Although it may end some of your financial troubles, filing for bankruptcy is not just something that you do once and the work is over. In fact, unless you want to file repeatedly throughout your life, the real work begins after your debts are discharged. Asking how does bankruptcy work is a question that few people ever really take the time to understand, but they should so they can save their finances. If you don't have debts like student loans or overdue taxes, you may get your debt balance reset to zero, but if you remain in an impossible financial situation then the relief is only temporary. … [Read more...] about How Does Bankruptcy Work? What You Should Know Before and After Filing

Personal Finance

My Broker Lets Me DRIP Stocks – Why That’s Great

Time and time again on this blog we’ve proven that we sometimes don’t know we can do something until we ask for it. That was exactly the case this week when I learned that I can DRIP stocks with my broker. Until now I didn’t think that my account had this feature, but I was glad to find out that it does and I will certainly be putting it to use. For those of you who don’t know, DRIP stands for dividend reinvestment plan (or program). It is also sometimes abbreviated DRP. When people say you DRIP stocks, they are usually referring to some system you enroll in where instead of receiving your dividend payments by check or cash each quarter you instead automatically buy more shares of that same dividend paying stock. There are a lot of … [Read more...] about My Broker Lets Me DRIP Stocks – Why That’s Great

Exploring My 401k Alternatives – Maybe More Dividend Stocks?

So I’ve been thinking … Last year I wrote a post about how I was thinking about diverting some of the money we were contributing to our 403b retirement fund towards our dividend stocks instead. This was somewhat of a controversial move because traditional personal finance advice is to invest in your tax-sheltered accounts, not your taxable accounts! After all, why would you want to save your money in an account where you have to pay taxes? But it wasn’t that simple. There were several more alluring reasons why investing in dividend stocks would make more sense: … [Read more...] about Exploring My 401k Alternatives – Maybe More Dividend Stocks?

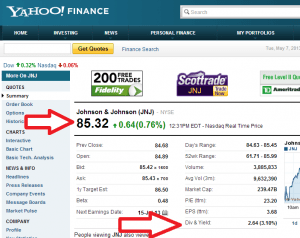

Using the Dividend Yield Formula to Evaluate a Stock Prospect

As part of my love affair over the last year with investing in dividends, I’m going to continue to introduce posts that focus on one particular aspect of evaluating a particular stock prospect. So this week, we’ll be looking specifically at the dividend yield formula and what it can tell us about the stock or company. … [Read more...] about Using the Dividend Yield Formula to Evaluate a Stock Prospect

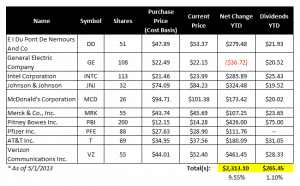

My Dividend Stock Portfolio Update – May 2013

What a wild ride the last 4 months have been! It’s been a while since I’ve done a dividend stock portfolio update, and I thought this would be a great time to report (i.e. celebrate) my earnings. … [Read more...] about My Dividend Stock Portfolio Update – May 2013

A Ponzi Scheme Example – An Illustrated Demonstration of How One Works

Over the last few years, the name “Bernie Madoff” and the term “Ponzi Scheme” have been used almost interchangeably. Obviously we all know that this man was a crook and that he committed a very serious act of fraud by stealing millions of dollars from trusted investors. But have you ever stopped to ask yourself just what one is or what a Ponzi Scheme example would even look like? Don’t be embarrassed if you don’t know exactly what one is. When Madoff was arrested and his wife was told about his crime, she replied “What’s a Ponzi Scheme”? As students of investing and diligent savers for retirement, it is very important that we protect our financial well-being by staying away from scrupulous investment opportunities After all, … [Read more...] about A Ponzi Scheme Example – An Illustrated Demonstration of How One Works

The Pension vs 401k – The 401k Did Not Kill Retirement

Every now and again when I read through the headlines on my favorite money news sites, I see the same desperate-for-attention headlines proclaiming that “retirement is dead” and that we basically have no hope of ever saving enough money. How do they draw those conclusions? The usual suspects cited are the decline of pensions, the deflating of Social Security and the rise in costs as reasons why none of us can save and why we’ll all need to work until we are 80. And then there is my personal favorite: The 401k. They talk about the 401k like it’s a James Bond villain. When they compare the pension vs 401k, they describe it as a horrible and inefficient means for retirement. Basically, their message is that the 401k killed … [Read more...] about The Pension vs 401k – The 401k Did Not Kill Retirement

Another Reason Why You Need Emergency Money – For Stupid Car Repairs

If you think that having $1,000 or so in your emergency fund is going to cut it, think again! I’m normally not a huge promoter of this topic, but over the last 2 weeks, I’ve had to dip into my stash more than I’d like. And if I didn’t have access to emergency money, I’d be up a creek either paralyzing one of my investments or taking on unnecessary debt. Here's my story of what happened: … [Read more...] about Another Reason Why You Need Emergency Money – For Stupid Car Repairs