It’s a financially responsible question I believe most people ask themselves at some point; especially when they find themselves with some extra cash that they’d like to put to good use. More than once after my wife and I have found ourselves with a new raise or bonus, we’ve questioned whether it would smart to use that extra cash to pay off some additional mortgage principal every month.

Why is that? Because eliminating your monthly mortgage payment has classically been accepted as almost a sort of “pre-requirement” to achieving financial independence. ABC’s “Shark Tank” co-host and personal finance author Kevin O’Leary has been quoted as saying “If you want to find financial freedom, you need to retire all debt — and yes that includes your mortgage,” according to CNBC.

And he’s not alone in his advice. Completely paying down your mortgage debt has been a sentiment shared by popular financial gurus, advisers, and those approaching retirement for decades.

Even those seeking early retirement have made paying off their mortgages a top priority. Read the stories of dozens of early retirees across the Internet, and you’ll quickly recognize that eliminating their mortgage debt was a huge component in reducing the amount of money they needed to accomplish their goal.

But then consider that we’ve all been in a very unique place in history in terms of interest rates. Up until 2016, the U.S. Federal Reserve has held interest rates at nearly 0 for almost 6 years (in an attempt to try to stabilize the economy). This means nearly anyone who got a new mortgage or refinanced within the past decade could be paying between 3 and 5 percent interest.

If you’re one of these people who was able to lock into a rate so low, does it then make sense to pay off your mortgage early when there could be better opportunities for you to use or grow your money?

In this post, we’ll look at both sides of the early mortgage payoff argument and weigh the pros and cons. In the end, you can consider which points will help you the most, and what you think would be the best use of your money!

Why You Should Pay Your Mortgage Off Early

Some people get extremely passionate when it comes to idea of paying off your mortgage early. And for several good reasons!

1. That feeling of finally being DEBT FREE!

When it comes to your finances, there is no better feeling than that of being “debt free”.

Say it with me … “debt free” ….

Imagine waking up and saying to yourself: I don’t owe anyone anything! I could lose my job tomorrow, and it wouldn’t matter. I’ve done what was needed to protect the greatest asset that my family and I depend on. The house and everything in it will still be mine – all because I paid it off!

This simple but powerful psychological reason is one that has driven many people to accelerate their house payments at incredible rates. Just like a career or weight loss goal, they simply want to be able to say “This house is mine! I own it and no one can take it away!”

Who can blame them? Wouldn’t it just feel great not to see that huge mortgage payment deducted from your checking account every month?

2. Saving yourself thousands of dollars in interest.

Now we get to the technical reason …

The definition of a mortgage is that it is a loan. Loans carry interest. When it comes to interest, there are only two sides:

- Those who pay interest.

- Those who receive interest.

Unfortunately, since none of us are lenders, we’re all on the wrong side of that equation! And the longer you carry your mortgage, the more interest you’ll end up paying to the lender over time. Who wants to do that?

Fortunately, mortgages are designed in a way that can exploited, and the way to do it is simple. The sooner you payoff the principal, the less money in interest you’ll pay over time!

