I’ve got a confession for all of you: I’m getting impatient! It was approximately 10 years ago that I first learned what a 401k was (I had never even heard of one before) and began my first steps towards saving for retirement. Like many of you, I knew the path to create wealth would be lined with hard work, lots of saving, and choosing the right investments. I took the conventional financial advice and began with a modest 10% savings rate. It wasn’t until the last few years that I’ve tried to accelerate my results by bumping my savings rate to extremely high amounts. So is it any wonder that when I look at my 401k balance and see how long I have to go that I feel I’m playing a rigged game? Sure if I stay the course I might have a … [Read more...] about Is the Conventional System to Create Wealth Rigged?

Index Fund

Which Is Better – Rental Income or a Stock Market Index Fund?

Who’s ready for some financial smack-down? If there’s any two groups of investors I can think of that are more divided, it’s those who invest in real estate and those who invest in stocks - like a North and the South of financial planning if you will. So the question here is this: Which one actually has a better chance of making you more money in the long run? This may be a controversial debate, but we’re going to settle this argument the MyMoneyDesign way – by running the numbers! So let's see what we come up with ... … [Read more...] about Which Is Better – Rental Income or a Stock Market Index Fund?

How Much Money Would I Make If I Rented Out A House?

When it comes to buying stocks, the old rule of thumb is to “buy low and sell high”. If you’re fortunate enough to understand this saying, then you’ll know that it doesn’t just apply to stocks. It’s meant to teach you to look for opportunities. So even though the value of my home seems to go down, down, down every year, perhaps therein lies an opportunity. As I walk the dog through my neighborhood, there is an abundance of houses for sale. And what’s more is that I KNOW they are selling for FAR less than what I paid for mine. So this gets me thinking: • If I have any aspirations to buy a house and rent it out, is now the time? … [Read more...] about How Much Money Would I Make If I Rented Out A House?

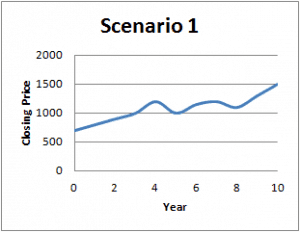

What Does “Stocks Return 8 Percent Each Year” Actually Mean?

Pop quiz: Pretend your investment portfolio looked like one of these three graphs. Which of these represents an 8% average annualized return each year? The answer: … [Read more...] about What Does “Stocks Return 8 Percent Each Year” Actually Mean?

How to Buy a Stock Market Index Fund

If you're wondering how you can buy an index fund, then you're in the right place! Index funds have become a favorite investment choice for people from all walks of life. Thanks to their simplicity and performance, you could easily grow all the money you'll ever need by consistently investing in an index fund. Even legendary investment guru Warren Buffett famously bet (for charity) a group of hedge fund managers that they could not outperform a simple index fund. And you know what? He was right! Even though these guys were supposed to have all the right connections and information to beat the market, they still managed to lose to an index fund. 10 years later, the index fund gained a 94% return while the hedge fund only … [Read more...] about How to Buy a Stock Market Index Fund