If you already have a Roth IRA, then you’re probably already familiar with how this would work. As a quick refresher, the Roth option basically means that:

- Your contributions to the 401k will be invested using after tax money (i.e. you’ll pay your taxes now rather than later)

- Your money still grows tax free just like it did in a regular 401k

- When you finally retire, you DON’T pay any taxes.

When you weigh a traditional vs Roth 401k, the Roth is considered to be a good thing for you and your money for a lot of reasons. By paying your taxes now, you’ll enjoy a tax free retirement. Plus if you plan to be in a different tax bracket when you’re older (meaning you plan to be richer than you are now – and hopefully you are), then you’ll have saved yourself thousands of dollars by avoiding extra taxes.

BUT is the Roth really the better deal?

Why the doubt? Doesn’t every financial article in the world always try to tell you that the Roth is the better option for sure?

Yes it does. But you CAN’T always go around believing every one-size-fits-all piece of financial advice you hear. Usually the numbers are dynamic, and that might mean that in some circumstances you would be better with one option as opposed to another.

But how can we really know? Simple – Do the math!

I’m a big fan of taking on these kinds of “what-if” scenarios and building a financial model to simulate what would happen. By spending just a few minutes crunching out the numbers, I could potentially save myself thousands or even millions of lost dollars in the future.

Recall that not long ago we did a really deep dive into how big the differences were between a taxable and tax-sheltered account for your retirement savings. (As a matter of fact, we did that same exercise twice thanks to finding out a lot of good information from our readers).

Knowing what we learned from working out the math on both types of scenarios using some very realistic assumptions, let’s apply that same technique to see whether the traditional vs Roth 401k is really the better deal. You might be surprised at what you discover …

Traditional vs Roth 401k – $10,000 Contribution Example:

Just like in the other exercise, we’re going to set up our model using two scenarios:

- You can invest $10,000 (pre-tax) in a Roth 401k

- You can invest $10,000 (pre-tax) in a traditional 401k

Here are the rest of the variables:

- We’re going to use the tax rates from 2013.

- Assume we’re a married couple filing a joint return (tax status).

- We’ll during our working years that we’re in the 25% tax bracket with a modified adjusted gross income (MAGI) between $72K-$146K.

- Our inflation adjusted gains will be an annualized average rate of 6% (9% – 3% inflation).

- After 30 years of working and investing, we’ll declare retirement in year 31. Retirement contributions will cease. Also assume we’re old enough not to have to worry about the 10% early withdrawal penalty.

- During retirement for living expenses, we’ll withdraw $30,000 per year for both strategies.

- Also during retirement, assume the kids have moved out of the house by then and can no longer be claimed as dependents on your income tax return.

Our Working Years:

If we opt to go with the Roth 401k, then during our working years we’ll have to give up 25% ($2,500) of our $10,000 contribution before it goes into our account, meaning only $7,500 will make it in.

With the traditional 401k, the entire $10,000 contribution will enter into our savings account tax free. That means that for a long time we’ll be saving and growing a lot more money in the traditional 401k account.

When We Retire:

At year 31 when we retire, that’s when we’ll stop taking making contributions to our 401k plans and start taking out money. We’ve arbitrarily selected $30,000 per year to withdraw. So what happens?

With the Roth 401k, we don’t pay any taxes on our withdrawal. So in this case we get to take out the entire $30,000 tax-free.

With the traditional 401k, we’ll pay ordinary income taxes on whatever we take out for living expenses. To compute this, the first thing we’ll have to do is subtract our Standard Deduction ($12,200) and a Personal Exemption for both me and my wife ($3,900 each).

$30,000 – ($12,200 + (2 x $3,900)) = $10,000 of taxable income

When looking at the tax brackets, your first $17,850 is taxed at 10%.

$10,000 x 10% = $1,000

Therefore we’ll be paying $1,000 of our $30,000 withdrawal to taxes.

Over time, what does that do to us? Do the taxes on the traditional vs Roth 401k out weigh one another?

The Results:

Amazing! As time goes on, our savings with the traditional 401k out paces the Roth 401k. This is largely due to the ultra low average tax rate we’d end up paying during retirement (3% in this example) on the traditional vs Roth 401k taxes paid during our working years (25%).

If this is the case, why in the world would anyone ever invest in the Roth 401k ever? Are there any scenarios where the Roth 401k is the better deal?

