The end of Summer and back to school time are a period of change for our household finances. This is generally when my wife and I get our raises, her contract gets negotiated, and a lot of other expenses or credits get mixed into our budget. So for us, this is a great time to take another look at our cash flow plan and see if any revisions are necessary. … [Read more...] about My Cash Flow Plan – September 2012 Update

money management

How to Budget – Making It Easy with Mint

At many times throughout this series and especially in Part 2, I told you not to worry just yet about your individual credit card purchases and to treat them all as one “big category”. The reason I did this is because I didn’t want our lesson to get hung up on analyzing credit card purchases to death. You have a lot of other bills besides a credit card, and most of them are fixed each month. As we’ve already shown, knowing what you’re going to spend each month versus what you’re going to take in is extremely helpful in creating a budget. But in no way does this mean that we should ignore your credit card purchases. In fact, hitting the credit card category is the first place I usually look to cut my spending and re-direct the money … [Read more...] about How to Budget – Making It Easy with Mint

How to Budget – Step 7 – Sticking to the Plan!

Time to test the gold in fire. Earlier I told you that a well designed budget would be the key to money management and staying within your means. This is still true. If you’ve created something that is tailored for you, meets your goals, and is comfortable enough for you to live with, then you should do well. All of this would be great if “you” were the only person this budget was for. The problem is that it’s not just “you”. A budget is usually for you, your spouse, and your family. Although that doesn’t sound like a lot, there’s a lot going on inside that group. Just like how a company sets a budget, each department will likely have competing goals and agendas. Similarly, sometimes each person in the family feels differently about … [Read more...] about How to Budget – Step 7 – Sticking to the Plan!

How to Budget – Step 6 – Adding In Your Investment Goals

So after Step 5, does your budget meet our goals? Did you make adjustments and sacrifices? Do you have a positive balance for each month throughout the year? Is less money going out than is coming in? If so, then you are ready to move on to adding in your investment goals. Notice we didn’t do this in any of the previous steps. This is because you have get your business in order before you can start getting advanced with your budget - You have to walk before you can run. After we’re meeting our basic set of goals, let’s start digging a little deeper and adding in our investment goals. … [Read more...] about How to Budget – Step 6 – Adding In Your Investment Goals

How to Budget – Step 5 – Apply the Formula for Success

Every great budget follows one simple formula: • [ Money In > Money Out ] = Good Or in other words … • [ Money In – Money Out > $0 ] = Good Basically you’ve got to have more money “coming in” than “going out”. Any other way is just a recipe for disaster! Don’t under-estimate how incredibly powerful this equation is. Everyday, people make the mistake of buying things on credit that they can’t afford or taking on payments when their income simply can’t sustain it. It’s simple physics that you can never have more going out than coming in. … [Read more...] about How to Budget – Step 5 – Apply the Formula for Success

How to Budget – Step 4 – Add In Those Special Times

As I’ve already expressed, your entire year is not just one month multiplied times 12. Your year is full of different events and one-time events that can greatly influence your money. The next step is to capture all those things in your 12-month snapshot. Here are a few to start with: … [Read more...] about How to Budget – Step 4 – Add In Those Special Times

How to Budget – Step 3 – Take It All The Way to 12 Months

Now here is where your budget will become far more advanced than everyone else’s: • Copy your one-month column 12 times so that you cover all 12 months! Yes, our budget is going to go for the whole year. What’s Wrong With One-Month Budgets? Lots: … [Read more...] about How to Budget – Step 3 – Take It All The Way to 12 Months

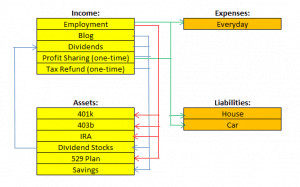

How to Budget – Step 2 – Income Vs Expense

Take that list of your major expenses you created in Step 1 and list them for one month. Create one column and put your rows of expenses near the bottom half of the page. Income Now let’s go up to the top of the column. This is where we will list your income for the month. For most of us, that will simply be your paychecks and your spouse’s paychecks. Congratulations if you have other significant forms of income. Some examples might be: … [Read more...] about How to Budget – Step 2 – Income Vs Expense