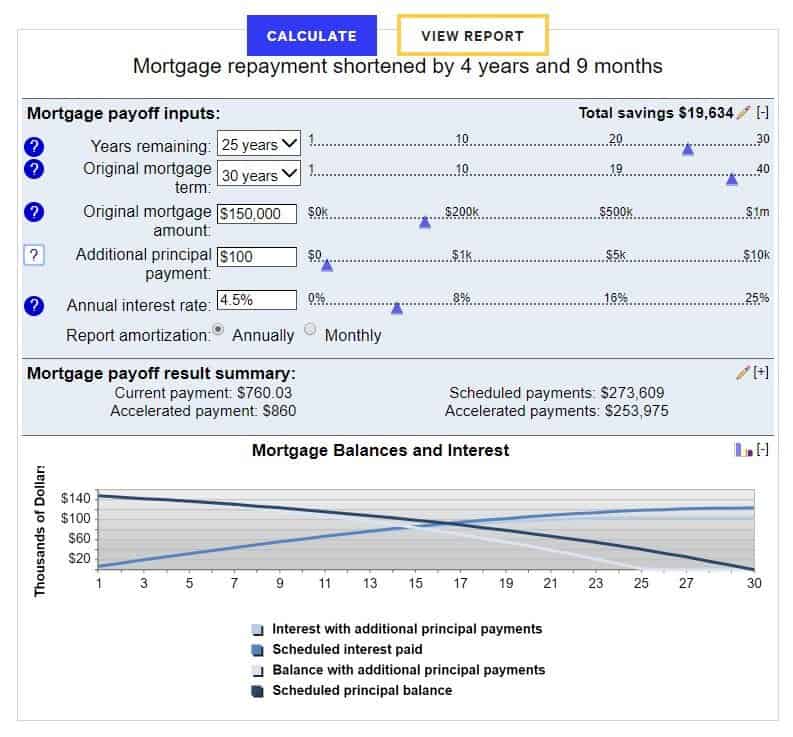

The savings are not trivial! For example, something as small as $100 extra dollars per month could end up saving you over $20,000 in interest payments over time! And that’s not to mention shaving almost 5 years off your payment schedule.

Want to see for yourself? Try this free calculator from BankRate. I highly encourage you to test it out and see just how much interest you end up paying on your house over the life of your mortgage. It can be extremely eye opening!

3. Building up equity

Unlike when you rent, every portion of your mortgage payment that goes towards the principal builds up “equity”. Technically, this is the amount of the asset (your house) that you officially own.

Why does that matter? Because when you go to sell your house, you’re entitled to this equity, which could mean tens or even hundreds of thousands of dollars!

Let me tell you – when we sold our house, it was pretty nice getting a big fat check for over $30,000! Depending on what your next move is in life after you sell your house, you could really use this money for a variety of reasons:

- Next mortgage down payment

- Payoff debt

- Finance a portion of your retirement

Effectively, you could almost think of it like paying your future self!

4. Locking into a fixed return rate.

Not a lot of people realize it, but paying down long term debt is just about the same thing as investing it.

How so? Let’s take your mortgage, for example. When you pay down your mortgage early, it’s the equivalent of investing that money and getting the same rate of return. If your mortgage APR is 5%, then for every dollar extra you put down on the principal, you’re effectively saving 5% in interest. (For an in-depth explanation of how that works, read my post Which is Better – Paying Off Your Mortgage or Investing the Money?)

Given our historically low interest rates over the past decade, and for some people this might be a more lucrative rate of return. When was the last time you went to a bank and were offered a CD with a fixed rate of 5.0%?

Why not just invest in stocks for a higher rate of return? Well … you could, and that’s one of the points we’ll discuss further in the next section. But keep in mind: Paying off debt is like getting a “guaranteed” rate of return (the same as a bank savings account or CD). Stocks are not guaranteed, and there is therefore more risk involved.

5. Reducing the amount of money you’ll need later or during retirement.

There’s a very good reason why so many financial guru’s and enthusiasts tell you to get rid of your house payment before you consider retirement. Eliminating your mortgage payment dramatically reduces how much money you’ll need in order to retire.

For example, let’s say you have a $1,000 mortgage payment and $4,000 in expenses. In the classic calculation, you’d need $5,000 x 12 months = $60,000 per year which equates to a retirement savings target of $1,500,000. But if your mortgage was completely paid off, then you’d only have to cover $4,000 in expenses. This means you’d only need $48,000 per year, which works out to a target nest egg of $1,200,000 instead; a difference of $300,000 less!

(If you’d like to see how I calculated this or why these numbers work, please check out this post.)

6. Lower taxable retirement income.

Again, thinking ahead to retirement, if you’re smart about how much taxes you’d like to pay when you’re retired, then you’ll want to make sure you pay off your mortgage before you enter into retirement.

The reason is this: When you retire, you’ll want to withdraw as little money as possible from your nest egg and Social Security so that you pay little to no taxes.

Suppose for retirement you decide you’ll need $30,000 per year pre-tax. Now let’s say that $10,000 of that $30K are your mortgage payments. If your mortgage was paid off, wouldn’t it be better to only need $20K instead of $30K. At $20,000, you’d actually owe no Federal taxes whereas at $30,000 you’d owe something.

