Spring is in the air! Mrs. MMD and I are ready to get to work on the yard and get it looking beautiful as soon as possible. We both thoroughly enjoy landscaping. First on the list is getting the gardens edged and covered with weed-block material. Once that is complete, we’ll be ordering the flagstone retainers and then covering the beds with some dark slate rock. So long dried up, old wood mulch! The kids are also enjoying the un-seasonably 80 degree weather. Last weekend, we built their basketball hoop (that they got for Christmas) and we’ve used it a few times already. But the really big hit of the warm weather has been the Razor Rip Riders. We cannot get them off those things! One of the bikes has a lever that makes sparks fly out the … [Read more...] about Weekend Wind Down 3/24/2012

Let Curiosity Guide You, But Common Sense Protect You

One of the biggest challenges to being new to investing is that you simply don’t know where to start. Sure you may start by reading a few magazine articles. But it can be overwhelming when they start talking about things like asset allocation, Index funds, P/E ratios, Large cap, Growth sectors, Valuations, etc. What does all this stuff even mean? The truth is that you don’t need to know everything about everything to get rich. In fact, I would venture to say that most people don’t. In reality, you really only need two things to get started on your investment journey: Curiosity and Common Sense. We All Start Somewhere: No one comes into this world being a financial genius. It is something we learn along the way. And if you feel left … [Read more...] about Let Curiosity Guide You, But Common Sense Protect You

Why I Finally Sold My Apple Stock

Admit it. You saw the title of this post and thought what the #@&! is this guy thinking! Is he insane? Who goes and sells one of the world’s most profitable and admired companies? The truth is that this was not an easy post to write. Having watched the price of Apple stock (AAPL) rise above $600 (about $50 more than what I sold it for) left me wondering the same thing about my decision. But isn’t that the problem when we invest? We let our imaginations run the show. If we sell, we’ll kick ourselves if stock goes up, but we’ll pat ourselves on the back when it goes down. … [Read more...] about Why I Finally Sold My Apple Stock

Would Dollar Cost Averaging and Bonds Have Saved You From “The Lost Decade”?

In the first part of this series, I wanted to test the claim that dollar cost averaging (DCA) was an effective strategy for protecting your investments. Too often I’ve heard claims against investing within the media saying that if you had bought stocks (particularly) during “The Lost Decade” between 2000 and 2010, then you would have had a -23% return on your money. After crunching the numbers, we determined that dollar cost averaging would have beat a static investment in the S&P 500 and returned a -6.8% return instead of a -23%. That’s great, but who wants a negative return?! Why didn’t we just hide our money under the mattress and do nothing? Unfortunately, that may be true. But remember that when it comes to investing: Defense … [Read more...] about Would Dollar Cost Averaging and Bonds Have Saved You From “The Lost Decade”?

Weekend Wind Down 3/17/2012

I am loving the warm weather! That and the combination of daylight savings time has made each day nice and enjoyable when I got home from work. It’s great to see everyone outside, the kids playing, and the landscaping starting to bud up. All-in-all, this winter has been a dream come true for a commuter like me! Almost no snow storms, no ice, and no big delays. With all the snow gone, I’m quickly realizing how TERRIBLE my yard looks and how badly I need to start the projects I had originally planned for the Spring. We’ve got flagstone retaining walls to build, slate rocks to cover all the gardens, and a whole lot of weeding along with weed block material to lay down. … [Read more...] about Weekend Wind Down 3/17/2012

Another Expense Reduced – Refinancing Your Auto Loan

It wasn’t one week after we closed on our mortgage refinance that my wife and I got our next “big break” on our expenses. As I’ve spoken about before, part of my annual budget is to pick a handful of expenses each year and see what I can do to reduce them. Sometimes this takes a fair amount of work and research as was the case with the mortgage refinance. But ironically, this next one came from an unlikely source: Junk mail. … [Read more...] about Another Expense Reduced – Refinancing Your Auto Loan

Would Dollar Cost Averaging Have Saved You From “The Lost Decade”?

From time to time when I get my 401k statement, there is a small newsletter mixed in with my financial statement. It usually presents some very introductory information about retirement, investments, etc. In this issue one of the topics was dollar-cost averaging. For those of you who don’t know, dollar cost averaging (DCA) is a strategy where you invest the same amount time after time. During the good times when shares are higher, you buy fewer shares. During the rough times when shares are lower, you buy more shares. This strategy prevents you from buying at the wrong time and over-spending or under-spending on your investments by “averaging” your price over time among these periodic investments. Sound familiar? That’s exactly what … [Read more...] about Would Dollar Cost Averaging Have Saved You From “The Lost Decade”?

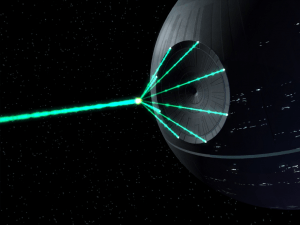

Buy Your Own Death Star for $852 Quadrillion

Okay, this one is too much fun to pass up. Consider it your Sunday comic blog post … A few weeks ago, MSN covered a quirky article from the blog Centives entitled “How Much Would it Cost to build the Death Star?”. Yes, that would be Darth Vader’s Death Star; the giant planet-like weapon from the first 1977 Star Wars movie (or Episode IV if you’re a true nerd!) The blog, ran by students at Lehigh University in Bethlehem, Pennsylvania, used some logical reasoning to estimate the size of the Death Star and roughly how much steel the creation would consist of. Here are the highlights: … [Read more...] about Buy Your Own Death Star for $852 Quadrillion