When it comes to retirement planning, lots of people know that there exists some withdrawal rate that is considered “safe”.

The most popular of these rates is of course the 4 Percent Rule. This was popularized in the 1990’s by Bill Bengen and The Trinity Study.

However, one very important point to consider is the fact these studies did NOT account for Social Security. They merely only considered retirement savings.

Since most U.S. tax-payers will stand to receive at least some sort of Social Security benefit, logically this is good, right? It means you should be able to start with a higher than usual safe withdrawal rate.

But the question is: How much higher? How much additional income should I be able to safely enjoy without completely running out of money in the long run?

Or to ask the question another way: How safe can I feel about the safe withdrawal rate I plan to use knowing that future Social Security payments are on the way? Will they provide a small buffer or a large one?

In this post, we’re going to explore this question further by creating a simple experiment. But first, let’s get on the same page and come to some sort of an agreement about the prospect of Social Security.

You Will Get Something From Social Security

Despite all the criticism and doubts about Social Security, the simple fact remains: They are NOT shut down for business yet. Nor do I believe they ever will be.

I will be the first person to agree with you that the setup of Social Security is basically a sort of legal Ponzi Scheme. Young people contribute so that the older people can receive benefits. It’s an interesting system, but its what we’re stuck with.

I sometimes laugh to myself when people say Social Security won’t be around anymore. Nonsense!

Consider what would happen if they were to suddenly announce tomorrow that Social Security was no more. Angry mobs of people who have been paying into the system their whole lives would hit the streets with pitch-forks demanding the blood of their politicians. It wouldn’t be pretty.

Yes, Social Security’s own website claims that starting in 2034 that they will only be able to pay 79 cents to the dollar. But again: 79 cents is still not 0 cents. Even at this discounted rate, you will still be paid something by Social Security.

My belief is that if anything is to happen, it would probably be that the rules of Social Security are tweaked. Or at the other extreme, the program transforms into an something new. But even if that happened, they could not simply wipe the slate clean of the benefits that are owed.

Therefore, whether you plan to retire tomorrow or even 20 years from now, let’s agree that you be paid “something” by Social Security.

Social Security Age Requirements

Another important point to consider about Social Security is the age at which you start your benefits.

To review, currently the rules state that for anyone born in 1960+:

- Age 62 = 75% of your full benefit

- Age 67 = 100% of your full benefit

- Age 70 = 124% of your full benefit

For purposes of this article, we’re going to assume that you probably want / need Social Security to kick in sooner rather than later. Therefore our assumption will be that you start collecting your benefits at the earliest possible age of 62.

According to Social Security’s data, the average monthly benefit received by someone starting at age 62 was $1,045.76 per month (as of Dec 2015).

For simplicity, we’ll round this down to $1,000 per month ($12,000 per year).

The Problem With the First 10 Years

Although our intention here is to prove that we can use a higher withdrawal rate at the start of retirement, we have to be very careful not to go TOO high.

Why is that?

Research has shown that the first 10-15 years are the most critical in determining how long your retirement savings will ultimately last. This is mainly due to the phenomenon of sequence of returns risk. Financial researcher Michael Kitces quantified this point in his 2008 publication of the Kitces Report.

“The safe withdrawal rate for a 30-year retirement period has shown a whopping 0.91 correlation to the annualized real return of the portfolio over the first 15 years of the time period”.

In other words, the more conservative we are in the beginning, the better our chances will be at not sabotaging our retirements down the road.

This means we have a bit of the Goldie-Locks conundrum. We know that we can pick a rate that is higher, but not too high. It has to be just right!

The FIRECalc Experiment

To see how Social Security impacts our retirement safe withdrawal rate, we can easily test as many scenarios as we want using the free online calculator FIRECalc.

