Well, there’s always a time to start.

This summer, I read the book “The Big Secret for the Small Investor” by Joel Greenblatt because I was interested in stepping up my stock picking game. If you’d like to read my book review, click here.

In Part “A” of Greenblatt’s “Big Secret” plan, he concludes that:

Fundamentally, this ratio is also referred to as “Return on Assets (ROA)” and the story it tells is how efficient the company is at making more money with assets that it has. This principle of “buying well below fair value” was most notably supported by Benjamin Graham, the mentor of Warren Buffet.

Looking to try my hand at a new stock picking strategy, I decided I would test this theory.

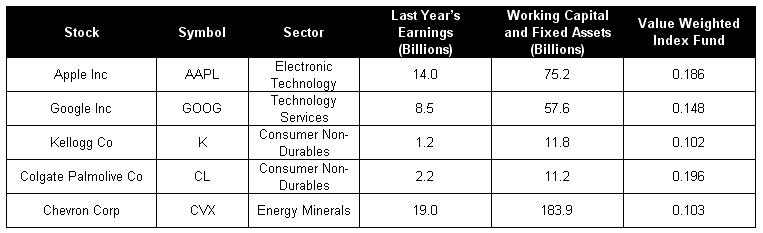

1) I started by picking five random but very reputable companies. I purposely did not stick to any one industry in particular.

2) Next, I grabbed the two variables described above from each of the company’s Balance Sheets. This was easily done using money.cnn.com to look up each stock.

3) Finally, I calculated the ratios. The results are below as follows:

So …. Who did I buy? Apple (AAPL)!

Wait a second, Colgate Palmolive had the highest ratio. How come I didn’t pick that one?

Well there is a lesson to be learned. You never just pick a stock based on one ratio! There are computers that use 100’s of ratios to try to pick the best stocks, and they still don’t get it right.

So why Apple?

1) Who wouldn’t want to own a piece of a company ran by Steve Jobs?

2) They’re everywhere and all over mainstream America

3) Their products are pretty awesome and it will be Christmas soon

4) Did I mention Steve Jobs is pretty good at running a company?

Okay, let’s get back to our experiment. So let’s compare Colgate Palmolive and Apple once again.

• Notice that Apple is working with 75 billion in cash versus Colgate Palmolive’s 11.2 billion, and the ratios are very close. If your company can be that efficient with that much cash, now who is more impressive?

And besides, I’m buying. So I picked Apple.

3 Months Later – So How Did I Do?

Not bad! Take a look at the change in stock price:

So did I just become some kind of stock-picking master on account of reading this book and learning some new strategy? Absolutely not!

• First of all, this is way to short of a time period to declare any type of victory. Any of the other stocks could still reasonable well.

• Using a strategy such as this is more-or-less part risk mitigation and part dumb luck. As I mentioned above, thousands of very smart people have tried for a long time to find the magic ratios to pick the best ones, but that doesn’t work. There are too many aspects about a company that cannot be accurately quantified such as leadership, upcoming product performance, market perception, etc.

• I should also point out that it was pretty risky of me to buy just one stock. What if I had picked the biggest loser out of the five? I could have spread out my risk by buying equal amounts of all the stocks. That would have net me a 9.5% return. However, I also would have had to pay 5x the commission.

So for now, I’ll say good job and give myself a small pat on the back. I’m content to see that my pick performed better than I hoped (aka – I didn’t lose my money). Someone let Warren Buffet know I’m moving up the ranks!

Leave a Reply