Now here is where your budget will become far more advanced than everyone else’s:

• Copy your one-month column 12 times so that you cover all 12 months!

Yes, our budget is going to go for the whole year.

What’s Wrong With One-Month Budgets?

Lots:

• They are unrealistic because many of your expenses fluctuate month to month. Averaging your expenses doesn’t work either because it could put you in a position where you think your bills will be lower than they really are; leaving you unprepared to cover the month.

• Some months you get more income than others (most likely from one time sources like income taxes, raises, bonuses, etc.)

• Some months you make some pretty significant purchases (like vacations, Christmas presents, property taxes, back-to-school shopping, etc.)

• A traditional one-month budget doesn’t capture the “three-check” month phenomenon.

What Is Three-Check Month?

Not sure what a “three-check” month is? If you are paid every two weeks, then you know there are 52 weeks in a year which means you get paid 26 times. Divided by 12 months. That means you have two extra paychecks somewhere throughout the year. This results in two months where you get a total of three paychecks. If you don’t believe me, grab a calendar and start counting your paydays. You’ll see that about every six months you’ll get a total of three paychecks in one month.

Although in reality this is nothing special because you were going to get your money no matter what, it is important for someone who is trying to figure out their finances for the whole year. You don’t capture that with a 1-month budget. Working with “Your Paycheck x 24” versus “Your Paycheck x 26” can make a pretty huge difference.

Last Month’s End is This Month’s Beginning

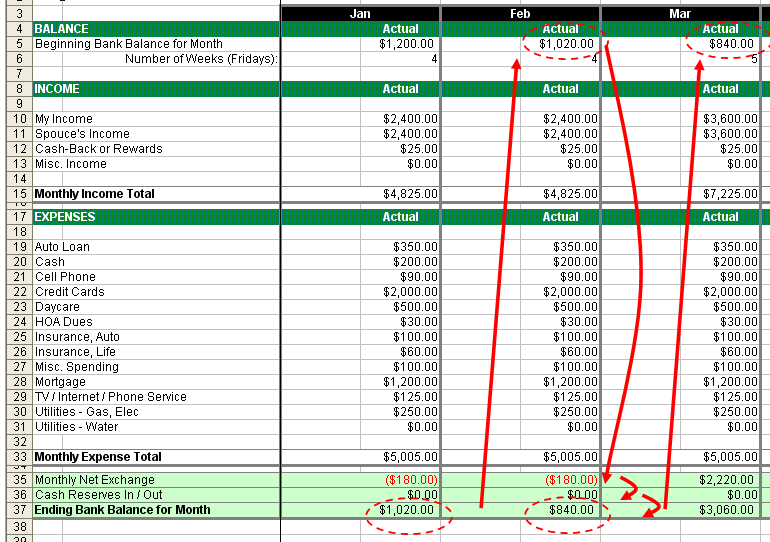

Now that we have 12 months instead of one, we’ve got to connect them all together. This is easy to do because the beginning of each month is really just the end of every month.

• End of January = Beginning of February

Here is how we will set this up:

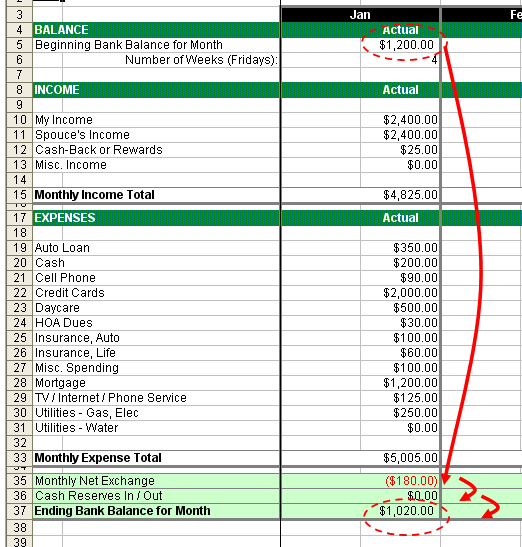

Start with January. Go to a spot above your expenses and write down your beginning bank account balance. This is your starting balance. Add the Monthly Net Exchange (the difference between your total income and total expenses). Now you have your Ending Balance for the month. However, I’m going to add in one more small thing.

Add one more a section under Monthly Net Exchange called “Cash Reserves In / Out”. What is this category? This is where we’ll bring your money in and out. For example, if you had an extra $1000 in your checking account that you wanted to put in your other savings account, it wouldn’t really qualify as an “expense”. Therefore, you’d put it in this row as a “-$1000”. Likewise, if you needed an extra $2000 to cover your expenses and brought it in from another account, this wouldn’t be true “income”. So it would go in this row as “+$2000”.

Putting it all together for January:

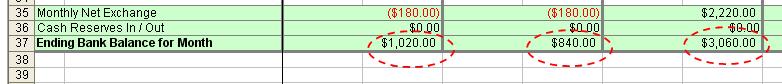

• Starting Balance + Monthly Net Exchange + Cash Reserves In / Out = Ending Balance

Now carry the “Ending Balance” for January over to the “Starting Balance” for February. Apply the same equation to February:

• Starting Balance + Monthly Net Exchange + Cash Reserves In / Out = Ending Balance

Repeat this for the all the months all the way to the end of December.

My Favorite Reason for the 12-Month Budget

Now you can clearly see for the entire 12 months of the year what your bottom line will be for each month. This is the most significant reason why a 12-Month budget blows away the single-month model.

This is a very powerful tool in money management. You now will know if at any time you are going to run into trouble. The entire path for the whole year is now laid out in front of you in black and white. You can also use it to run the numbers for any big “expenses” coming up because you’ll see how it affects your bottom line throughout the year.

In the next section, we’ll do just that. But these will be some of the bigger items that often get overlooked.

Table of Contents:

How to Budget – Step 1 – Where Does All My Money Go?

How to Budget – Step 2 – Income Vs Expense

How to Budget – Step 3 – Take It All The Way to 12 Months

How to Budget – Step 4 – Add In Those Special Times

How to Budget – Step 5 – Apply the Formula for Success

How to Budget – Step 6 – Adding In Your Investment Goals

How to Budget – Step 7 – Sticking to the Plan!

How to Budget – Making It Easy with Mint

How to Budget – Download My Excel Template

Photo Credit: Microsoft Clip Art

Leave a Reply