For anyone unfamiliar with this term, “travel hacking” is when you attempt to get free or near-free deals on your travel expenses. You do this by taking advantage of big credit card sign-up offers and optimizing the rewards points to get the best deals possible.

As I mentioned in the original post, I decided to give travel hacking a try after looking over our expenses for the year and concluding that we needed to find a way to save money on our annual family vacation. We really enjoy our vacations and enjoy traveling to new places. So if I’m able to apply even just a few of the travel hacking, money-saving tips that I’m always reading about other people enjoying, then this could be a huge win-win!

To quickly recap, in the first post, I talked about how we made a goal to travel to Orlando, Florida next summer to hit the Universal Studios theme park as well as a few other stops. Our first missions was to get free flights. To do this, we specifically targeted the Chase Sapphire Preferred credit card. By combining the 50,000 Chase Ultimate Reward point intro offer with the points we already had from our other everyday usage Chase Freedom credit card, we easily got $1,400 in airfare for no money out of pocket. Mission #1 accomplish!

In the second post, I decided to keep this free-travel thing going and set a new mission to get the hotel for free too. We explored some of the various options for a second credit card offer that would help us get the best hotel deal available. I ended up finding that yet another Chase credit card would give us the best results.

So … did we accomplish Mission #2? We certainly did! And that’s what we’re going to cover in this post. But we didn’t stop there. We also quickly set and accomplished Mission #3 to get a rental car. As you’ll soon find out, this is all literally adding up to thousands of dollars in savings.

And the best part … we’re STILL not done maxing out all of our tricks yet!

Here’s the latest chapter on exactly how we got our hotel and rental car for almost free.

How We Booked Our Hotel

Hyatt Has the Best Bang-for-the-Buck

After doing a little bit of research, I concluded that the Hyatt line-up of hotels had the best rewards program as far as point-per-dollar conversion.

In particular, we really liked the Hyatt Place Orlando Universal for several reasons:

- Since it’s not considered to be one of the “fancier” hotels, it only cost 8,000 Hyatt Gold Passport points per night to book. (Previously their website had a points+cash offer where you could pay just 4,000 Hyatt points plus $35 /night, but this was unfortunately no longer an option.)

- The hotel includes free Wi-Fi. I don’t know about you, but my family LOVES using up Wi-Fi!

- The location is practically across the street from the Universal Theme park; one of the main attractions we plan to visit.

- The hotel has free parking. Although they did not advertise it, the Trip Advisor comments seemed to suggest that they also offered shuttle service to the Universal theme park.

- They also offer free breakfast in the morning. SCORE! That’s one-third of our meal cost dilemma solved right there!

Ironically, the much “nicer” Hyatt Regency Orlando resort down the street not only cost a whole lot more per night to stay there, but it also did not offer free parking or breakfast. I guess more expensive doesn’t always mean “better”.

Since we plan to be gone almost every day and only truly use the hotel for sleeping, the Hyatt Place Orlando Universal will work just fine.

BIG Rewards with the Chase Sapphire Reserve Card

- We’d get more Chase Ultimate Rewards points that we could easily combine with the other Ultimate Rewards points we already had.

- Those points could then be simply transferred 1:1 to the Hyatt Gold Passport rewards program.

The only negative to this credit card is the sticker-shock of paying a $450 annual fee.

While that might sting you at first, you have to really look at the bigger picture to get a full understanding of the full range of possible benefits. Remember that:

- The intro offer for getting this card is 100,000 Ultimate Rewards points. That’s HUGE! That’s the equivalent of $1,000 in cash, $1,500 worth of travel through the Chase Travel Portal, or possibly even more rewards if you transfer the points to another rewards system like United Airlines or Hyatt. All you have to do is complete $4,000 worth of purchases in 3 months.

- If that’s not enough, you can also score $600 worth of travel credits if you’re creative about how you do it. Each calendar year, Chase will give you an instant $300 travel credit for travel purchases you make on this card. That’s one $300 between now and December 31, and another January 1st onward for next year.