Of course there are many ways to dance around paying taxes altogether during retirement, and this could be a complete non-issue. If you’re interested in knowing more about this, check out my how to have a tax free retirement. We actually worked out a scenario where you could withdraw $132,500 from your nest egg without paying any taxes at all!

Why You Should Not Pay Off Your Mortgage Early

While each of the above reasons above were pretty good, the reasons NOT to pay down your mortgage ahead of schedule can also be just as equally enticing.

1. Hedging inflation.

If you have a fixed rate mortgage, then your principal and interest payments will be the same for the next 15 or 30 years (depending on whatever kind of mortgage you took out).

While that may not sound very special, it actually has a very unique benefit to you in terms of inflation protection.

Consider this: As time goes on, all your other monthly payments will go up like your food, gas, utilities, car payments, insurance costs, etc, will go up.

But not your mortgage. Your mortgage is frozen in time. And relative to everything else you’re buying, that payment will actually “feel” like less the longer time carries on.

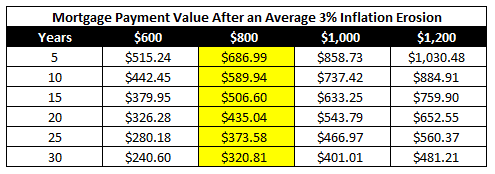

For example, let’s say you’re paying $800 today for principal and interest. For as long as you have the loan and do not refinance, you’ll always pay $800 every month. So if inflation increases by an average of 3% every year, that $800 will “feel” like the following over time:

Your future self might appreciate this!

2. Find a Better Rate of Return

Above we said that making a mortgage payment is basically the same thing as getting an investment with the same return rate. So let’s suppose that you refinanced your mortgage within the last year and got a fixed rate at 4.0%. If the average annualized return of the stock market (such as the S&P 500 index) is 8.0%, then that’s a difference of 8.0% – 4.0% = 4.0%. If you’re investing for the long haul, then rather than paying off your mortgage early, why not go for the market average and shoot for an 8% return instead of a 4% one?

3. Inability to tap into the funds due to loss of equity

What if we have another Great Recession like we had in 2008 and house values don’t go back to where they once were? What if they drop even further?

While debt is debt and you’ll have to pay off your mortgage no matter what your house value is, it may not strategically make sense to “park” your money in your house by paying your mortgage off early.

Consider if you made extra payments towards your house and you suddenly had to move for some reason. What if your house unfortunately sold for less than what you still owe on it? You’d never recover all that money you paid into your mortgage, and so you’d be out. According to this story from ABC News, this is unfortunately exactly the kind of thing that happened to one couple when they decided to use their 401k retirement funds to pay off their mortgage rather than waiting.

A better place may be to temporarily park your extra cash in an emergency fund or someplace where you can have access to it in case something came up.

4. Low interest rates.

When I refinanced my house a few years ago, I thought I’d never see interest rates that low ever again. Imagine my surprise when rates continued to fluctuate and banks were offering 15 year loans as low as 2.75%. Could you imagine a mortgage with a rate as low as 2.75%? That’s less than the average 3% inflation rate.

If you were lucky enough to lock into one of these ultra low rates, then you’re basically paying a historical low of almost next to nothing for your mortgage.

5. Fewer income tax return breaks.

You may not realize it, but your mortgage interest is deductible against your U.S. income taxes. Most other forms of debt (like a credit card or car payment) are not. While there is always a Standard Deduction, in some situations it may work out better for your tax situation to have more interest to declare.

Unfortunately this point can be somewhat weak in the pay off your mortgage early debate. Suppose you own a median priced house with around 20% equity in the house. In that instance the IRS Standard Deduction would automatically exceed whatever tax benefit you’d receive from itemizing.

6.Taking Care of Other financial goals.

Foregoing putting money into your 401k?

Not stuffing your emergency fund with the cash it needs?

Do you have high interest debt you should be paying off instead?

Maybe relative to these things paying off your house early just isn’t a huge priority.

Perhaps you’d rather dream big by starting a business, buying real estate, or fund other investment goals instead.

What is the Right Answer?

So after all of that, you’re probably wondering to yourself which of these directions is the right one to go in.

The short answer – it depends entirely on you.

