Let the winners step forward and do all the work!

All you need is to use a well-known stock picking method known as the Dogs of the Dow investment strategy.

The Dogs of the Dow is based on two simple premises:

1) Out of all the dividend stocks out there to buy, the top performing blue chip companies from the Dow Jones Industrial Average will be your best bet for producing stable returns.

2) By buying the highest dividend stocks while the yield is high, you’ll likely be buying them at a time when the price is low and likely to go higher (the old buy low, sell high mantra).

Sounds good so far!

But how exactly does this strategy work?

How the Dogs of the Dow Gets the Highest Dividend Stocks

The Dogs of the Dow strategy is very easy to follow. It works simply like this:

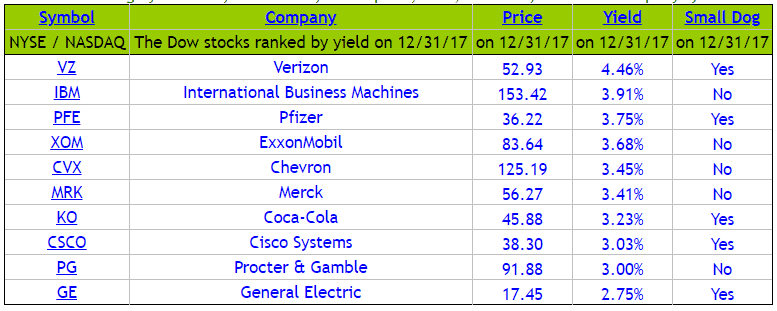

1. On the last day of the year you make a list of all the stocks in the Dow.

2. Order the list by highest to lowest Dividend Yield Percentage.

3. On the first day of the year, buy an equal dollar amount of the top ten highest dividend stocks. These will be your “dogs” for the Dogs of the Dow.

4. Hold the portfolio for one year.

5. At the end of the year, repeat Steps 1 –4 and reinvest any dividends you received.

As an alternative to Step 3, you could also just buy an equal portion of only the top 5 lowest priced stocks within this list of the 10 ten highest dividend stocks. This version is called the Small Dogs of the Dow.

Dogs of the Dow Past Returns

So how has the Dogs of the Dow strategy performed over the years?

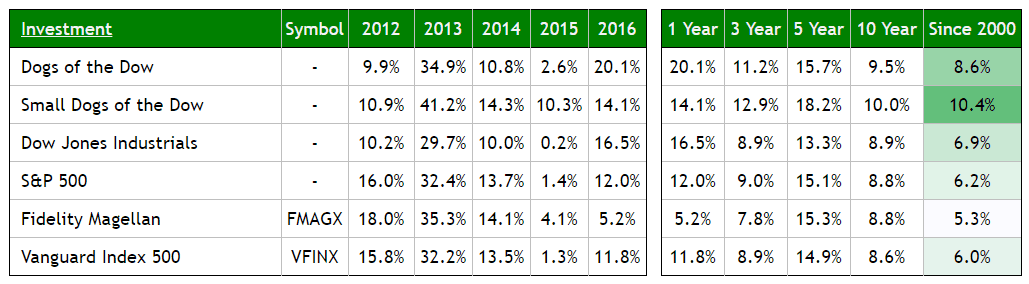

The table below is courtesy of dogsofthedow.com. The figures assume that the dividends have been reinvested and do not include commissions or taxes.

In most instances, both the Dogs of the Dow and the Small Dogs of the Dow beat the market indexes (the Dow Jones and S&P 500). However, because your diversification is lower, you also run a higher risk of greater losses during the bad years. As with all stock picking strategies, there’s a lot to consider.

What Does It Cost to Buy the Highest Dividend Stocks?

The great thing about the Dogs of the Dow strategy is that it is a no-brainer to put together. There’s no research necessary and all the information you need is free. You could manually put together the list of candidates from the Dow Jones yourself, or check out the above website anytime to see which stocks qualify. From there, all you need to do from there is have a brokerage account ready to go!

At worst case, you’d probably sell all 10 of your Dogs of the Dow stocks at the end of the year and then buy them again the next day. That’s 10 transactions x 2 = 20 transactions. For the cheapest results, try to use a discount broker that will charge around $4 per trade. That would be a total cost of $80 per year to implement the Dogs of the Dow strategy.

The Small Dogs of the Dow is an even cheaper alternative. Again, worst case, you’d have 5 transactions x 2 = 10 transactions for a grand total of $40 per year.

To shelter yourself from taxes, consider using an IRA or other tax-advantaged account. Don’t let taxes nip at your dogs!

Why the Dogs of the Dow Will Part of My Strategy

I love it when you re-read a book and learn something completely new. I was (re) introduced to the Dogs of the Dow investment strategy this summer while I was re-reading The Neatest Little Guide to Stock Market Investing by Jason Kelly. Although I had read the book several years ago, it was a pleasant surprise to rediscover this theory in light of my new affirmation for dividend stocks.