All in all, that’s a minimum of $1,600 worth of rewards in return for spending that $450 fee. Nearly quadrupling your money? I’d say that’s not a bad return on investment!

On top of that, this card also offers you 3x points for every dollar you spend on dining out and travel. Between how often we do these things and the travel I may have to do for work soon, that’s another strong reason to keep this card handy.

Converting Points Was a Breeze!

Because we put nearly all of our everyday purchases on our credit cards (including many of our regular automatic bills), we met the spending minimum and received those 100,000 intro points with no trouble at all.

Signing up for the Hyatt Gold Passport program was super-easy. It was completely free and only took about 10 minutes.

Once I had my Hyatt membership number, I was able to login to Chase and electronically transfer exactly the number of points I needed to my Hyatt account. The process was instantaneous.

Within minutes, I logged back into my Hyatt account and booked the hotel. We didn’t spend a single dollar beyond the $450 credit card fee.

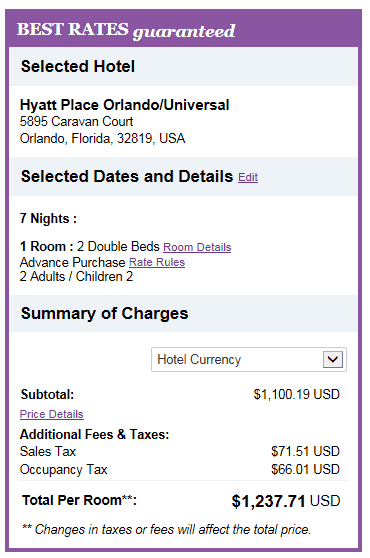

What was the retail price of the Hyatt if we had paid cash? =$1,238.

That’s a savings of $1,238 – $450 = $788!

But then it gets better …

Booking Our Rental Car Too!

Since I need to use our Chase Sapphire Reserve $300 travel credit before the end of the year, I decided now is the time that I should also book our rental car.

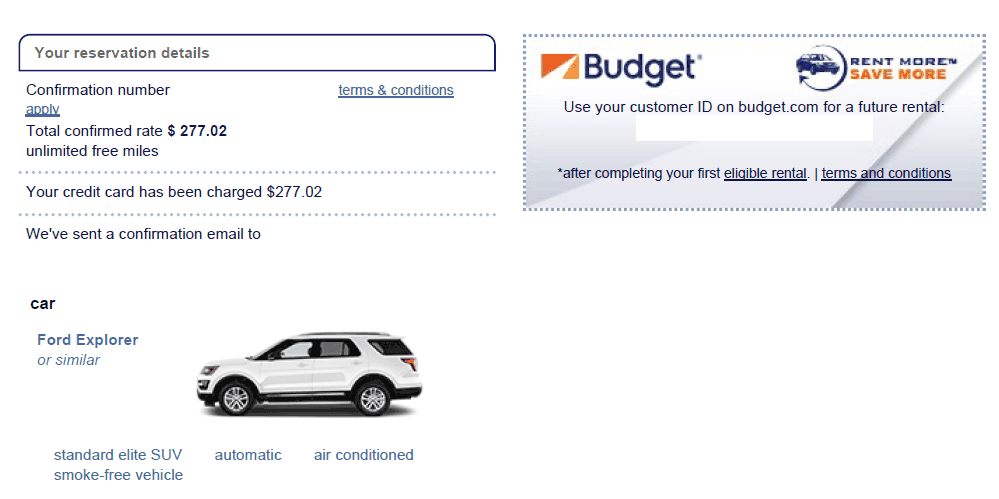

I researched about 4-5 different travel websites, including the Chase travel portal, and determined that for the type of vehicle and location that Budget had the best offering. They were asking $277 in total for one-week with a Ford Explorer or similar. This size vehicle will be perfect for our family of four and all the junk we always seem to bring with us.

