If so, then you are ready to move on to adding in your investment goals. Notice we didn’t do this in any of the previous steps. This is because you have get your business in order before you can start getting advanced with your budget – You have to walk before you can run. After we’re meeting our basic set of goals, let’s start digging a little deeper and adding in our investment goals.

Investment Goals

What are your investment goals? Do you have:

• A Roth or Traditional IRA?

• A 529 college plan for your kids?

• Could you live without a little less of your paycheck so that more money could be diverted into your 401k or 403b?

These are all things you should strongly consider as part of your money management and work into your budget.

Don’t feel like you need to do all of these things over-night. Each year I encourage you to pick at least one of them and work them into your budget. Again, sacrifices or belt-tightening will be worth it when you meet your investment goals.

Tip – The best time to add a new investment goal to your budget is when you (or your spouse) get’s a raise. You were doing fine without the money before and you’ll continue to do so. Divert the extra money to one of your investment goals.

Tip – Each time you add in an investment goal, treat it like an “Expense”. You literally have to pretend like it’s a bill that is due. This does two things:

• It gives the goal the attention and priority it needs.

• It “tricks” you into living on less of your income. As you “pay” into your investment goal, it will simply roll into your Total Expenses that you mentally prepare yourself to meet each month.

Pull in Case of Emergency

One final benefit of working investment goals into your budget is that you are automatically creating a “cushion” in case of emergency. For example, if you were to suddenly lose your job or if there was a serious emergency, you could simply stop putting money into your Roth IRA or 529 plan. By doing so, you could immediately eliminate several hundreds of dollars of “expenses” right away. Again, I STRESS serious emergency!

Bonus – The 12 Month Budget Deluxe!

We’ve really done a lot with your budget. But there is still one more thing we can do to really make it useful (and cool).

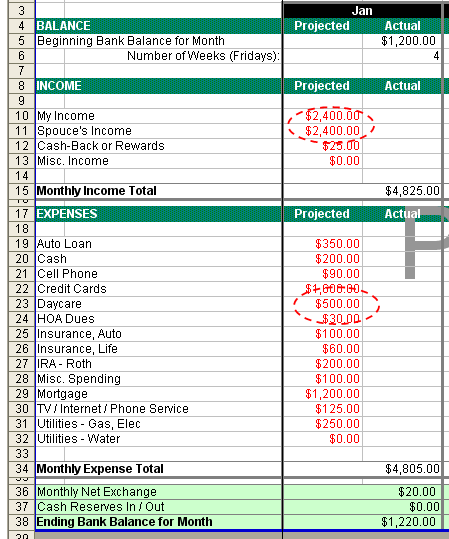

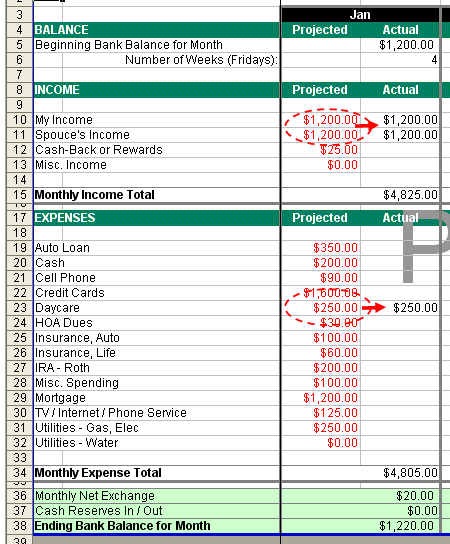

We’re going to break up each column into two – a “Projected” and “Actual”. Yes, one is for estimates and the other is for what really happens. Note that the “Total” for the Income and Expenses is really just the total of the Projected plus the Actual. Thus, the month doesn’t really change – it just divides it up into what has and has not happened.

Why are we doing this? Because how do you tell apart the things that have already happened versus the things that haven’t?

For example: In the “Daycare” row, what if you make payments each week? Wouldn’t it be helpful to put in what you’ve spent so far and leave what you still have to spend in a different spot? The same goes for your paychecks and other expenses.

Instructions:

1. After reformatting your budget (or downloading my free version), start the year listing all your Income and Expenses in the “Projected” column.

2. As your budget progresses along, start entering in the things that actually happen in the “Actual” column.

3. Remember that for each item in No. 2, delete that exact value from your “Projected” column. That way you don’t “double-count” that expense or income.

It may seem silly now but as you move along with your budget you’ll be surprised at how helpful this is. Plus: Seeing your estimates on the left also will serve as a red flag that a bill needs to be paid or that attention needs to be given to a particular category.

Now comes the part where the plan becomes action.

Table of Contents:

How to Budget – Step 1 – Where Does All My Money Go?

How to Budget – Step 2 – Income Vs Expense

How to Budget – Step 3 – Take It All The Way to 12 Months

How to Budget – Step 4 – Add In Those Special Times

How to Budget – Step 5 – Apply the Formula for Success

How to Budget – Step 6 – Adding In Your Investment Goals

How to Budget – Step 7 – Sticking to the Plan!

How to Budget – Making It Easy with Mint

How to Budget – Download My Excel Template

Photo Credit: Microsoft Clip Art

Hi,

My name is Steven Robert. I am a financial writer and I want to write a guest post for your site : https://www.mymoneydesign.com on finance topic. I have contributed many articles for numerous financial websites. My article will be more than 500 words, informative, unique and it will only publish in your site. In returns of I am ready to post your article in my site or I can add your link.

I will send my article an an attachment .txt file in HTML format so you can just copy and paste it.

Hope you would like my proposal and will give me an opportunity.

May I send my Article?

@ Steven, Yes, I’d be honored to have a guest post! Please email it to me at [email protected]. From there we can work out the details. Thank you.