This year, I bought a number of the highest dividend stocks I could find. I was specifically targeting the Dividend Aristocrats (another strategy we’ll review another time). But after more research, I’m convinced that the Dogs of the Dow may be a better and more stable approach.

Readers – What do you think about the Dogs of the Dow investment strategy? Has anyone heard of this or had any experience with it? What is your opinion of using blue-chip stocks from the Dow Jones Industrial Average? Pretty smart idea?

Photo Credits: Flickr, DogsOfTheDow

Nice pattern!

Shared with my friends who are in stocks.

Thank you.

Thanks Alik! Thinking about giving it a shot in January?

This is extremely interesting. I’ve never heard of it before but it seems like a reasonable option. There is certainly more risk than I’d like to have but I can see how this is a justifiable strategy.

Yeah, it’s not exactly bullet-proof. But it does seem justifiable to go with the biggest and best companies if you’re going to do anything! Plus, even if the stocks go down, having earned at least a 3% – 5% dividend does sound like a bad way to soften the blow!

I’ve been waiting for this post. I think it is an interesting strategy but don’t know enough about individual stock investing to feel comfortable with it. I would also like to see a longer history of performance (at least 30 years) before I would follow a theory like this… maybe it only works during recessions?

Thanks, I hope it was worth the wait! In the Jason Kelly book I mentioned, he had some past history in there that went beyond the 20 years. Since this is a pretty popular strategy, I bet we could find a site with more historical data.

I’ve never heard of this strategy — also what do you mean, put it in an IRA — can you do this same sort of investing through an IRA rather than stocks?

I’m no investing pro, but if the IRA works the same way as our TFSA up here in Canada, it can hold various different types of investments and protect you from paying taxes on the profits. That is until you withdraw it…unless you are using a Roth IRA. lol I know too much about American investing.

As for the Dogs of the DOW strategy…I really like this concept. I am just getting into the stock market after many years of mutual funds, but I was worried I wouldn’t have the time to properly research stocks. This sounds like it takes a lot of that work out of the process. The returns look quite good too.

Jeremy – you’ve been hanging around us Americans for too long! But very good understanding our IRA rules! Yes, that is correct – you pay taxes up front on a ROTH IRA and no taxes on the withdrawal. Therefore, if you wanted to avoid paying taxes each year, you could use a Roth to accomplish this. Does a TFSA work the same way over there?

This quite possibly one of the better low maintenance, low research stock strategies. You’re basically just putting your faith in the proven winners. I’ll be right there in January to put my money where my mouth is as I plan to invest in the Dogs come next year.

Good question! Remember that an IRA can be anything you want – cash, CD’s, mutual funds, bonds, and stocks! Most of us only think of it as mutual funds. But you could open up a broker account with Zecco, designate it as your 2012 or 2013 Roth IRA (assuming you do this next year of course), and then buy the stocks! The beauty will be that you won’t pay taxes on the dividends when you redo the process the following year! If you did this outside of a retirement-style account, then income taxes would be due!

This is a great strategy with one caveat. In recent years, Dow is representing a very small portion of all the market sectors that are influencing our economy and, thus, the investment returns. I’d use this excellent theory on S&P 500 stocks. S&P 500 provides much larger universe of quality, high dividend paying stocks.

“The Shilpan S&P Dividend Theory”. I think you should trademark it immediately! As far as the stocks go, that’s not a bad plan. The S&P is certainly more diverse. It would be interesting to see if someone was able to compile the data and test your hypothesis.

Thanks for the education! I’m so clueless when it comes to stocks etc. Seems like a good strategy to me, though.

Anytime! That was the whole point of this blog – to force myself to learn more about these strategies and pass it on to others to use as well!

A high dividend yield usually means the dividend is not sustainable. If there’s an ETF for these Dogs, it would be a bit safer to play since youspread your risk around.

You’re right – too high a dividend can signal trouble! Usually the Dogs seem to average in the 3 to 4% region which is where I would consider them to be relatively safe. I had considered looking into a mutual fund or ETF, but held off because of the erosion from expenses.

According to the chart above the stocks in the dogs of the dow have performed about the same as the dow jones industrials. Their was a period of time when the stocks selected by the value line investment service always outperformed the market by a huge margin. They have developed a complex model to determine when and which stocks are the most likly to outperform the market. Recently they have not done as well as they have in the past. Also the funny thing is the value line investment funds which select stocks based on the value line survey do not outperform the market. Theirs a theory about stock investing that is whenever some method or some person gets lots of press on TV shows on the internet and elsewhere than very often the magic is lost. In reality only a few can make a lot more money than everyone else in the market simply because the market is in total sum made up of everyone thats in it.

There are many people who believe that a stock strategy gets outdated just as fast as your computer does. I think it is more cyclical. Sure a lot of people will jump all over a trend, but that means they’re jumping off of something else. As people forget about these lessons learned, there will be opportunity to swoop in and reap the benefits.

You have a very smart strategies here. Thank you for sharing your knowledge about investing. I am looking for DJIA past performance and how to make money with the dow stocks. Now I learned so much things. Thanks a lot.