Why do we put off buying life insurance? Is it because it’s complicated, we’ve heard bad experiences about it, we don’t know which type to buy, or how much we need? Believe it or not, for some people it is simply because they don’t want to go to the doctor or have their blood drawn. Even though that may sound silly, but it only takes one excuse to keep you from doing what you should. Fortunately the industry offers a product known as no physical life insurance. By not requiring a physical, you can just buy the life insurance online or over the phone without any medical intervention at all. How No Physical Life Insurance May Benefit Your Situation: If you haven’t been told you enough already, by simply being an adult with a … [Read more...] about Why No Physical Life Insurance Might Be Right for You

Personal Finance

Is the Conventional System to Create Wealth Rigged?

I’ve got a confession for all of you: I’m getting impatient! It was approximately 10 years ago that I first learned what a 401k was (I had never even heard of one before) and began my first steps towards saving for retirement. Like many of you, I knew the path to create wealth would be lined with hard work, lots of saving, and choosing the right investments. I took the conventional financial advice and began with a modest 10% savings rate. It wasn’t until the last few years that I’ve tried to accelerate my results by bumping my savings rate to extremely high amounts. So is it any wonder that when I look at my 401k balance and see how long I have to go that I feel I’m playing a rigged game? Sure if I stay the course I might have a … [Read more...] about Is the Conventional System to Create Wealth Rigged?

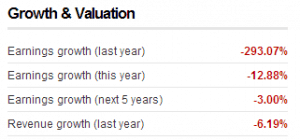

Rethinking My Strategy for What Stocks to Buy This Year

One thing you will learn in investing is that nothing is ever absolute and that rules are made to be broken. With that said, I’ve been giving a lot of thought as to what stocks to buy this year and my previous declaration to use the Dogs of the Dow strategy. As I get closer to actually making a purchase, I’m starting to reconsider my initial plan and may have an alternative solution that would make more sense. Here’s is where my mind is at: … [Read more...] about Rethinking My Strategy for What Stocks to Buy This Year

P2P Investing Denied! What Should be My Next Passive Income Ambition?

And so it was over before it even began … The tires on my P2P investing (peer to peer) efforts quickly went flat last week when I discovered some very important information. To bring everyone up to speed, I had wanted to start off 2013 by adding a new form of passive income to my money design. Last year blogging income and dividend stocks were valuable additions. This year out of the available choices I had listed, P2P investing was the one that stood out. It intrigued me in a number of ways: • Potential higher net rates of return than a stock market index fund • A steady stream of interest income • Access to the earnings before retirement age (helping the early retirement efforts) • Potentially lower risk (if you pick borrowers … [Read more...] about P2P Investing Denied! What Should be My Next Passive Income Ambition?

Should I Sell My Structured Settlement? Some Reasons Why You May Want To

Have you ever heard of someone being awarded a large amount of money (from a lawsuit, lottery, etc) and wondered if they receive it all at once? Chances are … they usually don’t. Most of the time, the payment is broken up into smaller payments over a fixed duration of time. So for example, instead of receiving $500,000 all at once from a lawsuit, the plaintiff may receive $2,000 each month for the next 30 years. Putting it all together, this type of payment is called a structured settlement. Investopedia defines a structured settlement as: While we often focus on building wealth for the long-term, it’s important to look at things from both sides of the fence. Therefore, I recognize that there may be some situations where … [Read more...] about Should I Sell My Structured Settlement? Some Reasons Why You May Want To

Our Long Term Financial Goals and How We’ll Meet Them in the New Year

Happy New Year everyone! I hope everyone is safe and having a smooth transition into this new start. It seems this event is always marked with a great deal of optimism because people feel like they have a symbolic marker from which they can wipe the slate clean and start out fresh. It might be eating habits; it might be quitting your bad vices. For me, it always marks a time to re-evaluate our long term financial goals and see if our actions will get us to where we want to be. … [Read more...] about Our Long Term Financial Goals and How We’ll Meet Them in the New Year

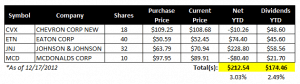

My Stocks with High Dividends Income Report – December 2012

What a great time of the year to receive the next installment of my “truly” passive income. By luck, it just so happens that my next series of payments from my dividend paying stocks was scheduled to be paid in December. Couldn’t we all use a little extra cash right before Christmas as the bills start rolling in? Over on the left are the results of my third batch of quarterly dividend payments received for Quarter 4 (Q4). … [Read more...] about My Stocks with High Dividends Income Report – December 2012

Why You Need to Get Your Full 401k Matching as Early as Possible

Not too long ago, I was trying to demonstrate how NOT taking full advantage of your 401k matching contributions offered by your employer was causing you to lose out on more money over the course of your career than you probably thought! While it’s never too late to get your personal finances in order, one simple mistake I see people making all the time that kills me is when they wait as late as 5 to 10 years before they finally get with the program and start contributing enough to their retirement plan to get the full 401k matching from their employer. I beg you - Please don’t waste another year! Remember time is one of your greatest assets as an investor, so don’t squander it! In this post, I’ll show you just how powerful taking … [Read more...] about Why You Need to Get Your Full 401k Matching as Early as Possible