As I get closer to actually making a purchase, I’m starting to reconsider my initial plan and may have an alternative solution that would make more sense. Here’s is where my mind is at:

Why I Want Dividend Paying Stocks:

First of all, the core of my plan has not wavered from going after dividend paying stocks. Fundamentally the concept still makes great sense to me!

When I think about which stocks to buy from all the choices out there, I want high quality companies with strong earnings potential that are going to pay me some guaranteed rate of return regardless of how much the market price changes – hence the dividend payment. But that’s not my only reason for liking dividend stocks.

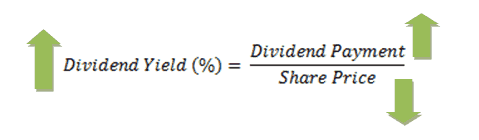

The dividend yield of a high quality company tells you something about the market price. Observe:

As you can see, if a solid company either holds or increases their dividend payment, then a higher than average dividend yield may indicate that the share price is likely to be undervalued in the market. This could mean that it is a good opportunity to buy!

The key here is to invest in SOLID companies – not just ones that arbitrarily raised their dividend yields overnight so that they look good to investors on paper. The long term ability of a company to make their dividend payments quarter after quarter is a sign of financial strength in a company; a quality most of us would find appealing for an investment.

This is why the Dogs of the Dow strategy has so much appeal to me, and why I have declared in previous dividend updates that I plan to use it as my simple answer as to what stocks to buy next. Rather than sifting through thousands of choices, I can conveniently cut straight to the Dow Jones Industrial Average to pick the highest dividend yields among the largest 30 stocks around.

But are things really so black and white? If there is one thing we encourage you to do here on My Money Design, it’s that no one looks out for your money the way you do. You need to use your own head to make a decision. Myself included!

So rather than just blindly following this strategy, I decided to dig a little deeper and see what exactly I’d be getting for my money.

Taking a Closer Look at What Stocks to Buy This Year:

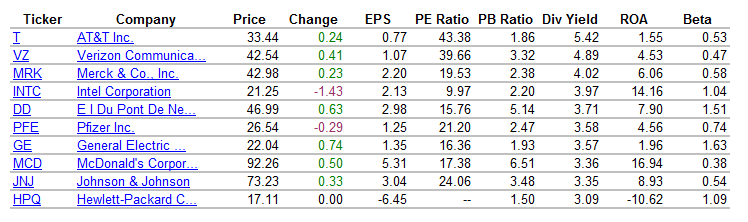

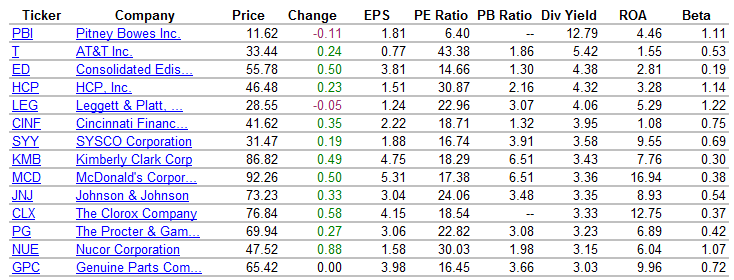

If I go to the Dogs of the Dow website, I can pull the stock symbols of the current ten Dog stocks. I can then quickly copy that information into Google Finance and gather a ton of useful information about the Dogs. Sorted by dividend yield, we have:

Earnings per Share (EPS), Price to Earnings (PE) Ratio, and Price to Book (PB) Ratio are all good figures for how to read stocks. But the metric I really like to pay attention to is Return on Assets (ROA). Using ROA was the conclusion of the book “The Big Secret for the Small Investor” by Joel Greenblatt. It’s powerful because, unlike other stock metrics, it takes the stock price right out of the equation. It looks at only the hard numbers of the company performance:

1) Net income, and

2) The assets of the company.

In other words, how efficient was the company in their ability to make more money with less assets? As you can guess, higher is better. Negative means the company is actually losing money.

