It’s All About How You Will Get There:

You might feel like there’s some special secret to early retirement planning. But the truth is that it is not really as difficult as you may think it is. Just Google “early retirement” and you’ll find all kinds of success stories from regular people like you and I who have pulled it off.

For example, MSN Money ran an article not too long ago about the different ways that people figured out to retire in their 50’s, 40’s, and even 30’s. One of them was about a woman named Syd who was able to achieve financial independence at the incredibly young age 44!

You want to know how she did it? By building a nest egg that was 33 times her anticipated annual expenses.

If we just assume her expenses are $60,000 per year gross, that means that all she did was build up a nest egg that was approximately $2,000,000. If we assume her expenses were half of that at $30,000 per year, that means she would have only need about $1,000,000.

Now I’m not making light of anyone saving up $1 or $2 million dollars. Those are both extraordinary amounts of money to say the least! No, the point I’m trying to make is this: She came up with a plan and implemented it. She didn’t just talk about it or wish it would happen. She came up with a goal and MADE it happen.

This is the aha moment that I don’t think a lot of people really understand. A lot of people want to know how to become financially independent and wealthy, but they get stuck on the part about HOW to actually make it happen.

Like many things in life, once someone tells you the steps of what to do, getting there doesn’t seem half as bad. The road to becoming financially independent is absolutely no different.

Steps on How to Become Financially Independent:

Before we get started, I’m going to assume you’ve got down the basics. You probably already:

- Manage your household finances according to some kind of balanced budget

- Have your debt under control to just a few select items (mortgage, car, or student loans)

If you don’t, then you’re not quite ready for the steps in the rest of this post. I’d highly advise that you focus on the basics first before taking on anything more advanced.

If you do, then great. Here’s where we’re going:

Where Does Your Income Come From?

If you’re like most people, then your income comes solely from your employer. If you don’t go to work, then you wouldn’t receive a paycheck and you wouldn’t be able to pay your bills.

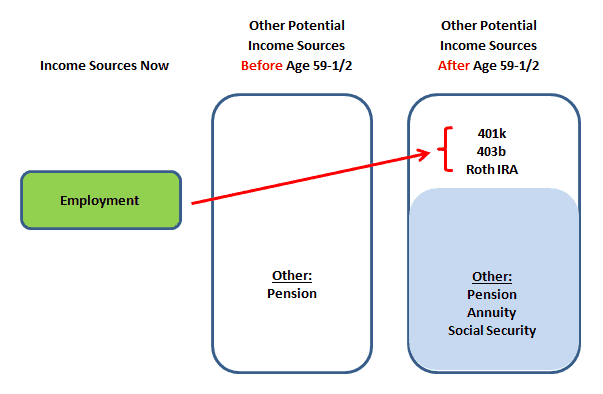

And if you’re like most people, then you’re following conventional financial advice to save for retirement by contributing to some kind of employer and/or individual plan (like a 401k and Roth IRA). Your finances probably look something like this:

What do you notice?

Later on in life when we want our income to come from something other than our employers (because we want to quit our jobs and retire), that alternative income will come from one of two buckets:

- Money you can touch before age 59-1/2 (orange)

- Money you can touch after age 59-1/2 (blue)

From each of those buckets we’ll only want to withdraw 3% or 4% each year for retirement expenses so that the money that’s inside them will last us for the rest of our lives.

And so we have a problem! There is no money in our before age 59-1/2 bucket because we have been contributing it all to our after age 59-1/2 bucket. Unless you’ve got an early pension coming or some other type of special accommodation, your bucket is more than likely empty. Therefore the best we can hope to achieve at this point is retiring after age 59-1/2 because we don’t have any other income sources to rely on other than from our job.

Is that really achieving financial freedom? Perhaps for some people. But you’re pretty bright. We can do better!

Why the distinction at age 59-1/2? Sorry, but that’s the way the law is written for accessing most retirement accounts. To touch your 401k or IRA would require paying a lot of unnecessary taxes and penalties; not to mention reducing the future balance of these accounts. There are some special exceptions such as:

- Leaving work at age 55

- Filing for a 72T

However each of these options carries some special rules. For example the leave work by age 55 rule only works if you leave work during or after you turn 55 years old. So if you leave work in your 40’s, this won’t help you.

Likewise if you use a 72T to legally avoid paying the 10% penalty, the prospect of draining out your after 59-1/2 accounts way ahead of schedule is not going to be your best bet on how to become financially independent and stay that way. In general, there’s got to be a better way.

So then what can we do?

