Even if you did take the time to figure out how much money you’d need and what size nest egg to save for, how do you know what chances your savings target would have of surviving another economic downturn like we had this past decade? What confidence do you have that the number you pick will result in your savings being able to last through thick and thin?

Pfau’s Suggested Savings Rate:

I was delighted this month when I received my new copy of Money Magazine for two reasons: 1) The cover story featured one of my favorite personal finance topics: Retirement planning. 2) That cover story “Six Secrets to a Dream Retirement” was based on the work of retirement income professor Dr. Wade Pfau of the American College.

Dr. Pfau has graced a few posts on My Money Design in the past with a few of his comments and perspective on retirement planning. In case you’re interested, here they are:

- Is 2 Percent the New Retirement Safe Withdrawal Rate?

- Be Careful With The 4 Percent Rule for Retirement Withdrawals

So what was so great about this article from Money Magazine? Only the fact that it solves our dilemma above by giving us a magic number to shoot for in terms of a “safe” savings rate:

“Wade Pfau, professor of retirement income at the American College, which trains financial planners, has crunched the number to find a safe level of saving that would have worked in every historical market stretch going back to periods beginning in the 19th century. He found that setting aside 16.6% of income and putting it in a diversified portfolio of stocks and bonds did the trick every time.”

Read that statement twice if you have to.

This gives us two very important points:

1. Not only does 16.6% represent a number that would help us hit our retirement income goal at ANY income level, but it was tested over various periods of time throughout the last century. In other words, if you had lived anytime between 1870 and 1980 and saved 16.6% of your income for 30 years, you’d be enjoying your retirement despite whatever economic event occurred. That’s a very powerful finding!

One caveat to keep in mind is that this savings rate was only good for your retirement formula as long as you plan to work / save for 30 years and then plan on only needing 30 years of retirement income. If your situation varies from this, then a different savings rate would most likely apply.

2. The good news though is that Dr. Pfau’s savings rate is designed to achieve a target retirement income level that is independent of some withdrawal rate like the suggested 4%. Basically as long as you save 16.6% for 30 years, you should have no trouble hitting your target income.

Testing 16.6% in Your Retirement Formula:

As you know on My Money Design, we like to crunch the numbers and put these kinds of theories to the test.

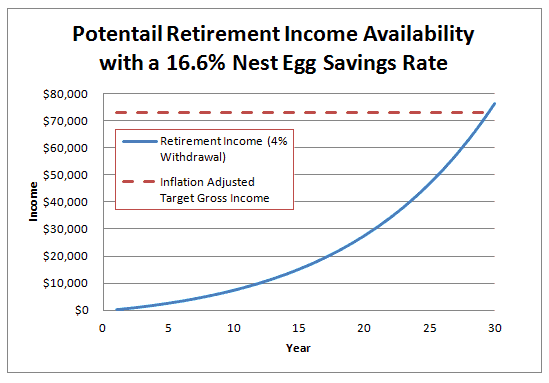

Even though Dr Pfau is not a fan of conventional retirement figures like the 4% withdrawal rate and 8% annual return, we’ll use these simplified values to put together a layman’s example and see what kind of results we get.

First let’s pick a concrete income level to use for our example. I’ll pick the round median income in the U.S. and go with $60,000 per year.

Now that we know that, we’ll need to calculate our target retirement income. Dr Pfau’s research puts this target at an inflation adjusted 50%. Performing an FV calculation using 3% as the inflation rate, we then get our target retirement income: $72,818.

If we use the conventional portfolio return assumption of an average annualized rate of 8.0% over the course of the 30 years, then our 16.6% annual savings rate would achieve the following result:

Success! As you can see, by the time we hit 30 years, our nest egg would reach a level that both produces our original desired target income as well as exceeds the conventional 4% withdrawal target. Regardless of which target you were trying to hit, you’ll finally have enough money to finally retire!

If you’re interested in the technical details as to what I used to calculate this retirement formula, here they are. If you don’t care, then just skip this section.

- Because our target income was already adjusted for inflation, I did not subtract away inflation from the annual growth rate.

- Salary and target income figures are gross (before taxes)

- My test assumes your salary will grow by 3.0% each year (such as the case with an inflation adjusted employer raise)

- I also assumed your employer would kick in a 2% contribution towards your retirement on top of your 16.6% savings rate.

The full summary of Dr. Pfau’s research is posted on his Retirement Researcher Blog. Click the Safe Savings Rate post to explore how he came up with this number in much greater detail.

Another Way to Test Your Plan:

If you’d like another fun way to see whether or not you’ll run out of money during retirement, a method I like to try is a Monte Carlo analysis. This is basically a simple simulation where the stock market return for each year is randomly generated. We can then use it to create various scenarios and see how long our money will last until we deplete it. You might be surprised by what you find!

You can download the Monte Carlo simulation I created in this Excel worksheet.

