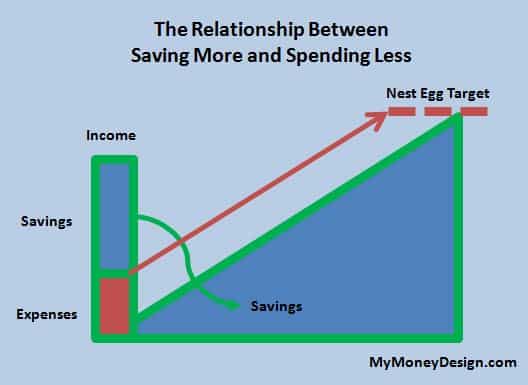

On the surface, everyone can recognize that saving a larger proportion of your income does exactly what you think it will do: Help you stock-pile more money more rapidly, and reach your nest egg target quicker.

But another benefit that sometimes gets lost is the way in which our habits react. Spending less doesn’t JUST mean having more money to set aside. It requires learning how to forego that lost additional income, and adjusting your standard of living. This, in turn, and completely affect what our target nest egg is ultimately. Hence, spending less and saving more could really be thought of as a double-ended approach to achieving an early retirement!

To better illustrate this point, let’s create a simple example of how this information sometimes gets lost in translation.

Example: Let’s say you earn $60,000 per year now and you’d like to continue to live off of 80% of this amount during retirement. Instead of contributing 10% to your 401(k) like most people recommend, you decide to really go for it and bump your contribution up to 20% instead.

Just as you guessed, this nice increase in contribution will certainly reduce the amount of time it will take for you to reach financial independence. The original timeline of 44 years at the 10% contribution rate turns into 33.4 years with the 20% contribution (assuming you started at $0 saved).

But in reality, is this really the only benefit? – Not at all!

When we save more, we don’t just decrease the amount of time it will take to reach our goal, but we’re also inadvertently making our goal even lower. Let me explain this a bit further …

How Saving More and Spending Less Really Benefits You

If you earn $60,000, then all you ever know is how to live off of $60,000 (net of taxes, of course).

When we start saving our money towards some goal (retirement, a new house, etc.), then we learn to modify our spending habits to adjust to this new level.

- If it’s 10%, then you’re really living off of $54,000.

- If it’s 20%, then you’d adjust to living off of $48,000.

In other words, we learn to treat this money as if it never even existed.

While that may not seem very relevant, this simple modification in our spending habits plays a huge role in determining how much money you truly need to save up in order to retire.

Remember that by conventional standards, your target nest egg amount is 25X times your expense needs. So if your expense needs are always decreasing, then your target nest egg is too!

So in our previous two examples:

- $54,000 of annual target income becomes a target nest egg of $1,350,000.

- $48,000 of annual target income becomes a target nest egg of $1,200,000.

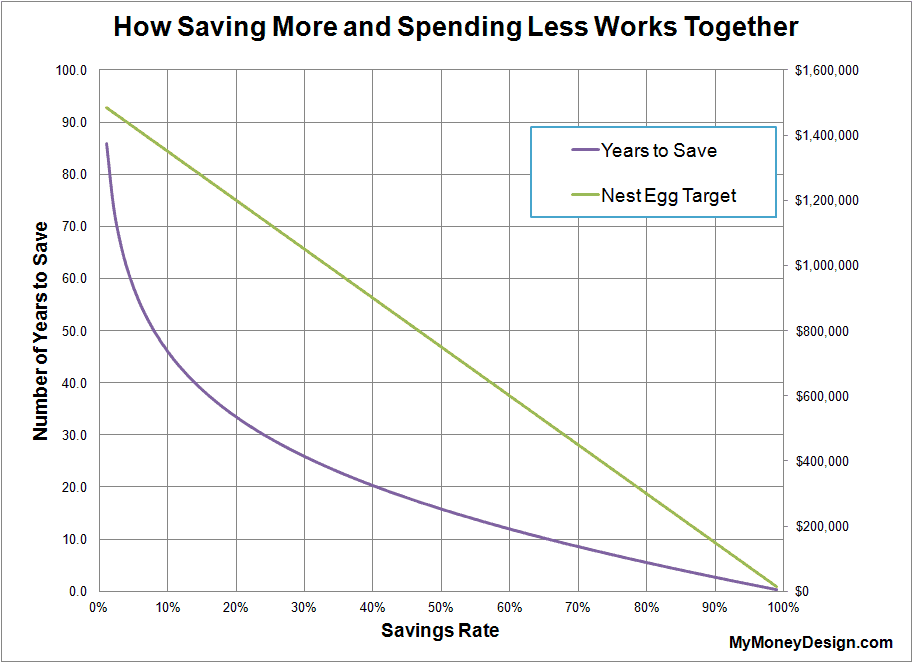

Here’s how this relationship works across all savings rates:

