Why do budgets fail? You read through your receipts. You set your goals and limits. And you track your purchases. Yet, even after accounting for every dollar and laying out the best laid money design possible, there is still one thing that could sabotage the whole thing: The motivation to participate. One of the hardest things about keeping your household budget on track is staying motivated. No matter how great your plan is on paper or what kind of budgeting advice you follow, it will all be meaningless and accomplish nothing if the people involved can’t agree to stick to it. People often under-estimate how quickly a low morale can derail your best efforts. But fear not! A few small rewards or signs of success can be just enough to … [Read more...] about Budgeting Advice to Help Keep You Motivated

Personal Finance

Building a Special Gift for Your Young Adult Children

While shopping for my kids this Christmas, I’m reminded by just how much you just want to spoil those little stinkers. What parent can deny this natural instinct? There really are fewer things better than waking up on Christmas morning to see how excited your children get when they open their presents. Taking this instinct one step further, it’s also natural for you to want your kids to grow up to be the best adults they can be. You give them chores to do to learn hard work, you give them an allowance to teach them about budgeting, and you help them with their homework to encourage learning. And on the things they can’t do for themselves, you want them to still have every opportunity available to excel. This gets me thinking about a … [Read more...] about Building a Special Gift for Your Young Adult Children

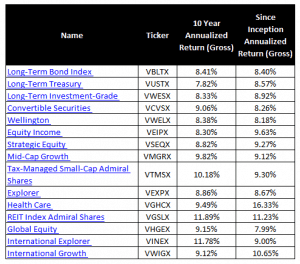

My Picks for Vanguard Mutual Funds for Our Roth IRA

The end of the year is full of things to do: Celebrate the holidays with family, prepare for the winter, get your tax information together, etc. But one very important chore we often forget to perform is re-evaluating our investment portfolios. Unless you review them, how do you know if the investments you own are performing well? Are they still helping you to reach your goals? Are there better choices out there? This is exactly what I’m looking to do with our Roth IRA funds. Both my wife and I both have a Roth IRA through Vanguard which we max out every year. Our belief is that these Roth IRA’s will help us to get tax-free income during retirement or possibly serve as a vehicle to help us fund our early retirement. To a new or … [Read more...] about My Picks for Vanguard Mutual Funds for Our Roth IRA

New IRS Contribution Limits for Retirement Accounts in 2013

If you are somehow managing to diligently contribute the maximum amount to your 401k and IRA accounts, then there's good news for you in 2013. The IRS contribution limits for the major U.S. retirement accounts will be increased next year! This is exciting news for anyone looking to invest more of their money without the burden of paying taxes on their returns. The Money Design November Update plan I proposed recently will get a big boost from these new increases that will help me to achieve my goals much more quickly and safely. … [Read more...] about New IRS Contribution Limits for Retirement Accounts in 2013

My Nine-Year-Old Daughter Received a Credit Card Offer

I thought I would have a few more years until I had to deal with this, but the other day I was shocked to see that my nine-year-old daughter received a credit card offer in the mail for a student account. I have no idea where they got her information because everything that she is signed up for is in either me or my wife’s name and email address. Naturally the Papa Bear instincts kicked in and I called the credit card company. Thankfully when I told them her age they quickly realized they had made a mistake, apologized, and took her name off their list for any future offers. The service rep could not answer how her name got there on the credit card offer list in the first place. I was glad to see that at a minimum her credit card … [Read more...] about My Nine-Year-Old Daughter Received a Credit Card Offer

Black Friday Shopping Tips – Preparing to Get the Best Deals!

Can you believe it’s already almost that time of year again? The Christmas Season and all its madness have quickly creept up upon us. And with the Christmas season naturally comes that special occasion of Black Friday where just about everything is on sale. It can be a little bit extreme in some circumstances, but fear not. Here's a few of my Black Friday shopping tips for getting the most out of the occasion! … [Read more...] about Black Friday Shopping Tips – Preparing to Get the Best Deals!

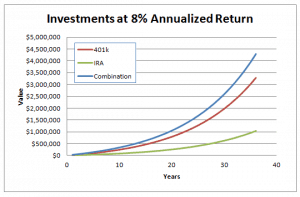

My Money Design for How to Achieve Financial Freedom – November 2012 Update

I was very pleased with the level of interest and positive reaction I received for my previous post on how I plan to retire early in Money Design update in October. However, that update was only merely a sketch of where I wanted to be. As I’m sure any designer can tell you, no blueprint is ever really complete until you put numbers to it – even if it’s a blueprint for your plan on how to achieve financial freedom. In this update, we’ll seek to build upon my earlier retirement income strategies by making some assumptions about how much money my family could expect to take in from our multiple developing income sources. Please feel free to compare my decisions and estimations to what you think would be reasonable for your own … [Read more...] about My Money Design for How to Achieve Financial Freedom – November 2012 Update

SCARY Retirement Statistics – Don’t Let Lack of Planning Haunt You!

Happy Halloween everyone! Since most people will be out celebrating Trick or Treating tonight, I thought we’d do a very brief post of something truly alarming! No, it’s not about ghosts, monsters, or anything else from the paranormal. This is something much more frightening - These are scary retirement statistics! The reason these should terrify you is because, unlike a superstitious ghost story, these statistics tell a very real story. And if they are any indication of things to come, reality is going to be pretty grim for a lot of people. Read these numbers and tell me they don't paint a pretty chilling picture of the future to come! The following figures are from Statistic Brain and are overwhelmingly alarming: … [Read more...] about SCARY Retirement Statistics – Don’t Let Lack of Planning Haunt You!