they will be very happy with this in the future! You are living proof that some people can and do perform these types of gestures.

Giving a little money today for your children can result in large returns later on. It’s amazing what compounding can do. But you’re right. Your financial goals need to come before your children’s because you don’t want to end up penniless at an old age relying on your children.

Even for the people who can’t give money, there’s a lot more you can give your kids that they will find more valuable later on.

As a first-time mommy I do consider multi-generational wealth planning quite a bit now in the back of my mind. But also I will try to balance any potential inheritance with instilling solid values in my children, of the pleasure of reaping the rewards from their hard work and how to make sound financial decisions. I am on a humbling financial journey and it would be beneficial for them to face some of the same experiences and consequences, in order to prudently learn financial responsibility. I love that family can pass their wealth onward in the hope it will be properly appreciated and nurtured by the next generation—if only one could wholly pass on their wisdom!

Jennifer, I don’t think there’s anyone out there who doesn’t want their kids to have the same sense of character and integrity they have grown to appreciate. I think if one were to actually pull this stunt off, it would have to be done in secrecy so that the kids never knew what good fortune awaits them.

It’s a nice thought and certainly very generous, but I think there’s a lot of value in letting your kids find their own way. A gift like that could almost be too big and prevent them from getting the motivation to work hard and achieve their own goals.

You’re right – you never want them to have a sense of entitlement or the general “who cares” attitude. If done right, it would have to be done in such a way that your kids would have already grown up and found their own way.

With owning a business, I have been able to invest for my daughter in some creative ways. My accountant is brilliant and suggested we “hire” her as model for promotional material and pay her a salary which was put into a Roth IRA. If we don’t touch it and never contribute again, it should be worth around $170K by the time she retires. I want her to earn her own way, but this will just be icing. I may not even tell her until she gets through the dumb teen and early twenties stage.

That is a pretty smart strategy you’ve got there Kim! (that’s worthy of a post!) I’ve heard other people tell me that they “hire” their kids simply so they can fund their IRA. I’ve read the rules on that before and they seem full of loopholes to where you could take advantage of them like this. I 100% agree that she can ever know about the money until she is older in life. I always used to wonder why trust funds start around 24 or 25 – now I know!

That’s so amazing! I’m guessing he achieved such success in large part BECAUSE of his modest lifestyle. I love this idea. Trying to save for college. It’s attainable, but still a large chunk every month for each kid. Hopefully someday we’ll be able to help them with something like land or real estate, too!

I’m very intrigued by the idea of using compound interest or other means to create a legacy of fortune for my family. For now, I’ll start small with college savings. But I don’t think these other goals are too far out of the question.

That is great advise and I didn’t realize it would take so little to invest monthly.

I can’t think of a better wedding gift than help toward getting into our first house. That would be AMAZING.

Wouldn’t it? I mean all practically aside, that would be a pretty outstanding way to help out your kids in their young adult lives. I would have loved a little extra help with our down payment!