(… Depending on the answer, it might also make you feel really good about your savings efforts so far!)

Suppose you were suddenly let go from your job. You find a new place to work, but it doesn’t pay as well.

So in order to maintain your standard of living you decide you’re going to cut corners and completely STOP saving money for retirement.

The big question:

Would you still be able to comfortably retire when you want to?

My Answer …

(… Kind of a funny question to ask on a personal finance blog, right? …)

I tried this little experiment on our current retirement savings, and you want to know what I found out?

We’d be okay!!

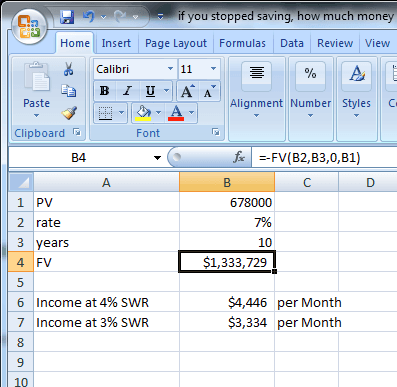

It’s true. As many of you know my wife and I have a plan to retire in about 10 years from now. So when I added up our savings, calculated what they would potentially be in 10 years from now (using 10% returns with a 3% inflation adjustment), here’s what I came up with:

- Using a safe withdrawal rate of 4% = $4,446 per month

- Using an ever safer withdrawal rate of 3% = $3,334 per month

Combine either of those figures with the $2,051 we expect my wife’s pension to be, and we’ve successfully exceeded our anticipated cost of living need of $5,000 per month.

Awesome!!

How Is This Possible?

I know what some of you are thinking – how can I STOP saving for retirement altogether and still meet our goals? Something doesn’t add up …

Fortunately it’s all thanks to the marvelous power of compounding returns. Because my wife and I have done a pretty good job of saving so much money, we’re now at a point where the earnings from our savings actually contributes more to our nest egg than what we’re saving each year.

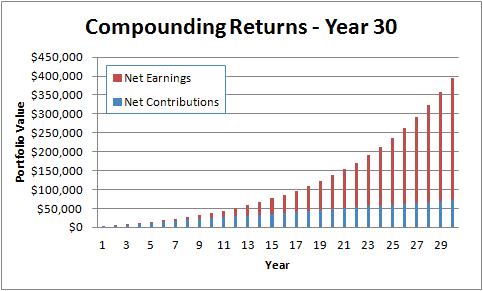

Just see this image below:

This is an example of compounding returns in progress. Notice how around year 15 the red part starts to outgrow the blue part? That’s because after a while your money starts to “make more money” than you do!

The “red part” is where we are at in our phase of accumulation. Adding money to it every year will be nice and all, but the real magnitude of growth will come from the money that is already in there.

This is just another nod as to why it’s important to start saving early and save big (like I stress hardcore in my first ebook)!

The First Signs of Financial Freedom!

So why care about how much my retirement savings are going to be under these fictitious conditions? After all, it’s not like I’m really going to suddenly STOP saving money into our retirement nest egg.

Plus I’m still 10 years away from retirement …

So where does that get me?

The reason I did this little exercise is because in our quest for financial freedom I think there are little milestones that we need to recognize and appreciate. And this is one of them!

Not that long ago I did a similar exercise in this post here and was further away than I thought. Now, almost a year later, it turns out we’re getting closer!

In terms of being where we want to be financially, this is the equivalent of just starting to see the sun peaking out from behind the trees in anticipation of a grand sunrise!

Though I would still need to let my money compound for at least 10 more years to make this happen, what this tells me is that the assets we have built up right now are significant enough that they could mature into a fortune that would take care of us for life.

Call it what you will – I see that as a HUGE accomplishment!

It’s a big deal to me because it gives me a positive sense of confidence and security that I would otherwise be lacking.

Suppose I really did lose my job. Suppose I did take another job that only paid half of what I make now. If I really honestly and truly had to stop all future contributions to my retirement funds, it’s very pleasing to know that at this point the game it changes nothing in terms of money!

In other words: There’s no knocking us off the road we’re on!

What If You Stopped Saving Money for Retirement?

Now you try!

- Enter the current value of all your savings accounts into a cell.

- In the next cell type in 7%. We’ll use 7% because that represents an average annualized return rate of 10% minus the average rate of inflation 3%.

- Next type in the number of years until you plan to retire.

- Calculate the future value of your assets. In Excel the formula is =-FV(cell with return rate, cell with number of years, 0, cell with current value of your savings account)

- Finally multiply the future value of your assets by 0.04 and divide it by 12 to get your estimated monthly retirement income (assuming a 4% withdrawal rate). If you really want to play it safe with your withdrawal rate to lower the potential that you could run out of money, use 0.03 to represent a 3% withdrawal rate.

Do you like what you see?

The important lesson to take away from here is just how powerful compounding returns are, and why we need to save/invest as soon as possible rather than waiting to do so in the future.

Because of how much money we have saved up so far, that’s why we could theoretically STOP all our retirement savings and continue to be okay. The compounded returns from just the assets we have so far we would potentially be enough to carry forward and amass into a fortune that we could use to live on.

That’s not an accident! That’s by design. About 5 years ago my wife and I made a conscious choice that we wanted to retire sooner than later. To do so we decided to up our retirement savings from a meager 10% of our income all the way up to the point where we are maxing out all of our retirement accounts.

