You might think you need to be some kind of stock-picking wizard, or that you need a “guy” to manage your money for you. But in reality, that’s often not the case at all. Study nearly any early retirement story and you will find that the truth is painfully very simple:

To get rich faster, you need to save more money. A LOT MORE money!

So then: Why does everyone focus on investing over the actual act of saving?

While investing is a VERY important part of growing your wealth and eventually turning it into passive income, there is a limit. As we’ll talk about more later in the post, history has taught us that there is an upper limit to what the average person can expect for a return over the long haul.

Perhaps we tend to put too much emphasis on our investment returns because we fool ourselves into thinking that we’re smarter than we really are. That we’ll somehow notice something that no one else has. TV shows lot Jim Cramer and article headlines like “The Hottest Stocks of the Year” on the cover help to perpetuate these illusions.

… But sadly, its all nonsense. It’s all just clever marketing noise designed to sell us something and distract us from what we should really be focused on: Investing in simple index funds and then figuring how to pour as much money into them as possible!

In this post, I’m going to contrast how simply saving more money can triumph chasing unrealistic returns any day. In addition, I’ll show you how there’s a very easy way to replicate that extra 1 percent return that you’re trying to get.

The Real Way to Get Rich Quicker

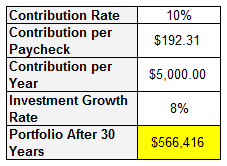

Let’s create a very simple example. Pretend you’re agonizing over which funds to pick for your 401(k). You know from reading this blog (and others) that an index fund will return roughly 8 to 10 percent per year on average over a period of 30 years or so. Let’s go with 8 percent for this scenario.

Like most novice investors, let’s say that you think you’re pretty clever and can out-smart the market. In essence, you’re going to try to get one more percent beyond everyone else for a 9 percent total annual return!

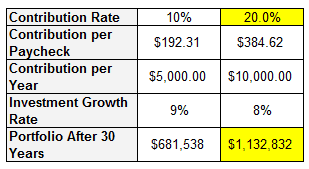

To round out the example, let’s also assume that you make an average of $50,000 per year, and you’re saving 10 percent of your gross income. That’s $5,000 per year or $192.31 per bi-weekly paycheck.

The Baseline Portfolio

To begin, let’s see what would happen if you took my advice and kept your money in an index fund.

Assuming an average earnings of 8 percent per year, by the end of 30 years you’d have $566,416.

(We’re going to ignore inflation to keep things simple.)

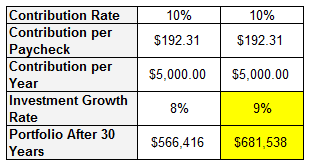

+1 Percent More Return!

Now what would have happened in this same scenario if you were able to find that “magic” fund or combination of funds that somehow produced one extra percent return?

In this case, that 9 percent annualized growth would have developed your nest egg into $681,538.

Not too bad! That’s $115,122 extra.

But there’s just one problem … That “magic” fund or combination funds doesn’t exist!

You Can’t Do Better Than an Index Fund!

We know from the teachings of Jack Bogle as well as several other studies that most fund managers (often quoted as 90% of them) fail to ever beat the market average. This is because of two main reasons:

- They can’t always predict which stocks will do better over the long haul.

- Even if they could, the high fees they charge will reduce your net earnings down below that of an index fund.

In almost every situation, the common investor was simply better off to go the easy route by just investing in a market index fund and not bothering to fuss over any funds at all.

So where does this leave us? Is there no way I can grow my portfolio up to $681,538 like we did in the second example?

Of course there is. We simply need to save more!

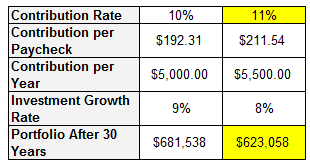

The Solution: Save Just 2 More Percent

Take a look at how the math works. By increasing your contribution rate from 10 to 11 percent, your savings increases from $5,000 to $5,500 for the year. Saving that extra $500 is effectively like getting an automatic 10 percent return on your original $5,000 principal.