Only you know your own financial well being. Perhaps some of the points we made here carry more weight to you than others. Regardless, there is never really a good one-size-fits-all answer to these kinds of situations. All you can do is look at the possibilities and decide for yourself which ones fit your position the best.

Readers – What do you think? Have you ever given much thought to the question of should I pay off my mortgage early? Did you end up doing it? Or did you find other reasons why you should do something else with the money?

Photo credits: Unsplash, Pexels, Pixabay

I think it all depends on your interest rate and the duration of your deal. We have a fixed rate for 3 years at around the 4% mark; in the UK it is hard to find a decent fixed rate for anything more than 3 years. If you can get a fixed rate for the entire term that is attractive, I would definitely NOT pay off my mortgage early!!! I am just scared right now that interest rates will balloon in the coming decade.

No attractive fixed rates over 3 years?! That’s no good. Conventional advice in the US is to lock in for a 15 or 30 year if possible. I do agree with you that rates will probably go much higher over the years!

Opps, both wrong. Eight years later and rates are still very low.

I’m trying to do both pay off the mortgage as my “safe play” and invest the other 30% of my money in “riskier” assets like shares and commodities.

I’m not sure what is right or wrong, but so far things are going fairly well.

If you’ve got the money to do both, then why not?!

I think it comes down to a personal choice. I know a better return is possible, but if we were in the position to then I would pay it off early. You could throw most of that extra money at investing, plus you can be entirely debt free. Also, with the supposed Cliff, you never know if they might be taking the deduction off the table or not.

I know a lot of people would rather bet on the sure thing, which is why paying the mortgage off early may work in their favor. Plus being debt free has a lot of perks. Sometimes the decision is based on more than just the numbers.

This is something that we are thinking about right now. We are wanting to sell our current house and move into a new one in around 1.5 years, so we don’t plan on paying our current one off. However, with the next house we do want to put a substantial own payment towards it.

I’m kind of wishing we had more money for our first down payment. If we had more equity, it would have made the first part of my story with the refinance a lot shorter (because it would have been easier and a sure thing)!

An important reason why not is diversification. https://nicoleandmaggie.wordpress.com/2010/07/31/the-pre-paying-the-mortgage-question/

If your house is a relatively small part of your overall portfolio, then go ahead and pay it off. If it isn’t, it is risky to have all your money tied up in one piece of real estate in one market. Even if you would never ever default on that loan, it’s still important to diversify where your money goes– we could sell stocks and pay off our mortgage tomorrow, but we choose not to because of that diversification. We do some prepayment each month but aren’t focusing on killing the loan at the expense of retirement savings.

Nicole and Maggie, you always bring a different perspective to the table! Great logic. In my case, I have lots of other investments, so I would be okay. But anyone who doesn’t have that would face significant risk by tying all their money up in one asset.

I feel that the pf community pushes hard for early mortgage payoff but between inflation, investment returns, and locking money into your house I don’t think it is the right move if you locked in a rate less than 5%. That is my personal opinion and only works if you don’t feel like a hostage to mortgage debt.

I’m not sure why the PF community always pushes early mortgage payoff. It makes sense sometimes, but not always. In my situation, I don’t think it is worth it at the interest rate I’m locked into.

You make some great points, i just recently had a friend who’s adviser told her she had saved enough and to start putting more payments into her student and mortgage loans.

There’s never anything wrong with using the money to pay down your debt. I just wonder if there is an even better use for that money? Depending on the interest rate, I think there might be.

I wrote about this from a slightly different angle a few weeks ago (in my link) and if I had a mortgage at today’s low rates I would probably extend it as long as possible and invest elsewhere. If I didn’t have room in tax-advantaged retirement/educational/health accounts, though, I might start paying more on the mortgage depending on the rates of return possible elsewhere. Unfortunately, I do not have a mortgage!

Interesting theory! I’ve heard other financial gurus go against the grain and recommend that you should take out a mortgage for as long as possible providing you can get one for an incredibly low rate, and invest the difference in payment. On paper, it actually does work out so long as you can get a higher rate of return from your investments.

Really, if you’re in the position where your only debt is the mortgage and you’re deciding whether to pay that off or invest, there’s no right or wrong. You’re in great financial shape, and you’ll be fine with either decision.

