Happy New Year everyone! I hope everyone is safe and having a smooth transition into this new start. It seems this event is always marked with a great deal of optimism because people feel like they have a symbolic marker from which they can wipe the slate clean and start out fresh. It might be eating habits; it might be quitting your bad vices. For me, it always marks a time to re-evaluate our long term financial goals and see if our actions will get us to where we want to be. … [Read more...] about Our Long Term Financial Goals and How We’ll Meet Them in the New Year

Savings & Budgeting

Budgeting Advice to Help Keep You Motivated

Why do budgets fail? You read through your receipts. You set your goals and limits. And you track your purchases. Yet, even after accounting for every dollar and laying out the best laid money design possible, there is still one thing that could sabotage the whole thing: The motivation to participate. One of the hardest things about keeping your household budget on track is staying motivated. No matter how great your plan is on paper or what kind of budgeting advice you follow, it will all be meaningless and accomplish nothing if the people involved can’t agree to stick to it. People often under-estimate how quickly a low morale can derail your best efforts. But fear not! A few small rewards or signs of success can be just enough to … [Read more...] about Budgeting Advice to Help Keep You Motivated

Building a Special Gift for Your Young Adult Children

While shopping for my kids this Christmas, I’m reminded by just how much you just want to spoil those little stinkers. What parent can deny this natural instinct? There really are fewer things better than waking up on Christmas morning to see how excited your children get when they open their presents. Taking this instinct one step further, it’s also natural for you to want your kids to grow up to be the best adults they can be. You give them chores to do to learn hard work, you give them an allowance to teach them about budgeting, and you help them with their homework to encourage learning. And on the things they can’t do for themselves, you want them to still have every opportunity available to excel. This gets me thinking about a … [Read more...] about Building a Special Gift for Your Young Adult Children

Black Friday Shopping Tips – Preparing to Get the Best Deals!

Can you believe it’s already almost that time of year again? The Christmas Season and all its madness have quickly creept up upon us. And with the Christmas season naturally comes that special occasion of Black Friday where just about everything is on sale. It can be a little bit extreme in some circumstances, but fear not. Here's a few of my Black Friday shopping tips for getting the most out of the occasion! … [Read more...] about Black Friday Shopping Tips – Preparing to Get the Best Deals!

Using a Flexible Spending Account to Get Another Tax Break in Your Paycheck

Recently my wife and I just renewed our medical flexible spending account. As silly as it may sound, we’re pretty happy to see that extra $50 to $100 in our checking account every two weeks. Even though we’ve always used one of these plans through her employer, I’m always surprised when I talk to other couples and find out just how many people DON’T use them. Or even know they exist! Most married couples or families can attest to the fact that there never seems to be any shortage of medical or daycare bills to pay! This is why taking advantage of a flexible spending account can help you and your money design. So read on and find out how an FSA works and how it can put a little extra money in your pockets on these types of … [Read more...] about Using a Flexible Spending Account to Get Another Tax Break in Your Paycheck

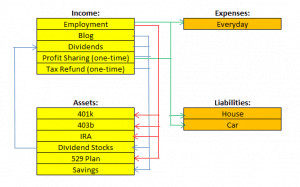

My Cash Flow Plan – September 2012 Update

The end of Summer and back to school time are a period of change for our household finances. This is generally when my wife and I get our raises, her contract gets negotiated, and a lot of other expenses or credits get mixed into our budget. So for us, this is a great time to take another look at our cash flow plan and see if any revisions are necessary. … [Read more...] about My Cash Flow Plan – September 2012 Update

My Alternative Emergency Fund Strategy and How It Works

Lately there have been a number of great posts and strong opinions about having an emergency fund, and I wanted to weigh in with my own opinion and experiences. I have had a long a standing love-hate relationship with emergency funds. Sure, you need them for critical situations! But my problem (and I think this is where a lot of people struggle) is how to save up enough. Depending on which advice you subscribe to, the recommendations can be anything from 3 to 12 months of your gross monthly income. If you’re a typical American household making $60,000 per year, that’s anywhere from $15,000 to $60,000 that we need to have in the bank! Ouch! Is it any wonder we fail at this? … [Read more...] about My Alternative Emergency Fund Strategy and How It Works

Six Beginner Strategies for 529 Savings Plans

The following post is from guest author Ryan Jones. Ryan is a contributory writer associated with Debt Consolidation Care and has written several articles for various financial websites. He holds his expertise in the Debt industry and has made significant contribution through his various articles. A 529 plan is a kind of savings plan which is especially designed so as to encourage savings for the future college or any other mode of higher education. These savings plans have some tax advantages and are also legally known as the “qualified tuition plans”. The 529 savings plans are named so because they follow Section 529 of the Internal Revenue Code and are mainly administered by the different state agencies and the organizations. Six … [Read more...] about Six Beginner Strategies for 529 Savings Plans