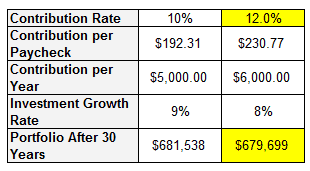

Of course, that’s only true for the first year. Because of the way that compounding returns works, when we extend this study all way up to the full 30 years, we can see that we actually would need closer to a 12 percent savings rate to achieve a portfolio of $679,699 with the original 8 percent growth assumption.

(This results in only $1,838 less than the 10 percent savings growing at 9 percent growth scenario; close enough for me.)

Awesome! Rather than chasing unrealistic returns and taking unnecessary risk, we were able to replicate those returns by simply saving a few percent more per year!

Now watch what happens when you increase your savings rate to 20 percent! By doing so you’re putting away $10,000 per year in this example.

The result? Your nest egg grows to $1,132,832! Now you’re buiding wealth fast!

Focus on What You Can Control

Don’t get caught up in the numbers. The real message we’re trying to convey here is this:

Saving is controllable. The market is not!

While we can ”assume” that the markets will grow at an 8 percent annual rate, this is merely an average figure over time. Depending on a great number of variables (most importantly years invested), you could end up with a totally different rate of return. (Check out these averages on the S&P 500 Wikipedia page.)

To paraphrase investment legend Benjamin Graham: No one ever really knows what Mr Market is going to do next.

Saving, on the other hand, is known. It’s absolute. If you decide to save 10, 12, or even 50 percent of your money, that’s a sure thing that is about to happen. While your money may tend to fluctuate up and down depending on which investments you have and how they are performing, overall you’ll always have more money to work with than if you tried to rely on investment returns alone. This is a very important concept to understand in the accumulation phase of retirement planning.

Conclusions:

- Investing is important. But don’t get caught up. Make life easy and pick a balance of stock to bond index funds that you’re comfortable with. Set it once and then check on it once per year.

- Use the rest of your time to focus on HOW you’re going to SAVE MORE! Saving more is the part of this equation that you can control. Therefore, it’s your key to building up your wealth as quickly as you want to!

But I Can’t Afford to Save Any More?

Ask yourself: You “can’t” save anymore money, or you “won’t”?

… Notice there’s a difference?

Saving more is a bit like exercise. You have to put in the work and stay disciplined if you want to see results. There are no quick, over-night solutions!

Anyone can save more money if they put their mind to it and make an effort really optimize their expenses. The trick is to focus on one at a time and follow-through!

Just this year to save money, we’ve already:

- Refinanced our house (after just one year),

- Lowered our property taxes,

- Reduced our cell phone bills, and

- Lowered our auto insurance costs.

On top of all of those, we’re already working on next year by eliminating as much of our vacation costs as possible through travel hacking. We’re taking advantage of credit card sign-up bonuses that we can use for free flights and hotel stays.

Find more of these kinds of money saving tips in my ebook: Save MORE, Earn MORE!: 21 Easy and Practical Ways to Save More Money for Your Retirement and Other Financial Goals.

Again, all it takes is focusing on one bill per month and developing a plan for how you’re going to reduce the cost. Though it may take a few emails or phone calls to make it happen, you’ll be happy when those savings start to add up, and you can use them for the things that really matter!

Readers – Which do feel will make the richest the quickest: Trying to boost your returns or your savings rate? Which one do you tend to dwell on more and why?

Featured image courtesy of Flickr | Chris Potter

Agreed! Focus on what you can control. When you simply say “I can’t save any more”, that’s giving up. When you ask “How can I save more?”, you start to look for solutions. Where there’s a will, there’s a way.

That’s totally it! Once you ask the right questions and challenge yourself to think, you’ll find the answers you were looking for. Putting that effort in is the key ingredient.

Always ask what’s easier… increasing income or increasing a savings rate. I always say the latter. Adjusting a savings rate is much more in our power than raising our income. Of course, both are achievable but one is easier to do than the other.

The great thing is that the two go hand in hand. If you develop the good habit of increasing your savings rate, then when you do finally increase your income, it will be that much more powerful!