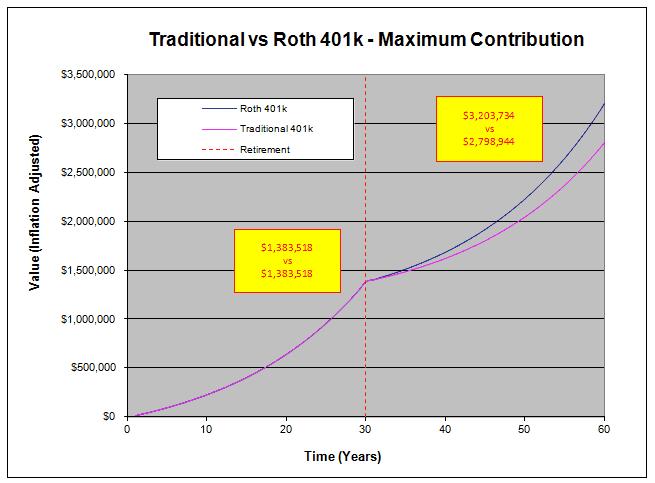

Roth vs Traditional 401k – Maximum Contribution Example:

Let’s try our model again but this time use the maximum contribution for both types of 401k plans. If we were able to that and then withdraw $60,000 at retirement, what would the results look like then?

Wait?? What happened? How come the Roth 401k is now a better deal when compared to the traditional 401k?

The difference between the two is due to the way the law is written. Let me explain further:

You Effectively Invest More with the Roth 401k:

Notice how I said “the maximum contribution for both types of 401k plans”. The IRS defines the 2013 limit for employee contributions to their 401k as a maximum of $17,500 for both types of plans. BUT does that make them equal?

Absolutely not. Observe.

When you reach the maximum savings with a traditional 401k, $17,500 simply comes out of your paycheck BEFORE taxes. No taxes are paid at this time and so the net transfer is simply $17,500 both before and after the transaction.

This is not the case with a Roth. Because when you save with a Roth option, your contributions transfer to your account AFTER you pay taxes. Therefore, in order for $17,500 to make it into your 401k account, you had to start out with $17,500 / (1 – 25%) = $23,333 BEFORE taxes.

In this case, you’re effectively deferring $5,833 more money towards your retirement initiative with the traditional vs Roth 401k option ($5,833 towards taxes and $17,500 towards your retirement savings). You might say “that’s not fair”, but that’s the way the government has set it up.

(By the way – the same thing is also true for a traditional vs Roth IRA. Even though the 2013 maximum limit is $5,500, you effectively get to defer $5,500 / (1 – 25%) = $7,333 with the Roth option).

Understanding this phenomenon clearly, you can see that (all things held constant) both plans grow at basically the same rate until the day you retire. This was NOT the case when you were simply investing some number below the maximum contribution limit we saw in the graph from the first example.

In year 31 when we finally retire, now we owe taxes on our traditional 401k withdrawals. If we had the Roth 401k we would owe no taxes. Hence as time goes on a gap starts to form between the two options with the Roth 401k taking the victory as the better retirement plan for this scenario.

(Of course we could also really complicate this story problem and look at what would happen if we had added an extra $5,833 to the traditional 401k balance to even them up through an alternative retirement savings account, and then seen which strategy comes out on top. But this post is already too long, so we’ll save that for another time …)

Conclusions:

So to conclude our examples and go back to answer my original question of whether or not I should go for the Roth option, the answer is NO. I should stick with the traditional 401k option unless I have sufficient reason to believe that:

- I’ll be investing somewhere the maximum 401k contribution limit every year

- I’ll be in a higher tax bracket and a larger average tax rate during retirement than I am right now if I were to take the Roth 401k option.

Due to the likely preferential tax treatment you’ll experience during retirement, the traditional option is the more tax-effective one as long as my retirement income stays reasonable close to what I enjoy right now.

Readers – What about you? Which kind of 401k plan does your work offer? What makes you want to choose a traditional vs Roth 401k?

Related Posts:

- How Do You Compare to the Average Retirement Savings of Other Americans?

- The Pension vs 401k – The 401k Did Not Kill Retirement

- When Can I Retire – It All Depends On How Badly You Want To!

Images courtesy of FreeDigitalPhotos.net

Great breakdown MMD! I think so much of it goes back to the fact of what you pointed out – it’s not a one size fits all and you need to do what’s best for your specific situation. I was always a Roth guy, but came to much of the same conclusions when looking at our options. Thankfully the SEP works similar to a Traditional so our focus is on that. Like I asked Matt on his post last week, what are your thoughts on tax diversification?

