The truth is that this was not an easy post to write. Having watched the price of Apple stock (AAPL) rise above $600 (about $50 more than what I sold it for) left me wondering the same thing about my decision.

But isn’t that the problem when we invest? We let our imaginations run the show. If we sell, we’ll kick ourselves if stock goes up, but we’ll pat ourselves on the back when it goes down.

What Was Wrong With Apple?

Nothing! The company is doing outstanding. They’re on fire! They’ve been breaking records, beating analysts’ earnings predictions, and exceeding their own reputation. Apple even finally agreed to start paying a dividend – something I was holding out for but began to doubt if it would ever happen or not.

The analysts are also very optimistic. According to CNN Money: The 44 analysts offering 12-month price forecasts for Apple Inc have a median target of 635.00, with a high estimate of 750.00 and a low estimate of 500.00. The median estimate represents a +4.79% increase from the last price of 605.96.

It doesn’t stop there. In one recent speculative article, it was predicted that the stock would have to rise to a price of $1,368 in order for the share buyback to “worth-while” for Apple.

Believe me: If the price ever goes back down, I’d consider buying up some shares again (after re-evaluating its recent financial health of course).

Removing Your Emotions From Opportunity:

Selling a stock can be a confusing time for your emotions. At no other time in your life do hold onto to something that is performing really well, making you lots of money, making you really happy, and you say to yourself “time to get rid of this thing”.

But that is exactly how it works. There’s a reason we’re told “Buy low, sell high”. There’s a reason why Warren Buffett proclaims “Be fearful when others are greedy, and be greedy when others are fearful.” It’s a logical way to lock into your earnings.

You see, I could have held onto the stock and we could have speculated on the price forever. Maybe it will rise to $750. Maybe it will fall to $200. What if, what if, what if? The truth is that despite our best guesses – no one really knows what will happen tomorrow.

But a capital gain is real. When you buy at a lower price and sell at a higher one, that’s when you capture the profit.

The Signs It Was Time:

Here were the reasons why I decided it was time to sell:

1. Apple met (and exceeded) my sell-point.

When I bought Apple last summer at $333, I had heard a media report that said that Apple may reach $500 within 12 months. I laughed to myself and sarcastically said “Okay, if it hits $500, I’ll sell.” After all, $500 would buy me a new iPad, right?

Regardless of how you come up with a sell-point, it’s important to have one. Anyone would be happy with a 50% return, right? If your mutual funds did that, you’d be telling everyone you know how excited you were.

The hard part is actually following through. After the stock went above $500, before I could log in to my account to sell it, it had climbed to $510, and then $530, and so on. That’s when greed set in. I kept asking myself “How high can this go up and how long will it last?”

Don’t do that. That’s called timing the market, and no one (of any worth) advocates that strategy. What the financial greats do advocate is opportunity. When your stock hits your sell-point, lock into those earnings!

2. The price was rising too rapidly.

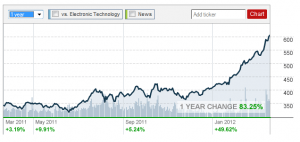

Apple crossed $400 right around December 2011. About 3 months later it crossed $500. In 2012, it soared over 30% before the time I sold it.

When a stock trades at its 52 week high each day and continues to increase that rapidly, something is going on. Maybe it’s the company or maybe it’s just the market. Maybe it’s just hype! Regardless, it would be naïve of me to think that this lucky streak could continue to rise at this rate or stay this high forever. Again, you take the opportunity where you see it.

3. Attack of the Androids?

One of the main qualitative reasons I first picked Apple was because it was a company ran by Steve Jobs, one of the greatest leaders of modern times. At the time, the iPad 2 was relatively new and there was talk about an iPhone 5. The last rumored project Steve Jobs had worked on was the iPad.

Although the Apple products are cool, I do feel as though the iPhone and iPad have a tremendous amount of competition and copy-cats coming after them. For example, around Christmas 2011, the Amazon Kindle priced at $200 was perceived as a serious threat to the $500 iPad. Now the market is being littered with dozens of other low cost alternatives. Android phones also continue to eat up a serious market share that once wholly monopolized by the iPhone.

Although there is no denying that there is still a bright future for Apple, time will tell if the post-Steve Jobs Apple will be able to keep up with the expectations it has come to deliver. Although I was glad to hear about Apple’s recent announcement to pay their shareholders a dividend, I question if this is a sign of decisions that will redefine the Apple of the past decade.

The Bottom Line:

We cannot time the markets or predict what our investments will and won’t do. Although it was tough, I felt satisfied to cash in on a 64% return in 8 months from Apple. Although the strategy of being logical is nothing new, it takes practice to perfect its execution. I will look at this as a learning experience and hope I can apply it to other fortunate opportunities to come.

Readers: What do you think about selling your stocks? Do you let emotion over-take your decisions, or do you stick to logic and reason. Do you still think Apple is a good buy, or is it all just hype? Please feel free to share!

Related Posts:

1) Trying Out “The Big Secret” Stock Picking Strategy

2) Browsing for Stocks – January 2012

Photo Credit: CNN Money

That must have been a tough decision to make. Since you made a nice profit, you should be happy with the choice. The company definitely is heading into an uncertain time. Personally I think they will ride their momentum to even greater popularity. With so much capital and so many extremely intelligent employees, they are bound to keep redefining markets.

It was definitely not an easy choice to make. Apple is great candidate for investing long term, and there is still a huge amount of potential for the company. But it was also too hard to ignore the rapid price and not react.