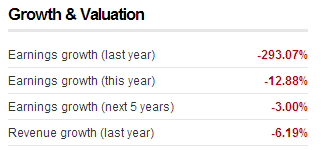

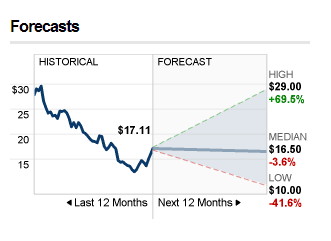

So as I look across the Dogs, I see that the last one Hewlett Packard is in fact losing money! A closer look using the stats provided on CNN Money indicate that the 5 Year Earnings Growth forecast as well as the 12 Month Price Forecast are also both sour.

(I don’t consider these two metrics to be hard requirements since they are merely analyst predictions, but they can still be helpful in your valuation. Just for good measure, all of the other nine stocks in the Dogs pass the sniff test of having positive Five Year Earnings Growth forecast and 12 Month Price Forecast.)

So if my fundamental goal is to invest in SOLID companies with strong earnings potential, would I be accomplishing this by investing in Hewlett Packard? I’m afraid the answer leans towards no.

Therefore, I can’t in good faith just blindly follow the Dogs of the Dow strategy. My decision as to what stocks to buy needs a little further investigation.

Using the Dividend Aristocrats to Complete the Puzzle:

The Dogs aren’t the only kids in town that pay good dividends. There is another group of popular stocks known as the Dividend Aristocrats (tracked by the S&P). These are companies that have increased their annual dividend payments for at least 25 years. 25 years! Think about how much commitment and financial stability that would take for a company to be able to do this through the thick and thin of 25 years!

So if we consider using one of the Dividend Aristocrats as a substitute, let’s do the same analysis as above to see what stands out. Again we put the ticker symbols into Google Finance to retrieve all their information. Sorting the results by dividend yield, here are the front runners:

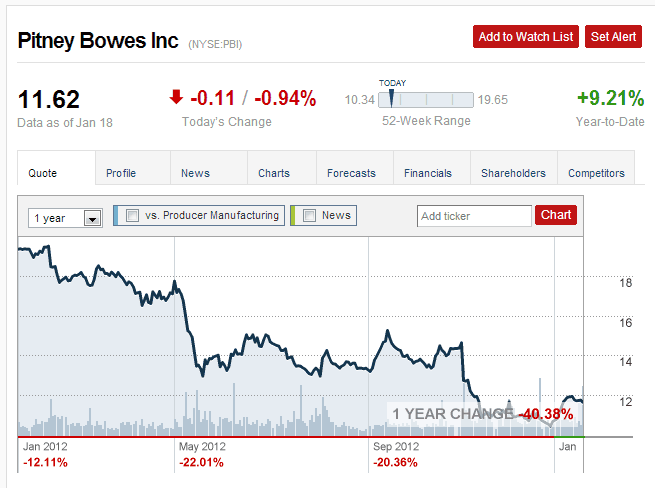

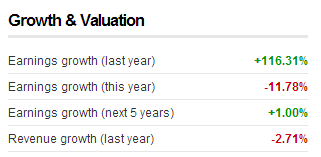

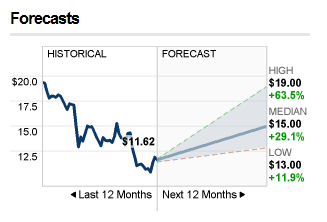

Right off the top, we see that Pitney Bowes has an ultra attractive +12% dividend yield as well as decent ROA and Beta. So what’s going on here?

A closer look shows that the market price has gone down-hill A LOT as it is near the bottom of its 52 week range. Apparently the company has had some hard times over the past few years.

But that doesn’t mean we pass it up just yet. Consider:

- The fact that it is an Aristocrat means that they haven’t stopped paying or increasing their dividend payment for over 25 years

- The Earnings and Share Price Forecast show signs of optimism.

Clearly there is some potential for a come-back from this company. Even if they experience a mild amount of slow growth, a 12% yield would certainly make it all worthwhile!

But I throw the question to my Readers: Do you think taking a chance on Pitney Bowes over Hewlett Packard would perhaps complete my quest as to what stocks to buy this year? Are there other stock picks on this list you think deserve a second look?