I was always a Roth guy too. But lately all this analysis is starting to demonstrate to me that nothing is really set in stone until you run the numbers and see for yourself which one will give you more money in the long run.

Tax diversification? I’m actually drafting a post right now on how to theoretically NOT have to pay taxes at all during retirement! However, that is just for fun. Personally I think the order of things you consider are:

1) Which accounts / strategies give you the biggest returns (considering the taxes you’d pay now vs the marginal tax brackets you’ll be in during retirement)

2) How can you optimize that income for taxes when you finally do retire

Take for instance this post: It might be cool to have a Roth 401k and pay no taxes during retirement. But not if I stand to make more overall with the Traditional. Like most scenarios, I think it’s an “all things considered” type of answer.

BTW – I might soon be getting my own SEP IRA! More on that to come in a later post.

Awesome breakdown MMD! I like it. I have a traditional 401k and a Roth IRA. I contribute fully to both, until I can’t do it anymore due to income restrictions. I am doing it to diversify my retirement taxation. I figure it can’t really hurt to contribute to both.

Nice work on the logo by the way! Glad to see you got it to work.

You and I have the same setup: Traditional 401k and Roth IRA. That’s because I’m totally confident that I can max out the IRA (as was proven in this post to be the most effective when you’re going to max out one or the other), but I’m not always confident I can do the same with the 401k.

Thanks for noticing the new logo. Fiverr! Thanks again for taking a look at my code to help me figure it out …

Nice breakdown. My wife and I max out both our 401k plans and our Roth IRAs each year. Once kids arrive we might not have that luxury so making sure we get every last cent invested while we can is huge.

You guys have got the right! Stashing away a ton of money early on is by far the best approach to take if you have to choose between now and later. In theory you guys could stop contributing once you start having kids, and you’d probably still end richer than people who were just now getting starting and struggling to play catch-up.

I’ve read that if you have a pension than it’s probably better to go with the Roth option. I’m not sure but currently I contribute to a traditional 401k but put money in a Roth IRA…tax diversification I guess. I will have a pension, however I live in NYC…a high tax state/city so the traditional aids deferring those taxes as well.

We plan to have a pension as well. However tax diversification is less of a concern for me because my wife and I plan to live modestly under the 15% upper marginal tax bracket. By doing so we’ll be paying a way lower effective tax rate than we would be right now.

This is a really great breakdown. I have been looking into this very issue, but there’s been so many good posts on this topic the past few weeks that I will need to re-evaluate! I was going to open a Roth IRA, but I’m not sure anymore. Thanks for the info and I’ll definitely consider it when making my choice.

I wouldn’t change course if I were you. The second graph (and example) demonstrates that if you plan to max out your plan, the Roth is actually the better option because the contribution levels are not “truly” equal.

With my work plan in the past, it has been a SIMPLE IRA, so the max was in the $11K-$12K range. I opened a Roth to at least contribute the amount that would equal maxing out a 401k. This year I have a solo 401k that I intend to max out at least for the employee part, and hopefully more and won’t contribute to the Roth. It seems to be the best plan otherwise with the sale of the business, we’ll get killed with taxes this year. Great write up. I enjoy the detail.

Thanks! I’m glad everyone is digging the detail in these examples.

I think seeing what happens to the retirement age will also contribute to this whole scenario. I imagine I’ll continue working for quite some time after 595 and that my tax bracket will remain quite high.

The age 59-1/2 limit has been around for quite some time. Unless life expectancy changes much, I doubt this requirement will change much in the coming years.

As for tax brackets, that remains debatable. As you look back through the years the marginal brackets have fluxed up and down. It just depends on what the needs of the government are at that time and where they want to get their money from. However if things continue the way they are we should be on track to pay much less during retirement than we do now making the Traditional options more appealing.

I like this analysis a lot. It shows it in a different but very useful way from how I did it. This is definitely a much more nuanced discussion than most “experts” make it out to be, one that is often much more favorable to the traditional account than is typically assumed. It’s interesting actually how close the two are even in your second example, which is unfairly biased towards the Roth (given that there’s no extra investment of the tax savings from the Traditional). I was a Roth guy for a long time but will be in the Traditional camp for the foreseeable future.