I completely understand what you mean about the “price rising too high, too quickly.” That makes sense – I had a stock do that on me, and I held, and then it crashed (although still left me with a nice profit). I am wondering, however, why you didn’t revamp your earnings expectations in light of the analysts’ revised predictions?

What you just described was precisely what I was afraid of. In the past, I have watched stocks rise, not made my move, and then watched them fall never to rise that high again. In the case of Apple, it felt like it was ballooning out of control and I wasn’t sure how much longer it was going to stay at this level. I did think to re-consider my position in light of the new analyst data, but my past failures to act and the Warren Buffett “Be fearful when others are greedy” mantra kept ringing in my head.

I hear you. I was in the same boat. Apple was one of very few single companies I invested in with some “fun money” that I was prepare to lose. (Although I used DITM calls, which were just ITM calls when I bought them). I got in for a $375 strike price and it rocketed up way too fast, becoming way too big a % of my portfolio and against everything I believe in for investing. I like having a few grand in risky stuff to have some fun, but it became a lot of money, so I locked in the gains. I still think it is cheap, but I got out around $537. Would love the extra 60 points, but I’m happy.

Congratulations on locking in on a 43% gain! I like to hear that you have a few grand to take some risks with. I feel like you learn just as much from those experiences as you do from playing by the traditional investing rules.

What a coincidence! I was thinking to write a post about why Apple is the stock of the decade. I still own it, and I’ve decide to buy it on every dip. Nonetheless, congratulations on your great profit. No one has ever lost money taking profit my friend.

Thank you! And please do write that post. I’d love to hear your opinions on Apple. I too am waiting for an economic rift to offset stock prices and provide opportunity for buying Apple on the cheap again.

Whether apple’s price rises or falls in the future is a different thing; what really matters is that you adhered to your rules. Jesse Livermore, said that he used to lose money when he did not stick to his own rules.

Discipline pays you in the long run. Your selling was based on logic and believe me, I never lost money when my investment was based on logic. You were strong enough to sell it off before greed could set in.

The two top qualities displayed by you,if you stick to them long enough, will keep you in the league of extraordinary stock operators:

1. You had predefined your selling point.

2. You did not waver when the selling point came.

Thank you for the compliments and affirmation of this strategy. I hope to pick some more winners and practice this same strategy over again!

Don’t feel too bad, I sold at $450!

Get Rich Point made a good point. Sticking to your rules is the most important thing. For the most part, you will lose money if you stray from the rules. As much as losing $150 a share stinks, I still made a profit.

I am hoping there will be a correction in the market soon so I can buy around $550. We will see!

Congratulations on your profit! I almost sold around $450 as well. Before Christmas, AAPL had briefly climbed to around $420 and then quickly dipped as low as $370. I kicked myself for not having seized the opportunity then, but I decided to hold out. Even after it went up beyond $420 and $450, I still really felt like it could do $500.

Congrats on the profit! I’m sure you’ll enjoy the new I-pad with your earnings.

Thanks! iPad 3 does look pretty tempting ….

I wouldn’t be disappointed by that profit one little bit. Although, I’m not really sure I would have been disciplined enough to pull it off 😉

Thank you very much! Believe me – it was like breaking up with a top celebrity! Kind of a “what am I doing” moment. But it retrospect, I’m happy to have made money rather than the alternative!

I think you did really well. I don’t invest in individual stocks, but when I do I’ll have a plan in place like you did and will be sure to execute it. Congrats on your profit!

Thank you very much. Might I suggest that before you start investing in individual stocks you read the book “The Neatest Little Guide to Stock Market Investing” by Jason Kelly.

https://www.amazon.com/gp/product/0452295823/ref=as_li_ss_il?ie=UTF8&tag=mymo0e46-20&linkCode=as2&camp=1789&creative=390957&creativeASIN=0452295823

It is an easy read that starts from the very basic fundamentals all the way up to the more advanced techniques. I still refer back to it every so often to brush up on my metrics and strategy.

after reading the reasons why you have sold it I think you have taken the right decision. 🙂

though at first I had thought that it would have been better if you would have hold the stock a bit longer.

Thanks! In hindsight, I’d be richer if I had held on a little longer 🙂 Glad I could persuade you with my reasons.

Hi MMD,

I have included this post at my website weekly roundup #2

Thank you for including it. I’m glad you liked it!

I think you made a good decision. In my blog, also discuss my position on Apple, which coincides with it. In this market you have to be greedy enough to know when to sell a stock.

Thank you for visiting! Yes, as much as it kills me to see the stock higher now, I don’t (and can not) regret locking in at a higher price. A profit is a profit!

Looking at the prices of Apple rise, I wish I’d invested a year ago. A missed opportunity for sure! Good for you for getting in the game. I don’t envy the decision you or any other shareholder has to make at this point.

I don’t think anyone really saw such a rapid price increase coming. At the time I was just satisfied to own a part of a company ran by Steve Jobs. The profit was a nice confidence boost, but I also quickly remember to attribute it more to luck and the good fortune of the company rather my Warren Buffett stock picking skills (or lack thereof) 🙂

I bought at around $367 and am holding onto it. I want to sell, but I bought in August 2011, so I’m waiting until I don’t have to pay short-term capital gains.

You are very wise to wait on this important reason! I REALLY wanted to hold out for a full year for the tax benefit, but I was terrified that the price run-up was just a fluke and it would be right back down before my year had passed. See – again emotions have steered me wrong! 🙂