In summary:

The more we save, the less we live off of, the lower our needs become, and the lower our target nest egg adjusts too.

To put it another way, not only are we saving more to run towards our target sooner, but our target is also effectively approaching closer and closer towards us. By working both sides of the equation to spend less and save more, we reach financial independence that much sooner.

Examples Where Spending Less = Early Retirement Opportunity

This phenomenon is something that is often under-appreciated by most people when they are trying to come up with their plan. However, if you look at any early retirement case study, you’ll likely find some aspect of this situation used in their strategy.

One extreme example that comes to mind is Jacob Fisker from Early Retirement Extreme. Jacob was an extreme saver; putting as much as 90% of his income into his retirement savings. He was able to do this by keeping his expenses low and only needing roughly $10,000 for his living expenses.

But at the same time, this low-expense lifestyle did something else to help him reach his goal sooner. With such a low standard of living, his target nest egg was only $250,000; significantly less than what most people think they need.

So as you might guess, by saving almost 90% of his income and having such a low target, he was able to hit his goal very quickly and retire by his early 30’s.

Mr. Money Mustache is another famous example. Though not quite as extreme as Jacob, MMM discovered that he would only need roughly $600,000 to cover his $2,000 per month lifestyle expenses. Again, this powerful combination of saving big and lower spending allowed him to become retired in his early 30’s too.

How You Can Save More

If you’re looking for ways to work down your spending, I highly recommend tracking (or back-tracking) your spending habits for 1-2 months. Try using a free program like Personal Capital or Mint. Even grabbing your last few credit card statements and firing up Microsoft Excel will be fine.

When you dive into your spending, it forces you to see the magnitude of certain purchases and how they can stack up over time. If you live in a household with a spouse, then it might also help you to learn a little bit about their spending habits as well.

Once you do this, you’ll be sure to discover several areas where your spending could be cut back. Are you spending too much at the mall? Grocery stores? Restaurants? Home Depot? There are literally thousands of ways you could be saving more money!

Whatever the heavy-hitters may be, challenge yourself (and your spouse) to keep your spending under a set limit. That way you can take the difference and apply it towards the savings goal you’d rather see it go to.

Readers – What are some of the unforeseen benefits you’ve discovered to saving more and spending less? In what ways have you seen one action play into another, and ultimately bring you closer to achieving your financial goals?

Featured image courtesy of Flickr

We’ve actually only recently discovered the benefits of saving more and spending less. Treating money as more than a tool to buy ‘stuff’ is definitely a game changer!

Aside from the benefits you already mentioned, I personally also find this to be a good self-discipline exercise. Truth be told, not everyone is capable of abstaining from buying useless ‘crap’. It’s difficult! So, really, spending less in order to save more is actually a pretty great financial achievement.

Totally! Even beyond the savings benefits, training yourself to show restraint when it comes to spending money will help set yourself up for a lifetime of financial success.

I like your blog because it addresses today’s problems. What I do not like is the fact that you have become unspecific. When you say savings and nest egg, where does one put the money. In a savings account that yields 1.%, in Stocks where it can vanish or what? I started with you when you did a certain analysis using one of the vanguard bonds and showed that as a possible place to put one’s money. MM is into real estate which i cannot handle. JL Collins is into putting all savings into 100% Vitsax and Mark Cuban says hold you cash for cash is king and you can do it with money market and CDs. While I enjoy reading about money, I seem not to get much from it. What am I missing?

