Contrary to conventional investing, how is it that someone gets “rich” from stock prices going down?

How Shorting a Stock Works:

Although there were a lot of factors at play in the movie, the basic answer to this question is that Schwartz was “shorting” the Kellar Zabel stock. What does that mean? Let’s look at a simple example:

1. You believe company KZI will not do very well in the near future. This may be due to a trend you have observed, a new CEO that you lack faith in, your gut feeling, etc. When you have faith in a company, you go “long” on a stock. In this situation where you lack faith, you decide to “short” the stock.

2. You enter into an arrangement with a broker to sell a set amount of shares at the current market price. For example, let’s say we sell 1,000 shares at $100 = $100,000 total.

3. As part of the short-sale, there is a contractual amount of time you must pay back the broker the number of shares they sold on your behalf.

4. A short-time passes and your hunch was correct. Company KZI goes down to $25 per share. You pay back your broker back the 1,000 shares at $50 each for a total of $25,000.

5. Congratulations! You just made $75,000 (minus fees and taxes of course).

Gambling on the Future:

Sounds great, but is there a catch? You bet!

Had the price gone up to $300 per share, guess what? You’d be stuck buying back the shares for $300,000. In other words, you’d lose $200,000. Ouch!

Basically, unless you can see into the future or know something the rest of don’t, shorting a stock is very similar to gambling because your speculating on what may or may not happen. Many experts argue that this is different from traditional investing because most of us want companies to do well and see stock prices rise. Just like with any complicated investment technique, you should never use any strategy where you don’t fully understand everything involved.

Movie Trivia:

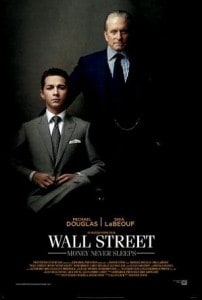

Although the movie Wall Street 2 is fictional, it is based on real events that happened throughout the Great Recession in the late 2000’s. Kellar Zabel is supposed to represent the investment firm Bear Sterns which collapsed in 2008 and was bought by JP Morgan Chase. Churchill Scwartz is a mixture of Goldman Sachs and JPMorgan Chase. The movie also has images of kids “blowing bubbles” (Get it? If not, click here.) and a shot of the building where Bernie Madoff committed his Ponzi scheme.

Have you ever thought about participating in shorting a stock? What kind of role do these play in your investment portfolio?

Related Posts:

1) What is a Ponzi Scheme?

2) What Will Be Our Next Economic Bubble?

3) Browsing for Stocks – January 2012

Photo Credit: Wikipedia

I guess the whole stock shorting probably relies heavily on insider information. It would be a lot easier to know when a company will fail as opposed to knowing when they will succeed. Still, it’s a pretty brutal way to do business.

Exactly! Either you would have to really know something special about a company or just have a strong gut feeling that the company was going to go under. Without that information, it defies logic. Most of us are hoping everyday the stock market and our favorite companies will go up.

Too risky for my portfolio! Have you tried shorting a stock yet?

No, I have never shorted a stock. But I have looked into Options before (similar to shorting a stock). I have heard of advanced techniques where funds use Options to hedge themselves against market losses. To be honest, the whole thing was really complicated and I decide to shelf the idea for another day.

Great article! I almost think Wall Street needs to come with a manual of what the heck is going on for those that were not investment bankers like myself.

I watched both movies with my husband and had to explain what was going on because he was completely lost.

Usually any type of options should only be used with sophisticated investors and I agree you almost have to have inside info or else you’re gambling really. But then again, there’s that little problem of having inside info….lol

HA! That is funny because the same thing happened to me! Before I ever rented the movie, a buddy of mine watched it and said he was really confused by the whole thing. So he asked me to watch it to explain it to him. Obviously as you can tell in this article, there were parts that even I was struggling with. That, and I kept waiting for a Transformer to bust through the wall …. Just kidding!

Good point about insider information. I should probably point out to the readers that insider information is ILLEGAL.

Haha! Yeah I know. I almost think it should be a movie for investment bankers only! J/K 😉

Transformer! That was too funny…maybe you can make a parody?

Yes, it is illegal. You should check out my “real estate or stocks” post it is pretty detailed and I cover why one is a better investment than the other. If you check it out, let me know what you think!

I will take you up on that. As you can tell by several of my posts, I really love “Which is Better” discussions.

I enjoy those debate type of articles as well. I think they can really get people thinking!

Thanks a lot for checking out the article and the awesome feedback. I’m very glad you liked it 🙂

I have recently shorted few stocks and made money. I short stock when 1) it cuts the 50 day moving average with very heavy volume and 2) if the news is bad — bad earnings or some business issues. I made money shorting NFLX and GMCR.

Netflix! That is genius! I am kicking myself for not thinking of that. It was all over the news and the writing was on the wall from the moment they raised their prices. I was even one of the people who canceled my service.

I didn’t follow Green Mountain Coffee. What happened there?

What service did you use to short these stocks?