Ahhh … the old “which of my debts do I pay down first” debate …

We tend to carry a lot of them in our society. According to a 2017 report from GoBankingRates, the top three forms of debt for most people are their mortgage (65%), credit cards (50%), and auto loans (32%).

Usually questions like this are a no-brainer. Simply look to your loans with the highest interest rate and pay those off first. That means tackling your high-interest debt like credit cards and student loans.

But what about our auto loans and mortgages? When it comes to debts like these, the differences can be a bit more subtle. The interest rates are often lower, and the payments are more manageable (likely because they’ve been spread out over so many years).

All in all, debt is still debt! And the sooner you can pay it off, the quicker you can crawl out from underneath the mountain of interest that is building up on top of you.

But for these two types of loans, is that all there is to it? Are there are other implications to paying off your mortgage or car loan that can make one option more attractive than the other?

In this post, we’ll break down the numbers and compare what paying off your car loan vs your mortgage actually means in terms of money saved. But we’ll also discuss a few other important points that could improve situation and add to your decision. Let’s begin!

Auto Loan vs Mortgage – The Comparison

Before we can make a good comparison between your auto loan and mortgage, it helps to understand how these loans are constructed in the first place.

How Do They Work?

First of all, for both, most conventional loans work in a similar fashion:

Monthly payments are determined by finding the future value of the loan amount in a financial calculation that takes into consideration 1) an agreed upon annual interest rate and 2) how long it will take to repay the loan.

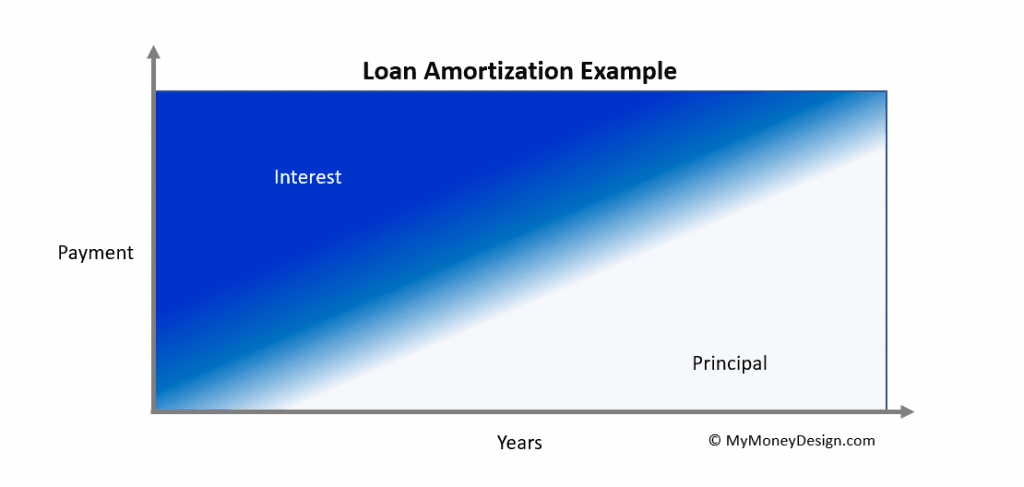

The general construction of the loan is that your initial payments end up being more heavily weighted towards paying back the interest and less towards your principal. As time goes on, the proportions incrementally change towards less money going towards the interest and more going towards the principal.

In case you want to know, this is a process called amortization. It’s designed so that the lender gets paid their interest more quickly, while it takes you longer to pay back more of your loan.

What does this mean for you?

- You can influence the amortization schedule in your favor by making additional payments towards the principal, which means paying less interest in the future.

- From a mathematical standpoint, we can conclude that the loan with 1) the higher interest rate and 2) the longer payment period will be the one you’ll want to accelerate.

In this case, your mortgage.

But how much better is this really? Can we put some numbers behind it?

Of course!

Loan Constants:

Let’s setup a real-world example of a typical auto loan and typical mortgage.

