If you’re one of those people who are really good at saving their money diligently for retirement, then the IRS has some good news for you next year: The 2015 maximum 401k contribution has just been increased to $18,000 (up $500 from 2014). For those people 50 and older, the $5,500 catch-up limit was also bumped up to $6,000. I’ve personally been saving up to the 401k maximum for a while now and am looking forward to bumping up my contributions. By saving so much I know that I’m not only helping my family to get closer to reaching financial freedom, but we’re also taking advantage of a few other extremely important benefits. Here are what they are and what you can do to help yourself get that point too. Why Max Out or … [Read more...] about 2015 Maximum 401k Contribution Increases to $18,000 – How You Can Get There

Personal Finance

Should I Do a 401k to IRA Rollover? The Benefits and Drawbacks

Recently during a discussion with my money coach client there was a very important question that came up: “I have an old 401k with a former employer that is still sitting right where I left it. I’m wondering if I should make a 401k to IRA rollover or simply leave the money right where it is?” That’s a really good question. I’m sure for a lot of people (myself included) that the money you have in your 401k account is probably the largest percentage of your wealth you have saved up – anywhere! Even if you’ve got nothing more than the average 401k balance of $81,000 as reported by Fidelity, that’s still a very serious amount of retirement savings that you want to be putting to work as hard as possible. Unfortunately, however, … [Read more...] about Should I Do a 401k to IRA Rollover? The Benefits and Drawbacks

Going Back to School on a Budget as an Adult

Going back to school isn't just for the little ones. It can be a time for grown-ups to get anxiety too. And not just over the work they'll have to do. If you've noticed the job market is saturated with candidates that have bachelor's degrees, you've possibly considered getting a graduate degree to give yourself an edge. But balancing family expenses is hard enough without adding tuition and books. Plus don't forget all those hours invested in working on projects and studying. You might even convince yourself that paying for a graduate degree and keeping your family afloat is nearly impossible. But remember - you're not the first adult who's gone back to school while working, parenting, etc. If you're in this boat, here are a … [Read more...] about Going Back to School on a Budget as an Adult

How to Remove Disputes from Credit Report History and Get a Higher Score

It is always a good idea to keep an eye on your credit score and credit report. I have been been doing my homework in this area, and I am thrilled to report that my credit score has risen dramatically due to some simple efforts I made. Here’s what was holding me back. I’m pretty conscientious when it comes to paying my bills on time. But a year ago my wife and I moved to a new city. Though we canceled our utility accounts only after the final balances had been paid, my credit report showed an unpaid partial month. Because we changed addresses twice in 3 months, I guess written confirmation never found me, and we were never notified any other way. I only noticed the negative mark on my credit report when I checked … [Read more...] about How to Remove Disputes from Credit Report History and Get a Higher Score

Can the Experts Help Us with Investing in Dividend Stocks? 6 Month Update

What if there was a really simple way for investing in dividend stocks and knowing which ones were going to do better than others over the next year? What if all you had to do was just read the expert opinions to know how they were going to do? That’s the fun little experiment I started about 6 months ago when I bought my last round of dividend stocks to add to my money design. Of course this is NOT how I picked my stocks and I would NEVER advise you do this. There are plenty of other ways to evaluate the assets of a company. All the same though, I thought it might be fun to note the “expert opinions” for each of the stocks I bought earlier this year and see how they did every 3 months are so. Who knows – could any of these … [Read more...] about Can the Experts Help Us with Investing in Dividend Stocks? 6 Month Update

How to Double Your Money the Safe and Smart Way

Blackjack. Hot-pick stocks. These are the kinds of silly things people usually think about when it comes to doubling their money fast. Unfortunately when it comes to methods like that, the story usually ends with them not only NOT doubling their money but also losing all of their initial investment too. Ever since I was a little boy I’ve been completely fascinated with the legitimate ways that you take one dollar and turn it into two. The truth is that it’s actually pretty easy to do. There are lots of ways how to double your money without having to take a whole lot of unnecessary risks. You just need the patience to give it time and let it happen safely. Here’s how that happens: The Rule of 72 and Doubling Your … [Read more...] about How to Double Your Money the Safe and Smart Way

What Size Mortgage Can I Afford and How Can I Figure That Out?

How big is “too big” when you’re thinking price tag on a new house? That’s the question that’s on everyone’s mind when they first go new-home shopping: What size mortgage can I afford? It’s a prudent thing to ask and sensible when it comes to your finances. Part of the whole Great Recession in 2009 was an issue with home buyers taking on far too high of a mortgage value than they could afford. (That and getting themselves into mortgage products that were probably not the most ideal for their situation). So to avoid another house buying implosion, a smart consumer will first take a look at their financial situation in the mirror and see what makes the most sense for their situation. Here’s a few tips to help you decide how much … [Read more...] about What Size Mortgage Can I Afford and How Can I Figure That Out?

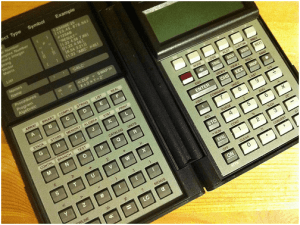

Some Unconventional Thoughts on Investing for Your Retirement

When I first started in financial planning, this would be back in the 1980’s, investing for your retirement was simple. When you were young, the theory went, you dutifully started putting away a little bit of your salary each month. The amount was as high a percentage of your income as you could manage. It was supposed to be a sacrifice. Give up something now to have something later. You invested in the stock market, of course. Equity returns were the way to go and you had plenty of time to ride out cyclical fluctuations. Your risk return profile indicated a higher acceptance of risk. You also bought a home. This was more a place to live than a retirement investment. Still, it increased your net worth. As you got older you … [Read more...] about Some Unconventional Thoughts on Investing for Your Retirement