To my surprise, getting that Chase travel credit really was “instant”. After booking the auto, the credit card recognized this expense as being for travel and applied the statement credit the next day. No submitting receipts or anything. Completely painless!

Total cost: $277 – $277 = $0!

$2,465 in Savings, and Still Going!

So, a lot of people have either commented or asked me: Has this whole travel hacking thing been worth it?

Thus far, between airfare, hotel, and rental car, the total retail price would have been $2,915. Out of pocket, I’ve only spent $450 in the process. Therefore, we’ve saved $2,465 so far!

At Least $1,000 MORE In Rewards

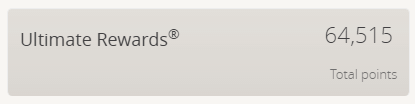

As of the writing of this post, we still have almost 65,000 Chase Ultimate Rewards points that we haven’t used. I have not decided if I will redeem all those points for a straight $650 in cash which we could use to pay for the amusement park tickets and food. OR I may just simply let the points sit (they don’t expire) and use them towards our next set of travel plans in 2018.

In addition, we still have another $300 travel credit that we can redeem starting January 1st. I’m fairly confident that between airport parking and fight baggage fees we should be able to rack up enough travel expenses to redeem the full amount with no trouble.

MORE Travel Hacking with Yet Another Credit Card?

With how easy it’s been to rack up all these free goodies, why stop here? I’m seriously considering keeping a good thing going and going after yet another rewards bonus. I have no idea which one yet.

It’s not that uncommon to read about travel hackers who open 5 to 10 cards per year for the very reason of taking advantage of these deals. (The Go Curry Cracker duo opened 9 this year.) Though I don’t plan to get that intense, I can see how one more card might just but this entire vacation over the top.

To be continued ….

Readers: What do you think so far? Have we gone far enough for the year in rewards, or should we keep on racking up more points? Has anyone else signed up for the Chase Sapphire Reserve Card? What travel hacking scheme are you working on right now?

Featured image courtesy Flickr

Yay! How did you manage you earn that reward points? Have fun in Florida, MMD!

Thanks! We got all the rewards from two Chase credit card offers so far.

I would LOVE to learn I have never been anywhere at all. I have never had a vacation:(

I need to sit down and see how I can manage and use the points I have for my next vacation. I opened 1 capital 1 card, and it was 25K points. Have to see if I can use this to go to Florida next October. I think 450 annual fee is a lot but if you use it and close it, might be worth it.

I don’t know much about the Capital One card, but I just went to the website and it looks like those 25,000 points are worth about $250. They’ve got two options: 1) to get statement credit, and 2) to book through their affiliate (which the article I read said was Orbitz). I would think option 1 might give you a little more bang for your buck. For example: Ever since we flew with JetBlue last summer, I’m signed up for their emails and I get offers all the time for last minute flights that are less than $100. I’m sure if you kept your eye out for something like this, you could use your Capital One card and then get reimbursed for the purchase using those miles.

Keep on racking up reward points. The more reward points, the better it will help you save on your vacation. I’d totally save up for my next vacation. How long did it take you to earn those points?

This is such a great plan! The amount of money saved is truly incredible. I’ll need to look into some of those credit cards.

Absolutely! There are a lot of really good deals out there to be taken advantage of.

This is quite informative although how do you rack up points that fast in a card?

It’s all about the sign-up bonuses. You find a card with a nice introductory offer, meet the requirements, earn the points, and then move on to the next one.

Are you going to keep the Chase card with the $450 annual fee?

If you used 8000 Hyatt points x 7 nights = 56,000 points, does that mean the value you got was about 2 cents per point? $1238 / 56,000 = .022

Will I get an email when you respond?

Thanks.

Hi Nancy,

Yes, 2.2 cents/point is accurate. And not too shabby of a return as far as points go!

No I will not likely keep the card open.