For the auto loan, using statistics from CNBC and Value Penguin, we find:

- Average loan: $30,032 (we’ll round to an even $30,000)

- Average monthly payment: $503

- Average term: 68 months (we’ll go with 60 months for our model)

- Average interest rate: 3.93% for 60 months and 3.78% for 72 month (we’ll round to 4%)

Similarly, for a mortgage, using data from Experian we find:

- Average mortgage balance: $201,811 (again, we’ll round to an even $200,000)

- For our model, we’ll use a typical 30-year fixed rate mortgage with a 4.5% APR

Putting all of this together, our monthly payments equate to:

- Auto loan = $552.50

- Mortgage = $1,013.37

Finally, the last piece of the puzzle will be how much extra money per month we’d like to apply to either our mortgage or auto loan. For this, I will select a simple amount of $100.

The Results:

Crunching all the numbers in Excel, at the end of the 5-year period, I come up with the following results:

Putting the extra money towards our auto payments saves us $531 in interest. Putting the extra money toward our mortgage payments has (so far) saved us $740 in interest.

Therefore, just as we assumed, paying down the mortgage was the better choice.

But take into perspective that this is only by a lead of $209 over a 5-year period. So even though there is a slight mathematical advantage with the mortgage, it makes almost no difference which loan you choose to pay down quicker!

But What About Interest in the Future?

One of the big arguments for people in favor of paying down their mortgage early is that accelerated payments will dramatically reduce how much interest they save over the life of the mortgage.

And they are correct. Paying down your principal early on will shave years and tens of thousands of dollars off your total mortgage. This, of course, depends on how much you pay and how often you make the payments. There are any number of mortgage payoff calculators across the Internet where you can see this for yourself.

So what about our example? How much money over the entire 30-year life of our mortgage will we save based on these first 5 years of our accelerated payments ALONE?

The answer: $14,111

Again … not bad. But not exactly a great return either; especially not after waiting 25 years.

For example, we could have easily introduced a third scenario where we took those 5 years to save up $100 each month, and then invested it all in a stock market index fund over the next 25 years. With an average annualized rate of 7%, it would have produced a return of $32,565. That’s double the interest saved over the life of the mortgage.

(Again, no surprise since 7% is a better rate of return than the 4.5% interest rate on the mortgage.)

So again: While there is definitely a strong potential to save even more money in the future by making accelerated mortgage payments, it’s not an overwhelmingly convincing reason to put your extra money towards the mortgage payments over the auto loan.

In that case, if the amount of money saved doesn’t sway you one way or the other, than what would be some other good reasons?

Freeing Up Money to Pay Your Other Debts

What if paying off your auto loan or mortgage early gave you the ability to do something else worthwhile with your money?

What do I mean by this?

I’m talking about cash flow. What if our goal should be to free up as much money in our monthly budget as possible, so that we can then use it to tackle our other debts?

This strategy is popularly known as the debt snowball method. The process is always the same:

- Pay off your debt with the lowest balance first (regardless of interest rate).

- Now take the money you would have normally used each month to pay off Debt #1, and redirect it towards your debt with the next lowest balance (Debt #2). Continue until Debt #2 is paid.

- Repeat the process with Debt #3 and so on until all of your debts are completely paid off.

As you can see, this technique creates a cascading effect where your budget stays the same, but your payments compound upon one another until your debts are all gone.

So what does this mean for your auto loan vs mortgage dilemma?

Without knowing your purchases, odds are very good that the amount of money you still owe on your auto loan is less than your mortgage balance. Therefore, with this strategy, you would:

- Use your extra budget to pay down the auto loan as quickly as possible.

- Once the auto loan is completely paid off, you then continue to take that same monthly amount of money and reapply it to your mortgage.

I can tell you from personal experience that I have used the debt snowball method in the past and it works really well! I’ve paid off small debts that carried 0% interest just so that I could free up and extra $200 (or so) per month to use towards paying off our other expenses. Nothing feels better than completely paying off large loans!

So if paying off your loans more strategically using something like the debt snowball method is your goal, than in this case paying off your auto loan in the smarter choice.

Which Asset Depreciates Slower?

In other words, focus on paying off the asset which depreciates the slowest.

Think of it this way: Let’s go 5 years into the future.

What will the value of your auto be?