Focusing On the Before Age 59-1/2 Options:

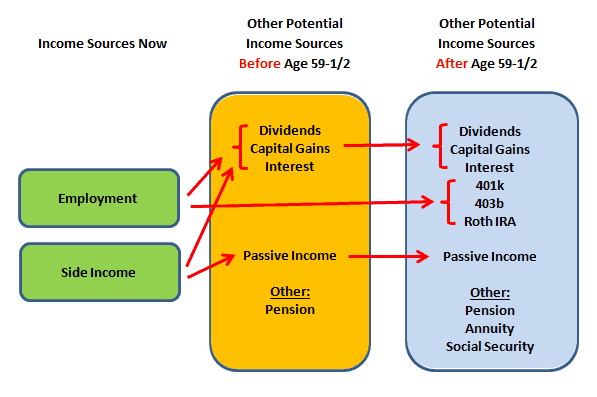

A savvy person would look at this phenomenon and try to even out the scales. They would make sure that both buckets of money were getting filled by diverting a portion of their savings into investments that they could also touch before age 59-1/2.

What kinds of investments should you be looking at? Ones with special reduced tax advantages of course, such as:

- Dividend paying stocks

- The capital gains from other types of stocks

- Other high-interest bearing products.

Here’s what your plan looks like now:

But wait – there’s still a problem! Isn’t your income is “finite”? Don’t you only have so much money to stash away into your savings every month; regardless of which bucket we’re filling? Even if we make sacrifices and save more of our income, at some point we’re not going to be able to save any more …

… or are we?

Accelerating Your Progress with Side Hustles and Passive Income:

Repeat it with me:

Your income is never fixed. It is never finite. You are NOT limited by how much money you make at your job.

Most success stories about how to become financially independent usually involve the person being creative about where their income came from. And they do this by going after any of the thousands of passive income ideas or side hustles that are available for the taking!

If you’re wanting to make more money, than why don’t you:

- Make money blogging? – I do!

- Make money on rental properties.

- Make money freelancing?

- And so many others …

Think of the possibilities and how this could really excite your savings. If you even used one of these strategies and made an extra $1,000 per month, then just think of how much faster you’d build up your buckets!

Now your plan looks like this:

With all these additional savings, you now have almost everything you need to succeed at your financial independence. But why stop now? Why not take it to a whole other level?

Knocking Your Finances Right Out of the Park:

If you really want to seal your fate with becoming financially independent, then the next step is to do what you can to turn your side hustles and passive income into fully automated businesses that generate revenue for you each and every month.

Consider your passive income examples from above and how they can be taken up a notch to really go into over-drive:

- Your network of blogs turns into monthly advertising revenue

- You put together a collection of rental properties or even purchase an apartment building where you can make multiple earnings from each tenant.

- You’re able to take on additional freelancing gigs by hiring additional help through virtual assistants, etc.

By relying on your business ventures to generate revenue, not you can:

- Rely LESS on your savings

- Your savings would have a better chance of sustaining itself and possibly last longer than you originally planned

- By not touching your nest egg, now your wealth will continue to grow with time!

Now your financial plan looks like this:

Now you’re set for life!

Financial Independence Starts When You’re Ready For It:

Remember: This is nothing more than a road map. The hard part will be for you to decide that you’re ready to become financially free and then actually making it happen.

Be patient. Don’t get frustrated. You certainly won’t make this happen overnight or possibly even in 10 years. But little by little you will chip away at a mountain until the prize reveals itself. It all starts with whether or not you’re ready to put the energy into it or not. By changing your mindset from “Can I retire early?” to “I will retire early!” will force you to demand results from yourself. You’ll fuel yourself with what it takes to vigorously face every challenge you find along the way. What are you waiting for?

Related Posts:

- When Can I Retire – It All Depends On How Badly You Want To!

- Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?

- My Money Design for How to Achieve Financial Freedom – November 2012 Update

- Finally a Safe Savings Rate for Your Retirement Formula

Images courtesy of FreeDigitalPhotos.net and MMD

LOVE this, MMD. I think the problem with 99% of people and their money issues is that they spend all of their time wishing and none of their time doing something about it! Even if you don’t reach your optimum goal, by working to do something – anything – positive about your financial situation, you’ll be scores ahead of where you were when you were just wishing.

I completely agree, Laurie. The trick is in the “doing”, not the planning. I don’t want to dismiss the process entirely because I think MMD laid out a great process of how to achieve balance between traditional retirement accounts and those that can be leveraged before age 60. But the tricky part is taking actions to make it happen. No plan or strategy can do the bit that involves actually working toward a goal.

Thanks DBF. I will say that on paper it seems to make sense but it can be more difficult to commit to than people think. My biggest obstacle right now is how to tackle the taxable retirement accounts. Do I divert from my 401k to fund these options? Do I continue my blog efforts with my niche sites to try to build this area up? These are all areas I plan to cover in upcoming posts.

