How about ALSO getting a second vacation to the warm sandy beaches of an all-inclusive luxury resort in Los Cabos, Mexico … for just $95 out-of-pocket?

Yes, it’s true!

After strategically travel hacking our way to a whole bunch of Chase Ultimate Rewards (UR) points and scoring nearly-free flights, a hotel, and rental car, we decided to go “all-in” and maneuver our remaining points towards yet another incredible vacation for barely any money at all!

Here’s the back-story …

As many of you already know from my previous Travel Hacking Chapters 1-3, originally our goal was to reduce the amount of money we were going to spend in 2017 by trying out this whole “travel hacking” thing. Even if we could knock of $1,000 or more, that would be more money that we could divert into our early retirement savings or emergency fund.

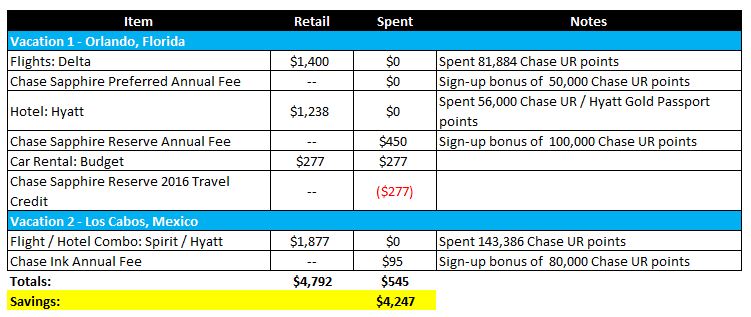

As it turns out, my expectations were completely blown-away! Using travel hacking, I was able to get enough points for all of us to take round-trip flights, cover the complete hotel stay, and get rental car for the week. All we had to do was open two credit cards: The Chase Sapphire Preferred (50,000 introductory UR points) and Chase Sapphire Reserve card (100,000 introductory UR points). Chase makes it very easy to transfer point within the same household, so my wife and I were able to combine the points that we needed.

Our only out-of-pocket expense was a hefty $450 membership fee for the Chase Sapphire Reserve card. I’ll admit though that is a ton of money to spend up-front for one card, the 100,000 Chase UR points (cash value $1,000) and $600 in potential travel credit more than made up for it.

By the end of my last update, I noted that we still had at least 64,515 Chase UR points left in our account and a travel credit of $300 for 2017. My options at the time were to:

A) Cash out the points and reimburse ourselves for the Chase Sapphire Reserve card membership fee.

B) Cash out the points and use the money for food and miscellaneous spending during our trip.

C) Wait to use the points for something else … something BIGGER!

As you can probably guess from the title of this post, we went for the gold and swung for Option C!

Truthfully, from a return-on-investment perspective, Option C had the biggest pay-off. Generally speaking, cashing out your rewards points for money or gift cards is nice, but it’s usually the worst pay-out. The points almost always work out to a 1:1 ratio, making them worth 1 cent/point each. If you can instead use your rewards with one of the credit card’s travel partners or book your travel through the credit card company’s travel portal, then the payout becomes a lot greater – often 2 cents/point or more.

Our Strategy for Going to Los Cabo for Almost Free

So why decide to try to go for a second vacation?

Why not? No really – This summer, my wife turns the big 4-0 and to celebrate, we wanted to finally take an awesome couples vacation – just the two of us.

We’ve been to Mexico before, but always on the east coast near Cancun. To try something different, we both agreed that somewhere near Cabo San Lucas seemed like a great target destination. That’s how we found Los Cabos.

To get there, our strategy was as follows:

- Find out which flights and hotels we could use our Chase UR points with.

- Build up our points by getting at least one more credit card with a generous intro offer.

