You have a lot of other bills besides a credit card, and most of them are fixed each month. As we’ve already shown, knowing what you’re going to spend each month versus what you’re going to take in is extremely helpful in creating a budget.

But in no way does this mean that we should ignore your credit card purchases. In fact, hitting the credit card category is the first place I usually look to cut my spending and re-direct the money towards one of my new financial goals.

Avoiding the Credit Card Dissection Funk

One of the biggest pitfalls of creating a budget is that you want to go crazy analyzing everything – especially your credit card purchases. It’s okay – I’ve done it too. Here is what usually happens:

• You try to download your activity – even if it means taking a lot of time cutting and pasting from the website.

• You try to categorize each purchase in an effort to see where you’re spending the most – and struggle when some purchases fit into more than one category.

• You try to merge several of your accounts together into one list for ease of viewing – which takes a lot of time to compile.

• You forget to add your activity for the week to your list. Now you’re behind!

• By the time you put all this effort in, there is no change next month and you spend exactly the same amount. You’re now frustrated and just give up.

Using Mint to Tackle the Credit Card Monster

Wouldn’t it be great if there was a way to download the activity for all your credit cards, categorize each one, and have a weekly email sent to you so you know how much you’ve spent? This is what Mint does.

Mint is a FREE financial software service that helps you with your budget, debts, investments, goals, etc. Think of software packages like Quicken – but completely free!

The way it works is that you go to their website and create an account. Next, you add in your credit card and bank information. Don’t worry! They use the same encryption that banks use. Plus, they have other safety protocols in place like not asking for any personally identifiable information.

With your credit card and bank info, they use computer programs to automatically log-in to your account and download your activity. The activity is then collected, analyzed, and sent straight to you for report – served on a silver platter. You don’t have to do any work.

I know it sounds crazy to trust them with all your bank info, but I haven’t had a problem ever with this service in the +5 years I’ve been using it.

Spend Your Time On What Matters

So how does Mint benefit you?

• Your account can be set to update as often as you’d like. I have mine email me once a week.

• The email contains a quick summary of what I’ve spent so far (both as a list and graph). If I’m getting too close to my budgeted amount, I then know if I should take it easy for the rest of the month.

• The email also has notifications about what bills are upcoming. This is helpful so I don’t forget to pay them.

• If I truly want to, I can log in and see specifically what purchases have been made (without logging into each and every credit card account).

• I spend my time doing more beneficial activities.

Other Benefits of Mint

I probably use about 10% of what Mint has to offer. They have a lot of other useful tools:

• You can create an entire budget automatically Mint uses your credit card and bank account info to keep updated – you just set the goals.

• A “Ways to Save” section that gives you advice about all things financial like your mortgage, insurance, and investments.

• A “Goal Setting” section. For example: Decide how much you need to save for retirement and Mint will keep you posted on your progress.

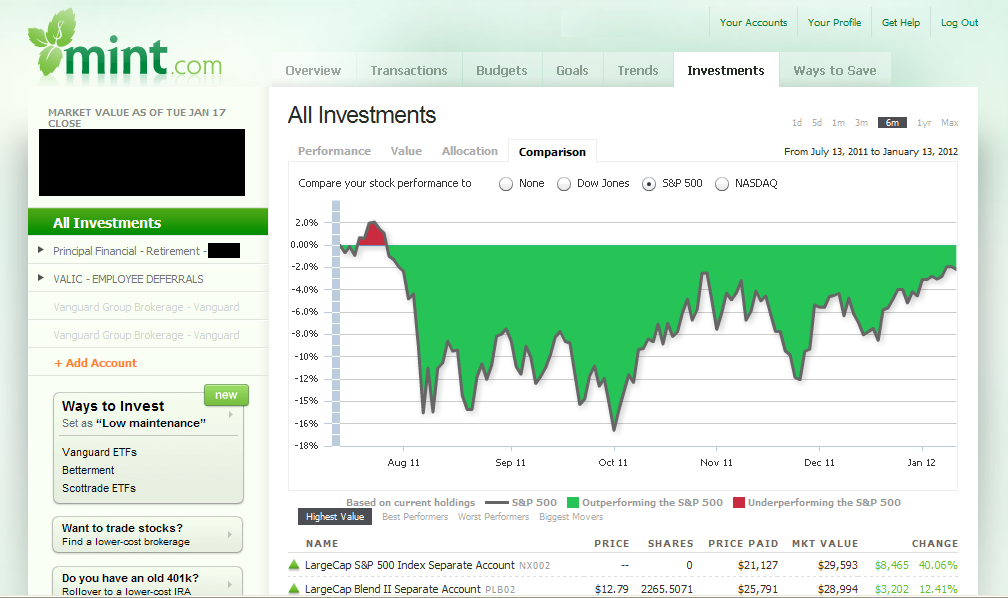

• Stock market / mutual fund activity and how your individual funds are performing

• Tax advice and software

• A whole bunch of links for useful products like high-interest savings accounts, CD’s, credit history checking, mortgage rates, insurance quotes, brokerage services, and more.

Table of Contents:

How to Budget – Step 1 – Where Does All My Money Go?

How to Budget – Step 2 – Income Vs Expense

How to Budget – Step 3 – Take It All The Way to 12 Months

How to Budget – Step 4 – Add In Those Special Times

How to Budget – Step 5 – Apply the Formula for Success

How to Budget – Step 6 – Adding In Your Investment Goals

How to Budget – Step 7 – Sticking to the Plan!

How to Budget – Making It Easy with Mint

How to Budget – Download My Excel Template

Photo Credit: Microsoft Clip Art

I have never gotten started with Mint because the idea of a software tool having access to your counts does make me feel a bit iffy. It looks like a very powerful tool, though, and I can see why they get talked about so much! 🙂

The first time I signed up for Mint and read the instructions about entering all your usernames and passwords, I was like “is this a joke?!” But then I started looking into their reputation and finally made the leap. It’s been pretty helpful ever since. No more checking up on when my credit cards are due, how much I owe, etc. It all gets emailed to me every Friday.

I also added my retirement accounts to the same update. Before, I was pretty lazy about checking in on them to see how they were doing. Now I can see the overall balance each week.