Pfau’s Opinion?

If Dr Pfau does get a chance to visit my site, I’d also be interested in hearing what he thinks of my retirement plan found in the post My Money Design for How to Achieve Financial Freedom – November 2012 Update. It’s a lengthy and tailored post to my own personal situation, but I think it is beneficial to others because serves as an example of a plan that brings together every retirement strategy I can think of into one executable model. All opinions are welcome.

Readers – What do you think about this safe savings rate? Would it work in your retirement formula, or is there something that would cause you to shoot higher or lower?

Related Posts:

1) Is the Conventional System to Create Wealth Rigged?

2) Why You Need to Get Your Full 401k Matching as Early as Possible

3) Retirement Income Planning with Author Daniel Solin

Image courtesy of digitalart / FreeDigitalPhotos.net

What an interesting and thought provoking post MMD – I love it!

Really 16% isn’t all that hard to achieve either once you have paid of all your debts.

I didn’t really think that was too bad of a goal to strive for either. In reality, I’m saving a LOT more than this because of my early retirement goal.

I agree with Glen, 16% is really not that high if you’re wise with your money and pay off all of your bills. We’re actually going to be saving very close to that (within a few percentage points either way) starting this year now that the business has taken off.

I agree. I actually always thought 15 to 20% was a pretty safe bet for saving for retirement. But I never knew that it had this kind of confidence level in terms of weathering the storm of market ups and downs.

16%? Yes, I can work with that..

I agree. Not too terrible of goal, is it?

Now, the 16% includes any employer match, right? In that case, I’m there. I can definitely see how it would be difficult to invest that much without a company match, though.

Actually I believe Wade’s paper said it was in addition to your 16% savings. Even still, I think the 16% figure is doable. Personally I’ve always tried my best to hit the IRS maximum for the 401k and IRA, and achieved it for the last 3 years.

That is interesting and I should be able to achieve it with some work. I am not there yet, but hopefully soon.

You will be. If you want to bad enough and are already working on it, then it is only a matter of time.

16% sounds pretty attainable to me! That is an interesting study.

Outside of the 16% punchline, I found the “test of time” part of the study to be the most interesting. Any one of us can “I’m going to save this much” and then get shot down by someone claiming what-if scenarios of doom and gloom in the future. To have someone actually run the numbers and find a minimum figure that withstands every market condition for the past 100 years is pretty fascinating.

This makes me feel a bit better. We’ve been saving at about half that. However, once our debt is gone at the end of the year we’re going to start pushing for retirement and have 30 years until we’re 61.

If I don’t achieve my goal of retiring at 50, at least I’ll be able to do it at 60.

I’m sure you’ll be able to reach it Justin. Incomes tend to go up, and we also get better about controlling our spending. Together, those two things increase that discretionary gap and give us the ability to put it towards goals like this. To really ramp things up, you should make retiring at 50 your fall back plan and 45 your stretch goal.

I’m always weary when someone gives a one size fits all answer. It might work but I’d rather monitor my plan once a year from now until I retire and adjust accordingly 🙂

I’m usually pretty weary too. But then I actually read Wade’s post. It was the bomb. It’s not often that people take +100 years of market data return and run hypothetical scenarios to see what your worst case scenario. It was an interesting approach to say the least.

I love Money magazine and look forward to its arrival each month. I enjoyed that article, however, they generally assume you need to work until you’re in your 60’s. I don’t want to work that long, but I guess 30 years isn’t really too bad.

I agree Kim. The lack of “early retirement advice” is exactly the reason I tend to frequent blogs more often than books and magazines these days. I like to read the methods of people who have actually pulled this off or are working with an overwhelmingly solid plan in place.

Wow. I think $70k is plenty to retire on. I prefer the approach of looking at expense spend with a buffer rather than income replacement (which may be surplus). If you have a more modest form of living and don’t need to spend everything you earn, your actual retirement goal could be much less. Nevertheless, the 16% savings goal doesn’t appear that onerous. The one big issue I have with the conventional thinking behind retirement is selling a certain amount of stock to fund it annually. We saw what that did to retirees in 2009 when the stock market collapses. My objective is to live off my dividends and not touch the principle.

That last part of your plan is something I’ve contemplated before as well. It’s a very solid point!

To anyone that is following along: Say I own 100,000 shares of mixed stocks that pay out approximately $50,000 per year. It doesn’t matter if those 100,000 shares go up or down in market value. As long as they continue to pay out a steady stream of dividend payments (and they would if we pick ones that have a solid history of doing so), then there would be no harm to my retirement income.

hey Mr MMD, where is your MonteCarlo simulation spreadsheet ? The link here is not working. thanks.

Thanks for letting me know. I have added it back in.

hey, thanks for fixing that. If I am not mistaken you also had a post explaining how the Monte Carlo analysis works, but i just can´t find it.