I was always a Roth guy as well. And I will probably continue to use our Roth for our IRA’s since we max those out every year. But it’s very interesting to see how the tax laws can bias what you owe on the Traditional versus the Roth. Better to find this out now rather than 30 years from now when you’re stuck paying higher taxes!

I prefer tax-deferred retirement savings but I have a Roth IRA as bonus savings!

So do I! And as long as you max that out, you’re getting the better deal (similar to my second example with the maxed 401k’s).

I have thought a lot about this. Basically, I’m contributing on a Roth basis now and later I’ll contribute to a regular 401(k)/IRA so that I can withdraw taxable funds for the 10-15% bracket than any additional income I need can come from the roth and not put me into the 25% bracket. I want my roths to grow more over time though.

That’s a smart way to diversify your retirement taxes. Plus the Roth will have some inheritance advantages that the other accounts won’t.

We have traditional 401K plans and we also contribute to a Roth IRA. I’ve never had an employer that offered a Roth 401k.

Up until this year the Roth 401k was never an option for us either. I’d imagine that they will become a more popular option as more employers and brokerage’s start offering them.

While I appreciate a good tax shelter, I’m particularly leery of 401k plans.

At least with an IRA, I have the option of making it a self-directed IRA and investing it wherever I choose (with significant additional transaction and maintenance costs).

With a significant chunk of my retirement assets in 401K / IRA plans, more and more, I find myself investing money outside the stock market in an effort to more fully diversify outside of the securities markets.

That said, I still contribute enough to my 401K to receive the full company match. If at some point I run out of interesting investments outside of the stock market, I’ll start pumping more into the 401K.

What makes you leery of 401k plans?

Good breakdown, I always assumed that the Roth 401K was capped at 5K just like the regular Roth IRA. I never looked into researching it at my job, because I do a 401K and Roth IRA already, and thats enough to help me reach financial independence.

Nope, a Roth and Traditional 401k are capped at the same level. The difference is just in how taxes are handled.

If you’re already contributing to both a 401k and IRA, then I’d say you are well on the right track!

Nice layout, however the difference is you’re putting in after tax dollars which means you’re really exceeding the $17,500 net of taxes. I like pre tax though as I’m going to have a post on that.

Understood, and that’s really the way it would go. It may not seem fair, but the way the limits are written make it so that you effectively get to contribute more money to the Roth option if you’re able to max it out. That’s just one of the advantages.

Great and thorough breakdown!! We pretty much pay zero in taxes with all of our deductions these days, so we likely would be better off with a Roth, from what I understand. Thanks for the good info here, MMD!

Wow, what kind of deductions do you have? A 0% tax bill is pretty amazing. I’d love to see some kind of blog post laying out how you do this.

You put up a very nice presentation. I have always thought that the Roth IRA was the way to go due to never having to pay tax when it is cashed out even though it has already been taxed.

You make some very compelling points that the traditional IRA is probably the better choice with some nice charts and graphs but, I will probably end up sticking with the Roth.

Once again, great presentation.

Thanks. Whether you go with a 401k or IRA, I think it’s at least important to consider how taxes will ultimately effect one decision or the other. If you plan to max out the Roth IRA, then the Roth is still your better bet.

Nice analysis. I’ve never really considered a Roth before. I always suspected the traditional 401k would be better than the investing after tax dollars in my own situation because of the tax aribtrage of higher rates now, lower rates later. I think if you factor in the tax savings upfront from the 401k today and assume some type of reinvestment of growth rate, you’d actually come out better than the Roth. I couldn’t tell if your analysis did that or not. My investing strategy is now being morphed to take into account taxes paid today and the time value of money of securing tax deferral of those.

Why not both??? Diversifying is best way to ensure that you’re not left to rely on one or the other to provide for yourself in the future. Annuities are also another good way to protect yourself against the ups and downs of the market.

There are certainly a lot of reasons why you could end up choosing both – or one over the other beyond the reasons I’ve outlined here. Plus there is always the uncertainty of what taxes will be like in the future which throws a wrench into this whole debate.

I was contributing only to an unmatched 401(k) until I realized that I want to retire with a pension (that will likely not cover all expenses) at age 54, and I could not tap into the 401(k) without significant penalty until I am 591/2. Now I am contributing to the Roth so that my contributions can be pulled out to cover the shortfall during those first few years after retirement until I can access all my retirement accounts. I also like knowing that those contributions are accessible if I have a catastrophic emergency my emergency savings can’t cover.