Thanks Laurie. That’s exactly one of the things I was hoping to overcome here. I didn’t want to just keep saying “I’m going to retire early” without a Real plan for how to pull it off. Detailing it out like this helps me to see where I’m weak presently and where I need to go with it.

Thinking of retiring I think is scary for a lot of people right now. A lot of people have problems putting stuff away. Even if you put away a little, then it can help a lot in the end.

Retiring doesn’t have to be scary. If anything I hope this blog teaches people that a regular dude can pull it off and well beyond when he was supposed to. Even though I’ve got a long ways to go, the architecture is here and it would work for a lot of other people too.

I think the first sentence pretty much sums it up. We are usually our own worst enemy. When our house is paid off, I think we’ll have enough rental income to cover expenses. We are aiming for 6 years to have everything paid off. Amazing considering that five years ago I thought I’d have to work until I was 70 or something like that. The key is to not think like the masses. They will let you down every time.

Thanks! I was going for something catchy. 🙂

That’s outstanding that you guys will be retired by 45!!! Good for you. Again, it just goes to show that 1) doing something about it and 2) having a plan really do pay off. I feel bad for people who think they will have to work until they are 70 (or forever). With just a few small moves you can change your future and not make it have to be that way.

This is powerful stuff! You’re absolutely right, people usually get in their own way when it comes to actually making a plan and then carrying it out. It seems simple when you’re just reading about it, but taking action can be difficult! Love the way you broke everything down and illustrated your point. Makes me want to work that much harder on my side/passive income to make early retirement and financial independence a reality for our household!

Thanks Kali. I was hoping to inspire some confidence that this actually could all work. Hopefully this will have more of an impact in a few weeks when I follow up with some numbers to go with it.

I see everyone talking about financial independence and everyone makes it sound like you have to do it before traditional retirement age. Our plan is to make sure we’re financially independent by traditional retirement age and if it happens sooner, which it likely will, that opens up our options even more. As long as we stay on track we can enjoy life along the way 🙂

No early retirement plans, Lance?

Hey MMD,

This is a great kick in the ass for people. If you want to retire at 50 you need to start in your 20s. The problem with a booming stock market is everyone thinks they will achieve early retirement without accounting for bear markets and actually running the number.

That’s exactly why I use numbers in my model that are below status quo. I call it a safety factor, and I’m just trying to hedge the probability that my account will sustain itself even in an unexpected down turn.

I love this post for the fact that it covers how to actually have an early retirement. I am ready to start saving for retirement but I want to invest in options that I can use before age 59 1/2. I know there is still importance in traditional retirement accounts but I don’t want to be limited by those.

Thanks Alexa. Imagine that – a post that actually does give the framework for how to retire early 🙂 I think there are certainly more ways to make money before 59-1/2 that you could use and we didn’t even really cover much. Rental income is probably one of the biggest ones that I hear about other people using. Personally I think you’ve got a good thing going with your internet and freelance writing that you could probably develop into an automated system of revenue.

Very encouraging post. Once I pay off some debt I plan to get back on track to saving and investing.

Tackling debt is the first step. It makes no sense to throw money in the bucket if the water underneath it is leaking out faster than you can fill it.

Great article! Things are of course different here in Romania, but the base concepts are similar. We do tend to get lost in the planning phase, then the dreaming phase and we fail to take action, which is the most important thing to do. Even if we put the worse ahead – not getting to be financially independent, if you take action now you will still do a lot better than most of the people out there.

I’m totally guilty of spending too long at the dreaming phase and not doing enough. It’s great to decide you want to retire; that’s a first step. But like most things actually executing the plan is where you’ll either make it happen or not.

The biggest problem with the path to financial independence is that it looks a lot like work. It’s much easier to just do as your told and then complain when things didn’t work out instead of taking any real responsibility for your life. Increasing your income (and saving it) is really the quickest way to independence.

It’s so much easier to just complain than to actually get something accomplished. Especially when it comes to increasing your income. I totally agree that increasing your income is the fastest way to being independent. More Income – Keeping Your Expenses the same = More Opportunity to Save. But again that is easier said then done. Figuring out how to make an extra $1K, $10K or even $100K per year is quite a task for most people. It takes a lot of ambition; and unfortunately that is not a common trait.

I like the 33x your annual expenses rule as a target to manage toward from a capital base perspective. Personally, I find it a little easier to manage to a passive income dividend number that will rise over time and work toward that as a goal, but 30x your capital base should work as a goal to shoot for and draw down against over time. Interesting, your yahoo finance link also suggested that Jacob from ERE has gone back to work. I could never understand how $7k could be enough for anyone to retire on….no matter how frugal they were..

Great thought provoking post!

I think that for most people though saving $2m+ dollars is unachievable under normal circumstances.