Related Posts:

1) Getting the Highest Dividend Stocks Using the Dogs of the Dow

2) How to Read Stocks and Evaluate Their Basic Metrics

3) Book Review: “The Big Secret for the Small Investor” by Joel Greenblatt

4) My Stocks with High Dividends Income Report – December 2012

Image courtesy of renjith krishnan / FreeDigitalPhotos.net

Do you ever look into reading the charts? So much insight can be gained by looking at only a few key metrics.

I do look at the charts but not as much as I did in the past. The more I read about stocks, the more I hear that you need to ignore price and focus more on metrics that reflect the company. This is why I like to see ROA; it focuses on net income and assets. It’s difficult to do though because ultimately the price will make or break your decision.

Uh. I only look at the charts. Is this bad?

Not at all! 🙂 The charts are always good to look at. I just prefer to read into the numbers.

This is a great example of doing your diligence. The market would be far less turbulent if everyone did the same. Great article.

“Leverage Debt”… Read about it and become a rich super villain! At Snarkfinance.com

Thanks! And I’ll be sure to give your article a look.

I am not an individual stock picker so I can’t really say which would be the better bet. A 12% yield does seem a bit too good to be true though… not saying that HP would be any better.

I actually had my eye on PBI last year when I first noticed the 12% yield. But the fact that they were losing money kept me away. Now that things seem to be on track and the dividend is still high, this might be the right time for the picking!

The numbers seem to sway toward PB. That would not have been a stock I would have paid attention to, but that seems like a great yield. Curious to see how it works out.

Yeah, last year it didn’t look quite as attractive. But a lot can change in a year. I’m curious to see how that works out too. Hoping for the best!

Great work & insight MMD! I think the numbers would point to PBI, but I do know that the stock price has hit some hard time. I am a little hesitant to say go with HPQ as they really seem to be having some issues.

Thanks John! Yeah, I’m staying away from HPQ. PBI does seem to have a rocky past behind it, but the numbers seem to support an optimistic year ahead. Like all investments, I guess I won’t know until I go for it!

Great advice. I recently started using the CNN Money tool for my investments. Only time will tell if it is accurate.

Thanks Brett! I do like using CNN Money to dig into stocks. I sometimes like to compare their analyst forecasts to the ones in Fidelity. Going back my picks from last year, CNN was mostly right about 4 out of my 5 purchases (McDonalds was the loser).

Do keep in mind that doing comparisons on one or two numbers can oversimplify the whole process. For example, the reason HPQ shows negative earnings this year is because they wrote off 20 billion in a one time charge. I’m not saying that’s irrelevant, but it’s a non-cash charge that tells you management screwed up big-time with the purchase price of an acquisition a couple of years ago and destroyed capital in the process. But it’s not really telling you much about this year’s or next year’s earnings. It’s essentially telling you that previous earnings were overstated and they jammed the adjustment for all of that in one year. A number of the companies above have this situation. Obviously T cannot pay out 5%+ year after year if the real P/E was in the 40s.

Similarly, ROA is interesting to look at, but many things can be hidden in this number (as with any single number). For one thing, it hides leverage levels. It’s also skewed by how capital intensive the business is. Industries that require a lot of assets will typically have lower ROA. This is why analysts generally compare ROA only between companies in the same industry.

Excellent insight SB! I can tell from this assessment that I have a long way to go if I truly want to dig deep into a potential purchase and see if its really something I want to invest in.

I totally agree that ROA (along with PE and other things) should be compared between industries to really be used effectively. In generic terms, I like to interpret this as a company’s ability to convert their resources into profit. So even though some companies may be better suited for higher ROA based on their infrastructure, it still tells me something about who has better efficiency.

I want to invest in the stock market and this information will help me a lot.

Thanks Lorilla and welcome to the site. I’m glad that this info will help. I hope you turn it into millions!

A few years back I thought long and hard if Pitney was a viable investment, it just seem to have so much upswing potential. A quick stock quote today, and the price went up to almost 24 dollars. So that means it was a good investment, and if you got in with a 12% yield it makes it that much sweeter. The yield is now only 3%.