Further, all these analyses do not refer to after deductions income or net. I think that should be the starting point of these write-ups. It shouldn’t be if you make $60,000 but if ur take home is 65% of your gross

Definitely I’m an advocate of putting your money in your tax-advantaged retirement savings and investing in index funds.

https://www.mymoneydesign.com/personal-finance-2/stocks/invest-in-actively-managed-funds-vs-passive-index-funds/

I often use gross income because taxes can vary widely from case to case. But to give you an example, a married couple trying to cover $54,000 of expenses using their tax-deferred retirement savings would be in the 15% Federal tax bracket. After a standard deduction and 2 personal exemptions, they would only owe $4,063 in taxes for an effective tax rate of just 7.5%.

https://taxfoundation.org/2017-tax-brackets/

Thank you for your patience! Some time ago, you tended to advocate income lifestyle index from Vanguard as a means of handling emergency funds. I was so impressed with your statistical analysis that I tried for a year. It was not successful then I sold it and went into VASGX without success because it returns almost diminished by an initial investment of 25k. However, I decided to adopt VITSAX and started seeing returns better than 1% given by online banks. Can you suggest anything better?

On my second point, it doesn’t make sense using gross. For example, my gross is around 17,5k per month but my take home is usually around $7000 since one would pay taxes, retirement, insurance (eyes, teeth and disability and then some more. Therefore, when discussions are posted from gross standpoint I seem lost. For me, my interest is how effectively utilize 7k left over. I have paid off my house.

Ahhh … I remember that post. Unfortunately, I haven’t reviewed any conservative mutual funds in some time. So I do have any useful recommendations.

Remember that when I say gross, I’m taking taxes out of the equation since there are thousands of different directions we could go. But we are factoring retirement savings out. That is of course the theme of the article: The more you are saving for retirement -> the less money that nets into your paycheck -> your lifestyle adjusts and your expenses go down -> the less your nest egg target goal to save for retirement is.

Since you have provided me with your numbers, I will use your numbers as an example. You say you make $17.5 /month which works out to $210K /year. Conventional wisdom would tell us that you must need $210K / 0.04 = $5.25M to retire. But I do not believe this to be necessarily true.

As I illustrated in the article, if your net income is really only $7K /month, and we assume your lifestyle is in line with this level of income, then your target retirement income should really be closer to $84K /year. That’s a much lower nest egg target of $2.1M.

Now we can estimate Federal taxes. If we assume you’re married and filing jointly and all of your retirement income is taxable, then we can proceed just as we did in my previous comment and subtract a standard deduction and 2 personal exemptions. This would work out to a taxable income $63.2K /year and $8,548 in taxes. So if you truly want to experience $84K /year in retirement, then bump up your retirement income target by $10K (or so) to $94K to cover the taxes. Now your nest egg target is $2.35M.

Grateful for your response. I will be able to do as suggested in your last paragraph without difficulty and I will keep learning!!

Wow, for some reason I never thought about how saving money would also help lower my FI target. I came up with my target awhile ago, but with the budgeting my wife and I have been doing, I’ll have to revisit it and hopefully be much closer to the goal than I thought!

I also use Personal Capital. My wife and I go through it every couple of weeks (every week if I can help it) to categorize expenses and make sure we both know what is being spent. This helps keep us accountable to each other and we’ve become much more cost-aware since doing this. Definitely recommend.

Yes, this phenomenon is a very awesome loophole. Most people think that if they earn $60K per year, then they must need to replace $60K per year with their retirement savings. But upon closer inspection, your expense needs are probably quite a bit lower because you can factor out whatever percentage you were saving towards retirement. And if you exploit this relationship (such as saving more and eliminating other expenses like your house), then you gain even more leverage.

It was mind blowing to me when I figured out that I need 25x my expenses in order to retire. I feel like there is so much misinformation out there and that it wasn’t until I really started reading financial blogs that all this information really opened up for me. Great post!!!

You’re absolutely right. It’s pretty incredible that all this awesome information is just out there for the taking. All you have to do is have your eyes open for the taking.

I love that graph you put together. I only really figured out how powerful saving and investing a combination is in the past couple of years. As a result, we are basically able to retire right now after only 5 years of getting super aggressive on both edges of the sword!

Thanks Derek. Yeah it is a little opening to look at that graph and see how quickly your “years you need save” drops off the higher the amount you save. As you said: It’s a double-edge sword with both sides working on your behalf!