It wasn’t easy. Sacrifices had to be made. But after careful planning we got there. And now I’m proud to prove to myself that the mass we’ve built up so far could potentially grow into the fortune we need to secure our financial freedom.

Readers – How did you do at this test? Could you stop saving today and still be on track? How do you challenge yourself at saving money for retirement?

Image courtesy of Neil Fowler | Flickr

Congratulations to you and your wife! I bet that is an amazing feeling. I don’t need a spreadsheet. In fact, I know that I can’t stop saving. I need to do the opposite and kick my savings up a few notches!

It all starts with just making a commitment to start saving as much as you possibly can (and then some) right now. After a few years you’ll be surprised how quickly it all builds up.

Awesome job! We wouldn’t be too far off either because of our rental properties. They will provide a pretty decent chunk of our retirement earnings when they are paid off in around 11 years and have nothing to do with the money we have invested and saved for retirement.

Great strategy! Having those rentals is really going to offset and reduce how much of an income stream you’ll need your retirement accounts to provide.

Congrats on that milestone. It shows how fast you can turn around when you really put your mind to it. Like Holly, our rentals should take care of us, but it’s nice to also have a backup plan if we need it.

Those rentals are really going to be a nice offset to your retirement savings needs. That’s a really smart way to combine a passive income strategy with investment income.

Congrats, this is awesome! My situation is fairly different as the retirement systems work differently here in Europe. However, probably the rentals would help me out for a while as well, but only for certain period of time. Very interesting post!

Thanks Reelika, and welcome to the site.

Congrats on the milestone and it will snowball big time from here for you guys. Over 600 grand is enough for many people to retire with today including some other bloggers who did it with about that figure. Well looking forward to any developments in how you will change your FI journey given this awesome news.

Thanks EL. Yeah, it is true that some other FI bloggers have been able to call quits with what I have now. Waiting until my wife is eligible to retire too and receive her pension is a big part of our plan. I’d actually like to use the next 10 years to see if I can get my passive income streams up to the point where we don’t even need to touch our retirement income. That would be quite an accomplishment.

Between this and your previous post, you are just swimming in good news! Awesome!

Right now, I don’t even have to do the calculations to know that I’m nowhere near financial freedom, be it in 5, 10, or 30 years. But I’ve also only been going all out with this for the last year. And I started doing some light calculations and realized that with the pay raise my promotion will be giving me, I can double my 401k contributions, stay in the same tax bracket, and STILL increase my net pay! I think, at least. They were very back of the napkin calculations I did on the bus this morning.

Sincerely,

ARB–Angry Retail Banker

Doubling your 401k contribution is no small accomplishment! That’s great. Every bit more you add each year helps.

I’ve actually thought about this exact question. What would our retirement nest egg be in 30 years if we stopped contributing today? It’s amazing how the power of compound returns eventually outweighs any contributions that you could make. Really gives you peace of mind over time.

It’s totally fascinating how that all works. To think that your nest egg can snowball faster than anything you can add to it is somewhat mind-blowing.

Good job MMD! I couldn’t believe that you could retire 10 years from now. But, with those numbers, retirement years would surely be great and fun!

I’m definitely looking forward to it!

Compounding is really awesome when you see it in action. I’ve also had some dreams of early retirement in 10 years at age 45. I’m not sure about it though. One of the big problems is that we live in NYC and with our friends and family here….it would be hard to pick up and leave. It is very hard to retire early in a high cost of living area. Plus, while I also have a pension…I would be majorly penalized if I left before 55. Or maybe I’m just greedy because it’ll still be a decent amount (though I’d have to wait until 55 to collect).

I can see where that would be an issue. It seems like living in a place like NYC you’d probably need double the numbers of what most other bloggers are saying they would need to feel financially free.

As much as you might want to retire early, I probably wouldn’t give up the pension. My wife is going to get her pension in 10 years and so most of our plan is built around that milestone.

It’s commendable for you and your wife to have made savings for such a long time. However, I do not think that halting my retirement benefits contributions would do me any service. In fact, it would be a disservice since I have only been contributing for almost ten years. I need another eight or so years so that I can consider stopping.

You’ll get there. It’s quite a cool sign of financial freedom when you reach the point that contributing to your retirement savings no longer matters because your gains have outgrown your contributions.

What portfolio are you using where you believe 10% is a fair estimate for the next 10 years of your returns?!? US stocks are at nosebleed valuation levels, and bond rates are very low.

I can think of a very optimized (heavy on foreign stocks) where you can maybe expect 7-8% nominal, but much beyond that and you’re hoping for a best case scenario.

I was simply using S&P 500 index fund statistical data to illustrate a point. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Hi,

Glad to see this amazing post! It is really informative as well as useful. I completely agree with each and every aspect.

This lack of savings indicates that just getting started on retirement planning is a significant obstacle for many people. This difficulty can be due to a lack of education on the importance of retirement savings.

Retirement years are one of the best years in one’s life most especially if you’ve already worked for almost all your entire life. It’s time to relax, to free yourself from worries and enjoy the remaining years of your life.

Thanks for being sharing..

Regards

Lyle L. Ketner

Thanks Lyle, and welcome to the site! Yes, I think its an interesting phenomenon when your assets actually generate more income than your savings rate produces. Though it can take a while to get that momentum started, it’s quite well worth it once you finally see it all in action.