I agree with this….to an extent. The only restriction is that you can only save up until the amount that you earn, meaning that if you make $100, the most you can save is $100. So while it’s definitely important to maximize the amount you save out of that, it’s also important to look at actually increasing your earnings as a means to increasing your savings. And, in theory, your earnings potential is infinite! So, I’d always recommend spending time maximizing savings, but when you seem to hit the point where you’re not getting a great return on your time doing so, then maybe it’s actually better to look at side hustles or some other way to bring in more dough.

Definitely! If I could write a follow up chapter to this post, increasing your income would be it. Once you’ve developed the good habit of saving, you can increase its power exponentially by increasing your income as far as you can take it! When I think of my own situation, I love making money from blogging. But its taken me a long time to our budget to a place where I really don’t “need” any of it. Thus, that leaves me with a LOT more to save!

This is such a smart article. I think people are always looking to get rich quickly instead of the boring way which is save and buy boring investments. Everyone is looking for the next Amazon, Apple and Google. Nobody ever talks about how Franklin Templeton is one of the best performing stocks over the last 25 years. Boring is sometimes the sexiest choice 🙂

Thanks! I’ll take that compliment all day. I think people tend to get drawn by the seduction of “get rich quick” because it seems so much easier. But they don’t realize that it would take infinitely more work to beat the market. People who work full time as fund mangers can’t even accomplish this. Yet, saving more is something that anyone could do better.

Props for the Jack Bogle call out. Index Funds are the smartest way to invest and a much better use of your time than trying to play the market every day. Thanks for this good post and I agree with your answers.

Thanks! The older I get and the longer I invest, the more I start to see that having chosen the index fund was always the smartest and best way to go.

I thought the answer to the question was rob a bank? In all seriousness, I agree that saving is the quickest way to get rich. Getting rich should be a slow and rewarding process. If you are trying to get rich quick then you are probably doing it wrong!

Exactly! There is no silver bullet. There is no secret investment that multiplies your investment by 10-fold. The hard but honest truth is that if you want to “have” more money, you’ve just got to buckle down and save more of it.

When I am in control of my finances, I’d definitely go for saving rate and determination to go through the long process because the person who goes through the process and learn from many money-related challenges turns out to be rich and successful in the end.

Every extra percent of your income you save can make that much more of a difference.

Wow, many wise words in this post. Should send this to a couple of friends/family as a hint! Thanks MMD.

Thanks! And by all means, please do share it!

Well the best way to earn money,to get high paid job!

Getting paid more is just one part of the equation. Knowing what to do with the money once you have it (such as saving and investing it) is far more important. Developing the good habits of saving and investing can be done at any income level. On the contrary, I’ve known lots of people who are earn way more money than I can ever hope to make, and they struggle to get by check to check because they don’t have those fundamental money management skills under control.

This is a great example to show people the power of just increasing savings. I am looking forward to how much compounding I will realize by 2020. When will you reach FI, do you have a date in mind? I am shooting for 2025. Hopefully the economy wont crash with all the new changes!

Our target is 2026. You can check out the entire plan here. It’s linked to the year that my wife will become eligible to receive her pension. In addition, we’ll also have an opportunity to purchase discounted healthcare through her employer. Though we could probably retire early sooner if we really wanted to, we’re holding to this date because those two things will help us need less from our savings, which will then help boost the longevity of those funds.

I’m actually sorta hoping we hit a recession soon so that we’ll have the opportunity to start buying up more shares of investments at a cheaper price. Then, hopefully by 2026, the markets will have a chance to rebound and things will look up again.

Totally agree with this. Saving becomes a pain when your salary is too low though. Requires a lot of budgeting

Don’t forget: You can always make more money than just what your salary provides you. People all over the Internet have found some pretty cool and clever ways to make some decent cash on the side.

Great Article. Totally Agree, saving is the first thing to be focused. Saving can be increased gradually to a point where saving rate can go upto 50% or more. Secondly, focusing on increasing income is another side to it.

Doing both properly with discipline will result magic. FI is sure.

Thanks again.