Seriously, if you’re trying to figure out what to do differently with your money this year, how about putting in something that will grow tax free! Whether you know much about investing or money, read on as I explain all the essential Roth IRA basics and what you need to know to make the most of them.

The Essential Roth IRA Basics:

How Much You Can Contribute:

To start out, an IRA (Individual Retirement Arrangement) is a special type of U.S. investment account that is intended to help you save for retirement by giving you a break on your taxes. Unlike a 401k, you setup this account yourself outside of your employer.

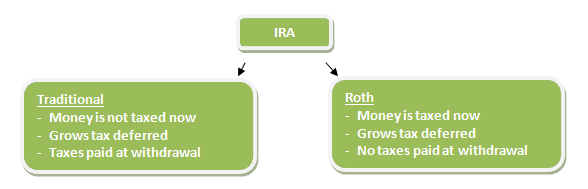

Although there are several types of IRA’s, the two most common ones that people invest in are Traditional and Roth IRA’s. The main difference is as follows:

Higher Earnings Potential with the Roth IRA:

Although they sound similar on the surface, one of the basics of a Roth IRA that people don’t realize is that you can actually potentially earn more with the Roth option. This is because of the way that the taxes work. It leads to what’s called a higher effective contribution rate. To see a detailed example of how this works, read my previous post Traditional vs. Roth IRA – Part 3: Why I Prefer a Roth IRA.

How Much Can I Invest?

No matter which IRA you choose, the maximum allowable contribution (as of 2013) is $5,500. Therefore, a couple can setup two for a maximum of $11,000.

What Can I Invest In?

Your Roth IRA can be any number of investments from safe to risky:

• CD’s

• Bonds

• Mutual funds

• ETF’s

• Stocks

• Annuities

• Real estate

Usually whenever you open any of these accounts, you can request that they be designated as a Roth IRA.

For help on getting started, read my previous posts:

• My Picks for Vanguard Mutual Funds for Our Roth IRA

Are There Any Requirements for Contributing?

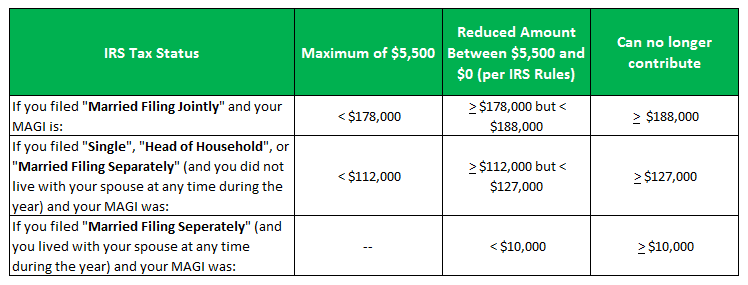

In addition to simply needing to have earned income, one of the big Roth IRA fundamentals is that your ability to contribute may be limited depending on how much money you make. It all depends on your Modified Adjusted Gross Income (MAGI) reported on your tax documents.

Here are the Roth IRA income limits:

Other Things to Know About Roth IRA’s:

• If you absolutely need your money back, you can take an early withdraw from Roth IRA contributions (the money you put in, not the earnings) after 5 years under certain conditions.

• You can’t convert a Roth IRA to a Traditional IRA. But you can convert a Traditional IRA to a Roth.

• You don’t have to take required minimum distributions at age 70-1/2 like you do with a Traditional IRA, 401k, and other retirement accounts.

• If you die, you can will a Roth IRA to an heir without tax implications or penalty.

Readers – What are some of the characteristics about Roth IRA’s that you find more attractive over other types of retirement accounts?

Related Posts:

1) Retirement Income Strategies for My Money Design – November 2012 Update

2) SCARY Retirement Statistics – Don’t Let Lack of Planning Haunt You!