If you’re really stuck between the two choices, then do a little of both. Take the extra money each month and apply half to the mortage and invest the other half.

Thanks Justin. I’d love to say I am, but in reality I’ve got some 0% interest debt and a 2.25% car loan also. But because those are practically nothing, I don’t really sweat those ones!

I would pay off the house. The reality is that you’re not factoring inflation into the fixed interest rate on the mortgage. So, if you’re paying 4% on your loan and you factor in 3% of inflation, that means you need to be earning 7% on your returns. On top of that the S&P COULD average (hence average…not actual) 8%, but why take the risk when you can have the guaranteed thing?

Sorry Jason – I messed up and forgot to post the table of inflation values. I was surprised at how small your payment would “feel” after just a few years.

Because a fixed rate mortgage is not calculated with inflation, you’d really only net a 4% – 3% = 1% return by paying off your mortgage early.

In mid 2013 it will be the 4th year we’ve owned our home but we’ve had the money to pay it off in full for 2 months now. We’ve been asking ourselves the same question, should we? In the end there was a lot of “what if’s”. The conclusion we came up with is what if we could make more money investing, but what if we didn’t. What we do know is paying off the mortgage is clear cut.. when it’s gone it’s gone. I’d rather feel good knowing that the roof over my head is safe rather than hope the money we do have if invested works in our favour. I’ll take the sure thing then look into investing my mortgage money that I’m saving for investments.

Regardless of what you decide, that is extremely impressive that you have the money to pay it all off if you really wanted to!

We are paying off our mortgage as quickly as possible but only after saving for retirement and some college saving for our kids. Even then we are still doing some investing in taxable accounts to stay well diversified.

There are so many arguments for not paying of your mortgage early. But at the end of the day it is a guaranteed return that significantly lowers monthly expenses once it is paid off.

I was on the fence until my mortgage guy talked to me about recasting. Essentially, at any time (sometimes for a small fee) you can recast your mortgage to take into account your prepayments. It does not lower your rate but, if you’ve made significant prepayments, it will lower your monthly payment. Before I heard about this I was worried about getting a lot, but not all, paid off and then having some sort of life change where we couldn’t get it all paid off.

Thanks and welcome to the site. I agree that retirement and college savings come first. Those are my priorities as well. During my last refinance, our agent talked to use about recasting (although I don’t think he called it that). Even if I won’t exercise it, it is an interesting option to know you have available.

I am at 2.29% and it is a rental so I am not repaying. It allowed me to put the money down for the new house in cash. I could sell a few investments, maybe at a loss but I am ready to take the risk, if I needed cash. Usually the bank of mom provides the cash flow 🙂

That would be nice to have a bank of Mom to help out!

For me a house is shelter. Sure I want it to be nice, but I don’t view it as an investment. Instead, I’d rather have the security of ridding myself of it and not worrying about payments. If another great recession hits and I lose my job I won’t have to pull mortgage payments from my E-fund.

I’m always concerned that another Recession could be around the corner. Having no more mortgage would certainly cut down on how much income you actually need. Perhaps a good compromise would be to have at least a few month’s worth of payments ready to go!

We refinanced our house at 3.25% and I was so excited!!! I have seen now that it is more like 2.75% for a 15 year. I guess I didn’t wait long enough =) I’m still happy with 3.25%, though.

We are in the mortgage payoff camp. Our house will be paid off in 34 months. I hate debt and that doesn’t exclude my mortgage. But, we are also saving aggressively for retirement so I don’t have to choose one or the other.

Well, I think congratulations are in order for both the 34 month countdown and extreme retirement savings! Way to go!

I totally understand the psychological argument, but inflation trumps it for me. The government is doing everything to drive up inflation long term. At 2.75% I am paying the minimum for sure.

Agreed! 20 years from now when my $1000 payment feels like $544, I’m pretty sure I’ll be fine with my decision.

We just closed last week on yet another mortgage refi – my 4th since I’ve owned the home! I’ve saved thousands upon thousands of dollars every single time. Got a 15 year at 3% this time, down from 3.75% only two years ago. And yes, we absolutely intend to pay it off early. Partly because we just added 2 years with this refi.

