Oh, no! It’s finally happening! It’s back to school time for Mrs MMD and my kids. Since Mrs MMD is a teacher, this marked the first week that she has had to go back into her room and start setting up for the start of the year. The kids had to actually wake up and go back to daycare while she and I are at work. Overall, it’s been an outstanding but too fast Summer. Unfortunately play time is over and they’ll be waking up at the crack of dawn (with me) every day very soon. The week flew by for me. I spent the first part of it in Virginia for business, and have been playing tons of catch-up at work ever since. Around the house, just after paying for the new floors, our washing machine broke down! Crap! This is soon to become another … [Read more...] about Weekend Wind Down 8/25/2012 – Getting in Back to School Mode!

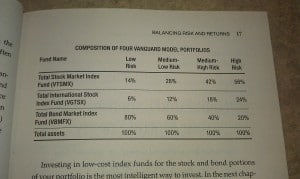

Asset Allocation Models from Author Daniel Solin

Do you really know how to split your retirement savings up in the best way? Chances are probably not. Trying to figure out the best asset allocation for your money design is something we refer to often here on my blog. Why? Because there of all the millions of combinations of investments we could put together, how do know which ones will work? What are the best asset allocation models for us to follow? I have been asking this question since I started investing and am still looking for the answer. We all know that in order to save up for a healthy retirement you’ve got to choose the right funds to stuff inside our investment portfolio. Choose poorly and your money will slip away from underneath your feet. Choose wisely and you’ll enjoy … [Read more...] about Asset Allocation Models from Author Daniel Solin

My Alternative Emergency Fund Strategy and How It Works

Lately there have been a number of great posts and strong opinions about having an emergency fund, and I wanted to weigh in with my own opinion and experiences. I have had a long a standing love-hate relationship with emergency funds. Sure, you need them for critical situations! But my problem (and I think this is where a lot of people struggle) is how to save up enough. Depending on which advice you subscribe to, the recommendations can be anything from 3 to 12 months of your gross monthly income. If you’re a typical American household making $60,000 per year, that’s anywhere from $15,000 to $60,000 that we need to have in the bank! Ouch! Is it any wonder we fail at this? … [Read more...] about My Alternative Emergency Fund Strategy and How It Works

Weekend Wind Down 8/18/2012 – New Floors

As some of you already know, this week was Mrs MMD’s birthday. And all Mrs MMD wanted was new flooring in our house. So we decided to make her birthday dream a reality! I’ve wrote before about what a great feeling it was to do your own projects when I installed my own hardwood floors. But I've got to be honest - I really wasn't feeling it this time. Instead, we decided to contract this job out. Even though it cost a little more money, the job got done fast and it looks great. Plus it’s pretty incredible to just come home from work and the entire project is all done for you! Here are a few pictures of the before and after: … [Read more...] about Weekend Wind Down 8/18/2012 – New Floors

More Blogging Tips and Celebrating My One-Year Anniversary

Today is one year blogging anniversary! It was a little over two years ago when I first read the book ProBlogger and said to myself “What a bunch of crap. There’s no way people can make that much money from running a blog!” Boy was I wrong! Despite my initial skepticism, the idea of creating a blog appealed to me in so many ways: 1) I’d have a motivator to encourage me to continue to learn more about money, 2) I’d finally have an outlet to utilize my passion for helping others with their money, 3) it would cost almost nothing to start, 4) if the prophecy of passive income was true, this would surely be one of the better ways to find out. So one year later there I was – with my very own blog. It took a lot of dumb blogging mistakes and … [Read more...] about More Blogging Tips and Celebrating My One-Year Anniversary

Blogging Tips from All the Dumb Mistakes I Made My First Year

Wednesday is my official one-year blogging anniversary. If it comes as a surprise to you that my blog has been around for one year, than shame on me! It seems this week will be a silent anniversary for me since my blog basically didn’t exist for about the first five months of its career. And it’s all thanks to all the really dumb stuff I did when I first started My Money Design. So for anyone out there just starting out (and for those of you who just want to laugh with me – not at me), here is a tally of all the stupid things I did over the last year and my blogging tips on how you can do better! … [Read more...] about Blogging Tips from All the Dumb Mistakes I Made My First Year

Weekend Wind Down 8/11/2012 – Bad Financing Offers

Dear readers - Pop Quiz! Which one of these financing offers is a better deal? A) [Carpet Price + $572] with 24 months, 0% financing B) [Carpet Price + $0] with 6 months, 0% financing Here’s the back-story: So Mrs MMD and I are buying new carpet for our house. We find something we like and we sit down with the sales representative to go over pricing. He gives me Option A with a price that just sounds wrong (of course I calculated out what the price should be ahead of time). When I interrogate him on the cost, I find out he is charging $660 for the installation. Anyone who has ever shopped for carpet knows that pretty much everyone who sells carpet always offers the equivalent of about $100 for installation. So when I bring this to the … [Read more...] about Weekend Wind Down 8/11/2012 – Bad Financing Offers

Book Review: Rich Dad Poor Dad by Robert Kiyosaki

Without a doubt, Rich Dad Poor Dad has become one of the most controversial personal finance books of modern times. Some people have praised it as the revolutionary how-to guide for creating ultimate riches through passive income. Others despised what they read because Kiyosaki challenged the conventional system for how people make a living and live their lives. When was the last time you were told that going to college and becoming an employee for someone else for the next 30 years is a terrible plan? Or that the only reasons you became an employee in the first place was out of your own fear and greed of money? Or that your house is NOT one of your greatest assets? Rich Dad Poor Dad is NOT a book that will explain to you what a 401k … [Read more...] about Book Review: Rich Dad Poor Dad by Robert Kiyosaki