Likely next to nothing. For the typical automobile, you might get a few thousand dollars at trade-in (if you’re lucky). Generally, all of the money you sunk into your vehicle loan will be effectively be gone.

Now consider what your house would be worth if you had to sell it?

Chances are your home will be worth approximately the same or possibly more than what you paid for it. That means that you’d have at least some equity to recoup.

When we sold our house after living in it for 11 years, we sold it for just about the same price as we paid for it. But since we had been making mortgage payments for so many years, our balance was low and we earned several tens of thousands of dollars in the transaction.

Therefore, if you think of putting your money towards something that will show a better return in the future, then paying off the mortgage quicker makes more sense.

Eliminating PMI

If you put down less than 20%, then chances are it does. PMI stands for “private mortgage insurance”. It’s basically an insurance policy that the mortgage lender takes out on your mortgage in case you default, and they make YOU pay for it!

If you’ve got PMI, one of your goals financially should be to get rid of it as soon as possible. Any money you put towards PMI is effectively gone the moment its paid. It does nothing to reduce either your principal or interest.

When we had our first mortgage, it came with PMI that worked out to almost $100 per month. That’s more or less a payment of $1,200 per year that went towards nothing tangible on our behalf!

So how do you get rid of PMI?

Simple: Pay down your mortgage principal quicker. Once your loan-to-value (LTV) ratio gets down to 80% or lower, you can possibly refinance and have PMI removed. That’s more money that’s back in your pocket!

Therefore, if you’ve got PMI and want to eliminate it, then putting your extra money towards the mortgage instead of the auto loan would be better.

Tax Deductibility

Though it’s not a heavy hitter, one more topic to consider is which loan can work out better for your taxes.

As you might already know: Mortgage interest on your primary home is tax deductible for those people who itemize. The interest you pay on your auto loan is not. Therefore, this can make paying off the auto loan more appealing since you’ll want your mortgage loan to last longer.

Again, this benefit will vary from house to house. In this article from Investopedia, they found the amount of savings between itemizing and taking a standard deduction to be anywhere from $100 to $1,500.

Conclusion: Do What’s Right for You

Still unsure of which option is the better one to go with?

It’s okay. You don’t have to be. Basically, just go with whichever one feels right to you.

You could look at your loans mathematically, strategically, or even from a tax benefit perspective. But either way, only you know your financial situation. Therefore, you have to do what works the best for your well-being.

No matter which way you decide to go, the good news is that you’re using your extra money to pay off your debt early, and that’s a “win” no matter how it gets done.

Readers – Which would you rather do: Pay off your auto loan first, or put the extra money towards your mortgage principal? What are your reasons for deciding to do one or the other?

Photo credits: Pexels, Pixabay

I also think the same that the decision should be our own. By comparing auto loans and mortgage loan we have got a clear picture. Now I would pay off my debts as soon as it is possible..

cash flow is king….snow ball is probably best…cash is king becuase it can keep you from falling back into the trap..

pay off you bills and invest every penny you can….and retire early….pretty simple math…here is the non math part….treat this problem with debt like a college class….focus on it every day….never take your eye off it….this will prevent you from tripping on surprises like year bills..like year taxes…and so on….also take that cash …and build a large emergency fund..and also make sure that some point you dont owe anyone that u give God….

Comparing auto loans vs. mortgages: BEWARE ! Many auto loans do NOT handle extra principal payments the same way as most mortgages handle extra principal payments.

Many auto loan processors DO NOT reduce the interest owed on subsequent payments after processing extra principal payments. I have experienced this in excruciating detail with major lenders twice now. How this can even be legal, I have no idea. But all they do is wind up using the additional principal to shorten the term of the loan, without reflecting any incremental interest savings in the interim.

Another car loan processing ‘gotcha’ is if you are not clear and forceful about wanting to “pre-pay principal only” they will default to taking additional monies paid by you and applying it to the next regularly scheduled loan payment(s) – thereby ensuring that you are actually pre-paying INTEREST as well as pre-paying significantly less principal than you might think you are paying !!

Net: car loans and mortgages are NOT just different sizes of the same kind of loan.

Stay alert my friends !