3) Six Easy Steps for Figuring Out How to Save for Retirement

Image courtesy of igraur codrin / FreeDigitalPhotos.net

We love the Roth! We are already saving for retirement and haven’t yet set up a Roth because we are throwing everything extra at our house. Once that is paid off, you can bet that our Roths will be maxed out.

The two of you have a plan and you’re sticking to it – I like it! Hopefully you can use some of this info later on when you finally do setup that Roth.

I love Roth’s! They can be a great way to start investing for retirement. If you start them early then even better. The tax deferred growth is a huge bonus to have one. We’re actually going to be opening a Simple later this year for our business. It does not have the same tax deferred growth, BUT we can put in significantly more.

I do like the sound of never having to pay taxes again on that money; especially after its been allowed to grow tax free for +30 years!

Some people like the fact you can withdraw contribution utions after 5 years but I actually don’t like that rule as many people will raid their Roth before retirement. I love the fact I will never have to pay taxes on it again. It at least gives you certainty in an uncertain world.

I’ve actually come to understand that the whole “withdraw your funds after 5 years” carries some pretty specific criteria to met. See the IRS publication:

Actually, Lance doesn’t have it completely right, although I love his sentiment. You can take the contribution out of your Roth immediately (no tax advantage to this money).

Thanks Joe, but is that correct? During my research for this post, I came across this set of rules by the IRS regarding early withdrawals:

It seems unless you are disabled or buying a home you will have to pay taxes on the distribution.

What I love about a Roth IRA is that everything you earn is tax deductible, after 59.5.

We currently have a Roth 401(k) and Roth IRA. My wife’s company match is placed into a regular 401(k). Our goal is to pull from the regular 401(k) until we reach the point where we would owe taxes. Then take the rest from the tax free accounts. This way we stretch our money and reduce our tax burden.

I love that you guys have thought about this and planned it out. That technique actually comes recommended by author Daniel R. Solin:

https://www.mymoneydesign.com/books/investing-retirement/the-smartest-retirement-book-daniel-solin/

Similar to your strategy, he recommends to drain them in order of:

1) Post-tax accounts (where you can pay lower taxes on the withdrawals)

2) Deferred retirement accounts like a traditional IRA’s, 401k’s, etc (because the money will grow greater tax free)

3) Roth IRA (where the money grows tax free and you pay nothing on the withdrawals)

I personally use my Roth as an investment tool for my more risky investments (currency, individual stocks). The hope is that if these end up outperforming benchmark indexes I will be able to max out the advantage of that tax benefit.

Using your Roth as a playground for investments? That’s something I don’t hear very many people say. Very interesting strategy! I’ll have to read up on one of your posts and see how its working out for you.

Investment idiot here: didn’t even know the difference between traditional and Roth! Thanks for the education.

Ha! I love it. My posts really do educate!

I love the idea of tax free growth. Anyone can argue that you could be in a lower tax bracket in retirement, but who knows?

I know I don’t plan to be in a lower bracket. If things go my way, I’ll be RICH old geezer! 🙂

For most people entering retirement a Roth IRA is unnecessary. The tax deduction in your income earning years is likely to be more beneficial than the tax free distributions during retirement. Even if you’re a rich old geezer, you likely have various tax shelters, off shore shell companies, charitable contributions, trusts, etc. For almost every retiree, their income from distributions will still be under their personal exemptions and itemized deductions.

Even if they were the same, I’d rather take them in my retirement years. There seems to be more of a psychological benefit. Knowing that my money is my money and not having to allocate a portion for tax payments is worth it to me.

Like Lacy @EarnVerse I also use my Roth IRA as a Trading “playground” for both speculative stocks and dividend stocks. Lately I’ve been trading in/out of UVXY.

Curious…

Does anyone know if you are required to account for stock trades (in other words — keep records of my trades, gains/losses, etc) within a Roth IRA since they are tax free? Also – do “wash” rules apply?

I would think not but alot of things in this world don’t make sense so I could be wrong.

I thought this was a great way to get around the craziness of record keeping for stock trades.