I wish I could say we did the same. If only we had just a little more equity, then we could refinance again with no issue. Stinks being under-water!

I think the key factor that governs your decision is the interest rate. For instance, if I had to make that decision in 70’s when interest rates were in double digit, I’d have paid my mortgage off; it’s better to invest your money into a safe instrument like Vanguard total market index fund instead of paying off your mortgage since you can borrow money for your house at a rate far below the return you would receive from your investment.

I agree Shilpan. It’s all about arbitrage – the difference in rates between what you owe and what you’re earning.

And thinking back on the days of those high interest rates, I wish I had taken out more long term CD’s and bonds! I remember having a CD at 8%!

I prefer the Dave Ramsey method of getting rid of debt to limit your risk in the long run. And getting a better interest rate in a safe investment isn’t exactly easy today.

As always, you have done an excellent analysis. For me #1 is the biggest motivator and we are going for the early payoff.

For someone who plans to own several houses, I can see why! Thanks for the compliment!

It may make sense to payoff your motgage early when you consider that you could lose your stock investment over night.

You’re absolutely right that you could lose your investment overnight when it comes to stocks. But at the same time, those same stocks could also go up.

In all choices, its important to consider your comfort and aversion to risk. All options with higher rates of return usually involve some higher risk taking. In my case, I’m pretty comfortable with risk since my investment time horizon is pretty long. But at the same time, I plan to invest in the most sensible companies I can find so that my choice isn’t doomed from the start.

My wife and I paid off our home this last year. Our 401k allows for taking up to half out for a home loan.. and then, I have to pay myself back (with interest).

I went from paying almost $5,000 a year in interest on a 30 year note (that I still owed 23 years on) to repaying a 401k loan that will cost me less than $5,000 interest over the next 5 years (less than 4 now).

There’s something to be said about opportunity costs too. Having a home paid off for 20 years of your young life is a lot of opportunity to do things that one could never do otherwise. Getting the home paid off at 80 does me little good in regards to enjoying life. 🙂

What an interesting strategy: I wouldn’t think that the interest payback from borrowing on a 401k is less than the interest you pay on your mortgage. What was the spread of interest rates?

To me the answer is pretty simple. A home always has value, no other investment always does. Blue Chips like GM can go bankrupt, eliminating the value of both stocks and bonds. Cities can go bankrupt, making their bonds worthless. Banks go under.

Paying off your home before retirement is a clear necessity if you want an affordable, stress-free retirement. And the extra money you have available every month after paying it off can be funneled completely into other investments if desired — secure in the knowledge that your most important necessity has been taken care of.

You can also borrow on your home after retirement if you face an emergency. And if you do a reverse mortgage then, you’ll never have to worry about repayment during your lifetime.

Unless you plan on defaulting on your mortage, it won’t matter if you have to move & sell at a loss — you’ll take the hit regardless of whether you’ve paid it off beforehand.

Only reason not to prepay is if the neighborhood could become inhabitable during your lifetime, and you plan on defaulting and turning the house over in that event.

Note: Yes, it’s theoretically possible that the money could potentially earn more in other investments. It’s also possible you could lose it all in other investments. You have a lot more control over your own home value than any other investment. And it will always have the inherent value of keeping a roof over your head, which is generally worth $1K-$3K monthly. I can’t see the risk often being worth it, especially if you can pay cash up front, as that can also secure you a better sale price.

Bottom line, look at the fact that you’ll pay twice as much if you buy a house on time vs. paying cash for it up front, or as soon as possible. I don’t care about inflation, etc. — once you realize you’re gambling that much money hoping the other investments will make up the difference, the choice becomes clear to me. You can gamble with other invesetments, but pay off the house as quickly as possible. And don’t borrow for ANYTHING unless absolutely necessary. Just makes everything cost more.

This all gets back to your comfort level on investments. Some people feel uncomfortable taking a risk on getting a better return rate. With a 30 year time horizon, the fact that stocks have returned 8 to 10% on average since 1926, and never lost money over a 20 year time period, I’m good with taking the risk.