Flights

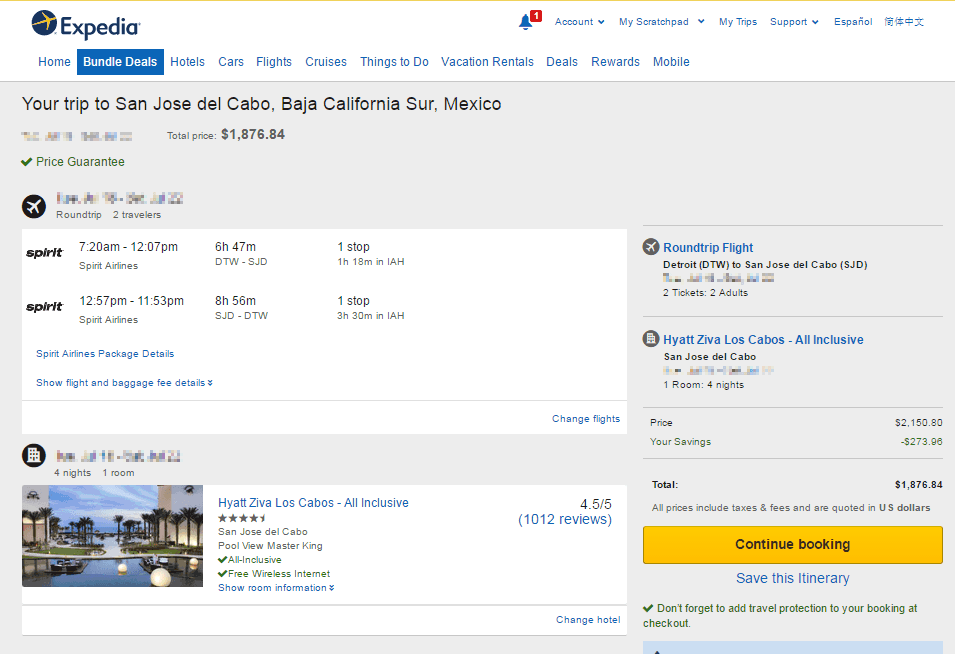

Usually the place I like to start in this process to go to Expedia and just start doing a generic search in the weeks we’d like to travel. This gives me a general idea of which airlines are available and which dates to pinpoint.

I quickly found a lot of United and Delta flights at this time and discovered a particular week that seemed to be the cheapest.

Neither United or Delta had any Super Saver-style options for these times. So at this point we could pretty much book with any airline through the Chase UR travel portal and our points would automatically be worth 1.5 cents each.

The most practical one was a flight from Spirit that cost roughly $400 per person. To book this flight, I would need at least 60,000 UR points.

Hotel

Having recently joined the Hyatt rewards program to get our last hotel, I was able to look up that this resort would only cost 20,000 points per night, or 80,000 Hyatt points for all 4 nights. Out of pocket, this hotel would have cost roughly $1,200 or more. Since Chase UR points convert to Hyatt points at a rate of 1:1, this meant I’d need 80,000 Chase points.

The Next Credit Card

After a little bit of research, I discovered that the Chase Ink Business Preferred card had recently increased its introductory offer to 80,000 points with a $95 fee for the first year. All you’d have to do is spend $5,000 within the first 3 months.

I was a bit concerned at first that I would be rejected for this offer since my only “business” is blogging. But surprisingly, that was good enough for them to approve me!

Like before, we earned all of the points after just 2 months of spending. We even scored quite a few extra points from the $5,000+ initial spending requirement.

Once the points cleared and were deposited into our account, it was time to make this second vacation a reality!

How Much We Saved!

In the end, between the flights and resort, we spent another 143,386 of our Chase UR points. Due to availability at the resort, I ended up going booking the Hyatt through Chase’s UR portal. No sweat though – we got a slightly nicer room, and for some reason it cost less points than what Hyatt was offering it for. So this worked out just fine to our advantage.

Out of pocket through a commercial site like Expedia, this trip would have cost $1,877 (or more). But using travel hacking, it only cost us $95 total out of pocket!

Between the two vacations, that’s a net $4,247 in savings altogether! Absolutely outstanding!

Our Next Travel Hack …

2 awesome (and pretty much free) vacations in one year is pretty incredible. From here on out, all my travel hacking efforts are going to focus on our vacation plans for 2018.

Where is our target destination this time? Hawaii!

My wife and I have talked forever about taking the entire family there. But just the cost of 4 flights alone from DET is over $5,000. AND, as I understand it, there are no all-inclusive resorts there like we find in Mexico and the Caribbean. So food and entertainment will be yet another cost to consider on top of everything else.

I will definitely have my work cut out for me on this one. But I’m up for the challenge!

Until next time …

Readers – How are your travel hacking schemes going? Has anyone else been able to book one, two, (three?) vacations this year as a result of your efforts? Who’s been to Los Cabos? Does anyone have any good advice for hacking my way to Hawaii?

Images courtesy of Trip Advisor and Flickr

Nice job on the Mexico trip on points! It’s your lucky day because I’m actually going to Maui, Hawaii in a few weeks on points. You’re gonna want to try scoring flights either through Flying Blue or Korean. Flying Blue is easier, though. Data point: I booked last August 2016 for an end of April 2017 trip. Good luck!

Awesome! Thanks for the tip (and welcome to the site). I’ll have to see if Flying Blue or Korean works out of DTW.

Hi, I love your advice on this travel hack, i never really looked at this way. I have a good credit score but would opening new credit cards and then closing them impact my score greatly? How long do you usually wait until you close the account? And do you recommend any other tips/tricks to rack up points faster?

Don’t worry too much about your credit score. Even after opening all my cards, I’m still close to a score of 800.

https://www.mymoneydesign.com/personal-finance-2/credit/how-to-get-a-perfect-credit-score/

If I truly don’t want the account anymore or don’t want to pay another annual fee, I usually wait about 10-11 months before I close the account.

Awesome article…I’m loving your travel blogs!

I just got back from Nepal and would recommend it to all of your readers…people are lovely, the landscape is beautiful, and it’s pretty cheap, too!!!

I was just wondering which is your favorite country to travel to?

Best wishes and keep up the great work.