Setting Up FIRECalc

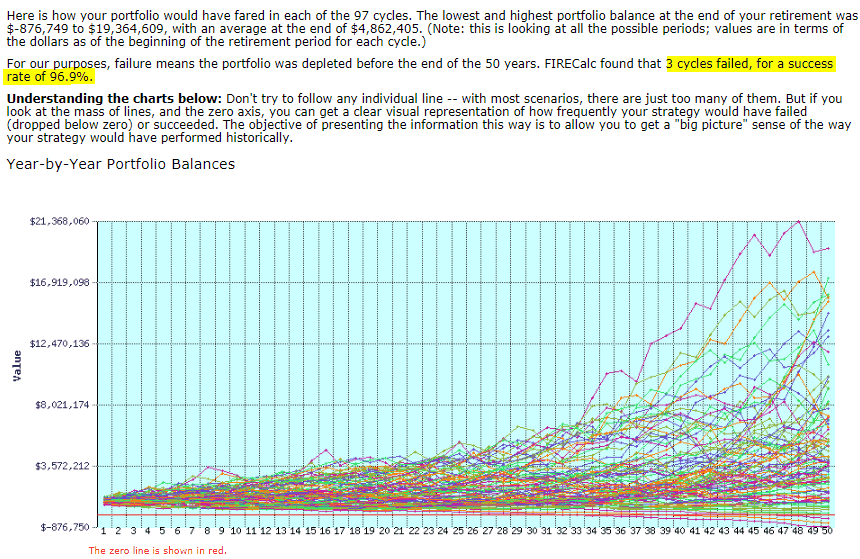

For anyone who doesn’t know, FIRECalc basically lets you recreate the Trinity Study. You enter in how much you’d like to spend every year (inflation adjusted) and how much money you plan to save. FIRECalc will then tell you how many cycles (or rolling periods) throughout history your plan would have worked or not using actual market data.

Here’s an example of what that looks like:

Like the Bengen / Trinity Study experiments, FIRECalc’s standard format does not take into consideration Social Security payments. But, using one of the many advanced features, this can be easily be added.

(Note: With this feature selected, you will assume that in the years leading up to Social Security that all of your retirement income comes from your retirement savings. Then once your Social Security benefits start, you will continue to receive the same level of retirement income from a combination of your retirement savings and Social Security.)

How Many Years to Consider?

Another helpful benefit of FIRECalc is that we can adjust the retirement horizon from the Bengen / Trinity Study time-frame of 30 years to as long as we want. For this experiment, we’ll look at horizons of 30 to 60 years.

This makes sense when you consider that the average life expectancy of a person is 79-85 years (according to CDC data, Table 15).

To put this in the context of retirement planning:

- If I retire by age 55, then I need my money to last at least 30+ years.

- If I retire by age 45, then I need my money to last at least 40+ years.

- And so on.

In terms of our model with FIRECalc, this means we need to define when it is that we plan to start receiving our benefits. For example:

- If I’m 60 now, then I can expect to start receiving my Social Security in 2 years.

- If I’m 50 now, then I can expect to start receiving my Social Security in 12 years.

- If I’m 40 now, then I can expect to start receiving my Social Security in 22 years.

- And so on.

Finally, as a baseline simulation to use for comparison, we’ll also compute the results assuming you never receive any Social Security benefits at all.

Retirement Safe Withdrawal Rate Results

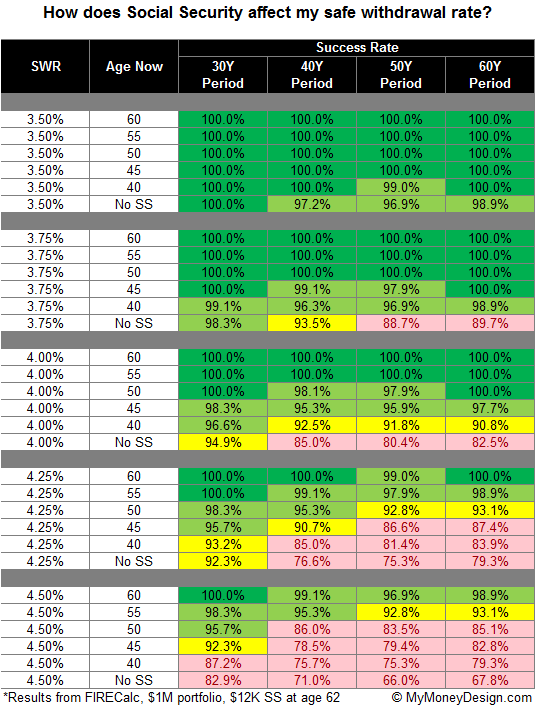

The following are the results of the FIRECalc experiment using a retiree with a $1 million dollar nest egg and $1,000 per month Social Security benefits starting at age 62.

To recap: FIRECalc defines each successful iteration as having made it to the end of the given time period with a remaining nest egg greater than $0. A result of 100% means that at no time in history would you have ever ran out of money.

For confidence, we’ll set the level of acceptance at a rate of 95% or greater successful iterations (green). Any simulations below 95% success will be deemed too risky (yellow – red). (You, the user, are always free to define your own level of acceptance.)

Take-aways:

If we look at the baseline results (no Social Security payments) across all the various time periods of 30-60 years, we can see that a withdrawal rate of 3.50% is generally very safe.

This should come as no surprise because it matches:

A) The conclusions we made from a previous study to determine the optimal safe withdrawal rate (also using FIRECalc).

B) Bengen’s finding (referring back to his original article from 1994).

When we factor in the prospect of future Social Security payments, how long you have until you can start collecting your Social Security benefits (i.e.the age at which you retire) plays a huge role.

- The closer you are to starting Social Security, the higher the withdrawal rate you can use.

- The further away you are from starting Social Security, the less of a benefit it has.