Despite how you feel about inflation, it doesn’t change the fact that it is a reality. Using the rule of 72 and 3% inflation, the price of everything will double in approximately 24 years. Basically in the future your mortgage payment will feel like half of what it is relative to everything else we spend money on. This can be a useful trick when you consider all the other opportunities you have to use that money and grow it in other places.

Here’s a twist:

If you are sitting on old stock options, or stocks, consider what has happened over the past year.

The stock market has inflated tremendously. Nobody – and I mean nobody – can point to fundamentals that explain why many stocks have doubled in value. Most people view this as a bubble – the economy is so poor that investors are pouring money into the stock market, and driving up prices, “just because… what else can they do?”

Thus the “inflation” argument might be turned upside down here.

If you suddenly have enough stock-value to pay off your mortgage, even after capital gains takes its bite, then consider doing so.

It all depends: do you think the market is still going to climb, or is this a peak?

If you think the bubble is going to burst, you’ll be paying for a hard asset (your house) with inflated dollars. Depending upon your tax situation, your stomach for risk, etc., that might be a wise thing for you to do.

Interesting post. Just one thing. Our mortgage payment has never stayed the same. We’ve been in our home over 12 years. Well ok the actual payment to towards the loan is the same, but because the bank pays our property taxes our escrow account changes every year. Our property taxes keep going up because of school levies. So technically our mortgage payment keeps going up.

I completely understand. My P&I has always been the same as well. But the taxes, insurance, PMI (escrow) can fluctuate. I suppose on that point if you really think about it, paying off your house completely won’t be that grand because you’ll still have to deal with taxes and insurance – those won’t go away!

For me I would pay it off because I want to avoid all risk. I would feel more at ease with a paid for house, than trying to hedge the market with the interest rate game. Once its paid off then you can plunge the entire mortgage payment for a year, and start investing some big dollars.

There’s a lot to be said about risk adversity. Certainly it would be great to have your biggest asset paid off and the deed in your hands. When people site that as their most compelling reason to pay their mortgage all off early, I can really sympathize with that notion.

Someone mentioned this option to me the other day and I think it is perfect. Invest the money. Then, when you have however much you owe on your loan in your investment account (after taking into account taxes on gains) decide whether or not you’d rather have the investments or no mortgage. You’ll be better off all around 😀 If, and only if, you can invest the money you’d throw into the mortgage without fail.

I think the whole investment vs mortgage payment return is well worth considering. If all goes as the market has done on average for years when you invest, you’ll end up with all the mortgage payoff money you’ll ever need (and then some) to settle the debt.

I think it all depends on the person. Many choose to invest instead of pay off their debt, but then they never get around to actually investing. For me, I would rather invest since my interest rate is low and I can earn a higher return in the market.

That’s how I feel about it Jon. If mortgage interest rates were higher (and thankfully they’re not), I’d be happy to effectively “lock” into a decent figure. But my mortgage rate is so low that I feel like I’m practically getting the loan for next to cash.

Well, I’ll be talking about this on my Monday post. We did choose to pay ours off earlier this year. The relief that it has brought to our monthly budget has been astounding.

Regardless of which side of the debate you’re on – I say good for you! Paying off a large debt of any kind is a huge accomplishment and display of responsibility in my book. I can’t imagine how great that feels not to have to worry about those payments anymore, right? I’m sure it could almost be intoxicating.

This is a question I have been writing about lately. I think it mostly depend on whether you are concerned with being debt-free or with getting the greatest return.

But why not do both?

It’s not a bad idea to invest the extra money into some good index funds and let it grow instead of putting it toward your mortgage each month. Once you have created some wealth with that money, you can always pull it out and it towards your mortgage.

My wife and I are doing exactly that. When we have accumulated the amount that we have left on our mortgage, we will simply pay it off.

Just a thought. Great post!

I think that’s a perfectly fine approach as well. Essentially you’re locking into the return you’ve made from the index funds and then re-locking into the rate of your mortgage interest (but more importantly paying down your debt). More than once I’ve questioned taking money from taxable investment account after one or two wild rides and using the proceeds to wipe out our own mortgage. Good suggestion!

I think it only makes sense to pay off your mortgage early if you have a low risk tolerance for investing in the stock market. If not, then you’d be better off to trade risk for higher rewards by investing!!