Though by building a property portfolio and using other peoples money to build your wealth it is eminently achievable.

It won’t be too long before the banks forget their excesses of the early 2000s and deposit requirements start lowering again.

Not only will the banks return to their pre Recession highs, but so will investors and their ignorance to risk. I’ll always look at any return above and beyond what an index fund returns with a great deal of skepticism.

Although $2M would create a great deal of retirement income, I also think it is going to be a big stretch for some people to come up with. I sincerely think that we’re entering a phase in society where two working parents is no longer enough and you have to have some kind of side business or passive income streams going.

I agree that planning is actually quite easy, because it’s all theory. Action is much harder because that’s where you put theory to work. Work is inherently difficult, and that’s where most people get hung up.

I put forth a plan at 27 years old and I’ve been working like a madman ever since. It’s not easy working 50+ hours per week at my day job, blogging, managing a six-figure portfolio with 42 positions, budgeting to save over 50% of my net income, etc. But you know what’s even more difficult? Imagining a life where I work until I’m an old man. I’d much rather put in the work today so that the me of tomorrow enjoys all the fruits of that labor.

Best wishes!

You could not have summed it up any better. Working until you are an old man with little time left is something I could not imagine either. Yes it’s hard work now to work and save. But trying to do so in my old age has got to be a 1000x worse. I think this is where people go wrong. They don’t realize how hard this is going to be and the life they could make for themselves later on if they were to plan and save now. Because they don’t have to deal with that reality now, they choose to make poor decisions in the present and live in the moment. It’s sad, but a little bit of foresight could do so much to prevent this.

Great, great post here MMD. You’ve laid it out so nicely. One option that does work well for younger individuals with substantial assets is the SEPP withdrawals from retirement accounts. Otherwise, as you said, it can be tough to have enough in taxable accounts to live.

Thanks Jacob. Substantially Equal Periodic Payments or a 72t was one thing I was considering to help my early retirement efforts. But at the moment the rate of return on the annuity you would receive (1.46% on Bankrate today) would be below 3% inflation. That means you’d be locking into a very sub-par rate which could devastate your potential future returns. If rates ever go back up (which they are supposed to starting in 2014) to something acceptable like 5 or 6%, then perhaps this strategy would be more favorable.

The rate that matters is the mid term Applicable Federal Rate which as of oct 2013 is 1.93%. You can use up to 120% of this when calculating the amortization under the SEPP rules – which means you can use a rate of 2.32%.

Calculating this for a 35 year old gives me a 3.4% withdraw rate on IRA assets, which is pretty much what you would want anyway. I personally think SEPP could be a one stop shop for most people with early retirement income (or at least the majority of it).

Re-reading your comment, i think you misunderstood the SEPP/72t regulations. You don’t trade your money in to create an annuity. You use the current interest rates to calculate what an annuity would give you and that is what you are allowed to withdraw each year penalty free. you keep your money invested in stocks (preferably low cost index funds) that will completely outpace inflation. So as long as your withdraw rate is less then whatever you want to use as your safe withdraw rate (3-4%) then you won’t run out of any money and your IRAs will be larger when you hit 59 1/2 then they were when you started. Right now (using the october AFR rates), for me i can get a 3.4% withdraw rate out of my IRAs if i want to using the amortization method at

35.

If you relied on SEPP alone you would have to accumulate a little more than the 33x annual expense to make it work, but not much more. And the tax breaks you get going into it will more than offset.

My personally early retirement strategy is to max 401k, then max HSA (which is an even better deal then IRA or Roth IRA), then fund IRAs or Roths if not eligible for IRA. For early retirement I am convinced that because of the SEPP rules, a ROTH is not the best way to go. Because if you can live on ~30k a year then a traditional IRA becomes a completely tax free investment both going in and coming out (effectively 20-25% better taxwise then a ROTH, depending on your current tax brackets))

This is an excellent article because it explains the importance of starting and owning your own business that creates monthly cash flow. Once you can get your assets to pay for your expenses and other assets, you will be in a great situation leading up to your retirement.

I have officially bookmarked this post. This is exactly the kind of thing I love to read and need to keep reading every once in a while to stay focused on the goal. I too want to generate passive side income. I too want to buy rental properties.

Most of all, while I think $2 million is a big number, I still want to aim for it. The beauty of that goal is that even if I only make it half way or somewhere in between, I’m still set.

Thanks for the post!

Thanks FI Monkey and welcome to the site. Actually if you liked this post, then you’re in luck – I’m just starting to work on a new eBook that will be somewhat of an expansion of many of the topics and things we talked about here. It should be ready in the next two months or so. I’m sure you’ll enjoy!

MMD,

Definitely looking forward to it!

FM