Maybe too well … As an engineer by trade, I know the value of building in a good safety margin to your plan. And right now, ours has a pretty large one!

But having taken some pretty important steps forward lately with estate planning, all of this has got me thinking:

What if retirement (or even early retirement at that) is just the beginning?

What planning for retirement is like standing in an art gallery and focusing on just one single picture in front of you? But when we take a step back, we realize there’s a WHOLE wall in this gallery we could have filled?

What if we realized that we do in fact have the power to fill that wall?

What am I talking about? The concept of creating a financial legacy! The carrying on of wealth from one generation to the next and the next.

Retirement planning could be just the beginning … the stepping stone by which wealth is accumulated. But once it’s here and you’ve created your monument of wealth, how can it be amplified into something far greater? What steps can we take to ensure it is properly managed? How can we ensure that it stays in the family or goes towards the causes that we believe to be important?

You Will Likely Have More Than Enough

But MMD, shouldn’t I be more concerned about the present and not running out of money?

Perhaps. But I would argue that for those of you who are doing your retirement planning properly, most of us are probably too focused on that 1 to 5 percent chance that our nest eggs will fail.

What about the 95 to 99 percent chance that it will succeed? And not just succeed, but grow into A LOT MORE money than we’re going to need?

Consider this: In a 2015 update of the 4 Percent Rule, financial guru Michael Kitces discovered the following:

- Over 2/3rds of the time the retiree finishes the 30-year time horizon still having more-than-double their starting principal.

- The median wealth at the end – on top of the 4% rule with inflation-adjusted spending – is almost 2.8X starting principal.

- In fact, even when starting with a 4% initial withdrawal rate, less than 10% of the time does the retiree ever finish with less than the starting principal.

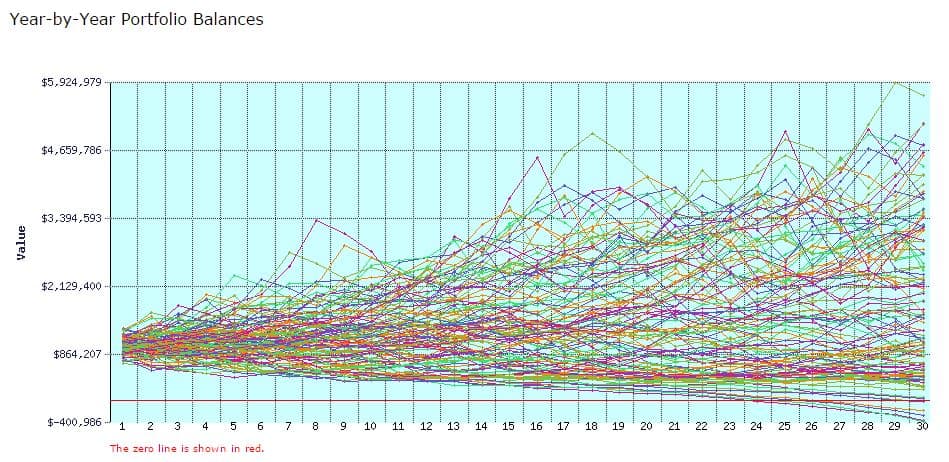

To illustrate these points, take a look at a simple FIRECalc simulation of a $1 million dollar nest egg with 4 percent withdrawals.

Notice that the majority of the lines are above the starting line of $1 million? If we’re just considering the odds, then there’s a high probability that you’ll have a lot of money left-over; as in millions possibly.

This begs the question: What greater good could we do (or should we do) with all of that money?

If you were “this smart” to get yourself to a point where you could retire comfortably or even retire early, don’t you owe it to your future generations to pass on this “power” of knowledge? You could literally be like a super hero … Why not go all the way and use your power to build something even greater?

The Power of Using Time

People who plan for retirement know that given enough “time”, you can use the power of compounding returns to leverage as big of a fortune as you want.

So let’s just play out one possible scenario.

Take, for example, a sum of $100,000. Let’s say when I retire that I ear-mark this amount and set it aside for the next 40 years. If circumstances work out that I never touch the money and it continues to grow along with the US stock index at an inflation adjusted return rate of 7 percent. Then in theory, it could grow to a real value of $1,497,446.

Now suppose we convert this balance into a trust that pays out 4 percent per year to my future family members – say for something specific like college expenses. That’s nearly $60,000 per year to distribute! How great of a gift would that be (especially considering the way things have been going with student debt)?

And what sacrifice was it to you? Looking at the graph above, likely none! All you had to do was just earmark this money and wait – patiently wait until compounding returns had turned your money into A LOT more money.

Now imagine $100,000 is $500,000 or even $1,000,000. Those numbers get a lot more exciting, don’t they?

The Chance to Leave Your Mark Behind

Wealthy families don’t stay wealthy by accident. Usually the ones that are successful put protocols in place. They planned things to be this way.

My example above with paying off college for all future MMD generations is just one example of leaving a financial legacy. This could, of course, mean a great deal of different things to different people.

The real question is: What does leaving a financial legacy mean to you? Could you use your skills of planning and saving to build up money that goes well beyond your own retirement needs, and possibly satisfies the needs of your children and grandchildren? Could you become the family patriarch from which generations of wealth began? If not your family, then perhaps a charity or special cause you find important?

Readers – What does leaving behind a financial legacy mean to you? Do you think you could apply your skills of retirement planning to possibly build something bigger than yourself? If so, what would it be?

Featured image courtesy of Flickr

Maybe I should write an article about these instead of just throwing them on your comments, but many insurance companies sell “asset transfer solutions”. They are a type of life insurance/fixed annuity hybrid where you pay an upfront premium which grows to an immediate income tax free death benefit. For anyone looking to leave a legacy behind, something like this is a must.

Sincerely,

ARB–Angry Retail Banker

I’ve never heard of an “asset transfer solution”, but it definitely sounds like something that an insurance company would sell. If you ever write about it, I’ll have to check it out.

Hey man,

Didn’t know your site – glad you left a comment on From cents to retirement.

Awesome, love the design and content. 🙂

Would like to get in touch with you.

all the best

Ben

Thanks Ben! Glad to hear it.

I think its important for my kids to be well taken care of to a certain extent. But the primary focus is to reach FI with a sizable buffer I can grow nest egg and leave the kids most of it. As long as it provides me sufficient income I don’t need to withdraw it ever. I will teach the kids to respect the cash flow when the time comes so that the can use the power of dividends.

True. The point of FI is first and foremost to take care of yourself. But I’m beginning to also see opportunities where using the same strategies as FI mixed with a little bit of goodwill now could compound into something very powerful in the future.

I love thinking big! We’re not nearly close to reaching any big financial goals just yet, but I would love to be able to leave behind something like this for our kids!

However, I think more important than any financial legacy is financial education. Inheriting fabulous sums of money must be awesome! But leaving behind a financial legacy means nothing if it isn’t accompanied by a good sense of how to handle it.

Very good point! Teaching the kids what exactly to do with the money once they have it will be half the battle. But it will be necessary so that we can keep them from squandering it too soon.

Thanks for your comment about how you should look into financial planning for when you retire so that your family will be in good financial shape. I also like how you said that you should start saving early on. My husband and I are looking into a retirement plan so that we can start saving now and prepare for our future.