To put this into numbers, generally speaking for the model we just created, age increased our baseline safe withdrawal rate from 3.5% to the following:

- Age 55: +0.75% to 4.25%

- Age 50: +0.50% to 4.00%

- Age 45: +0.50% to 4.00%

- Age 40: +0.25% to 3.75%

Further Analysis

Great! So we’ve proven that Social Security does in fact allow us to safely use a higher safe withdrawal rate that is approximately 0.25-0.75% greater at the start of retirement.

However, we can only unfortunately tie the findings from our simple experiment to the one example we constructed above. That was just one out of possibly millions of other scenarios that exist!

As you probably already guessed, there are a number of other great questions to ask that would likely yield different results, such as:

- What if your Social Security benefit is a different amount?

- What if you wait until a different age to begin collecting Social Security?

- What if your nest egg amount is bigger / smaller?

- What if you retire sooner than age 40?

- When you will collect SS?

- What about the asset allocation of your nest egg (stocks/bonds)?

- What are the economic conditions when you retire (CAPE)?

All important considerations!

Fortunately, I don’t need to spend anymore time with FIRECalc because someone else has done the heavy lifting. Please let me refer you to a more comprehensive analysis prepared by Big ERN from the blog Early Retirement Now called The Ultimate Guide to Safe Withdrawal Rates – Part 17: More on Social Security and Pensions (and why we should call the 4% Rule the “4% Rule of Thumb”)

ERN’s analysis builds in many of these other variables which gives you a more accurate way to pin-point which safe withdrawal rate you should plan to use.

To give you some idea about the sort of impact he found Social Security to have, consider the examples he gives half-way down the article.

If we consider a person with a $1 million nest egg, expected Social Security benefits that are 1.5-4.0% of current Net Worth, and a Social Security start age of 70, ERN concludes by:

- Age 30: We can increase our SWR by 0.174-0.461%

- Age 40: We can increase our SWR by 0.395-0.980%

- Age 50: We can increase our SWR by 1.012-2.188%

Conclusions

To summarize the conclusions from above:

Yes! Taking Social Security into consideration does impact which withdrawal rate you can use safely. However the magnitude of this impact will be highly dependent on a number of important factors: Age of retirement, when you take Social Security, how much you plan to receive, etc.

In the example above for the average scenario, we found that future Social Security benefits could enhance your safe withdrawal rate by 0.50-0.75%. But in reality, it will all depend on your situation.

… Which brings to one more great take-away that I’d like to emphasize from ERN’s analysis (and a fitting end to this article). Within the text, ERN makes the following statement:

“Determining your SWR is a highly customized exercise! ”

I couldn’t agree more!

Generalities and rules of thumb can be helpful in retirement planning for getting in the right ballpark. But when you get down to the actual nuts and bolts, every individual (or couple) should carefully review their own situation (or do so in the company of someone who can help them). The result could be potentially save you hundreds of thousands of dollars in savings and shave years off your target. Its definitely not a trivial effort!

Readers: How do you plan to work Social Security into your retirement plans? Could you agree that it might benefit your safe withdrawal rate by another 0.5% or so? Or could it provide that extra sense of safety you were hoping to achieve?

Featured image courtesy of Flickr

Cool! Thanks for the mention! I love it when people take some of my findings and apply them to their own calculations. Keep up the great work!

ERN

Thank you! Please keep digging deep into this stuff. It’s very interesting.

Great article. Though I wonder if that disclaimer to all the SS-doomsayers is directed at me (I know it’s not, but I still can’t claim to be as optimistic about the program’ fate as you. Plus, when you consider the 21% benefit reductions and the many renowned worker pension plans that have collapsed…….). Even still, it shows that many people often don’t take into account ALL their money when it comes to calculating early retirement.

I’m guilty of this too, often looking at my 401(k) and my dividend stocks as if they were owned by separate people. Though perhaps this might be for the best, as we may be motivated to work harder and save more. In other words, tricking ourselves into better financial situations. I do that to myself sometimes, for better and for worse.

Keep up the great work!

Sincerely,

ARB–Angry Retail Banker

Nah… not directed at you or anyone specifically. I just know from years of blog writing experience that if you even whisper “Social Security”, you’re sure to get a swarm of doom & gloom comments saying things like “Social Security won’t even exist by the time I’m retired … blah!” I just wanted to nip that one in the bud right out of the gate.

The interesting part about Social Security that a lot of people forget is that for most middle class Americans, it can be a life-saver. Even a SS benefit like $1000 per month can be the equivalent of not having to save $300K in your 401k. For some people who have nothing more than $300K saved for retirement, that’s like literally doubling their savings. In these sorts of cases, folks who previously thought retirement was unreachable might be closer than they think.

Probably the most sensible article I read about the 4% rule since no one ever factors in the addition of social security. For whatever reason people never mention the addition of social security which gives people a false sense of security. SS makes a big difference when added to the 4%.