Ironically, the answer you’re looking for might just be behind those large retail giants where we spend the most amount of money each month. While some people may scuff at the likes of Walmart or Apple with their anti-consumerism attitudes, I ask you to take a second look. Beyond the products they sell to us, what is about them that would cause us to stop and focus on them?

The answer:

They know something about how to manage their money!

How Thinking Like a CFO Will Teach You How to Manage Money Better:

Pretend for a moment that your household is a Fortune 500 company. Would your company thrive, or would it fail from the way you run your finances? Why?

Do companies that run paycheck to paycheck last very long? How about ones that get themselves into excessive debt?

Like a big time company, your goals are 1) to make money, 2) to keep your money, and 3) to use your money for growth in the future.

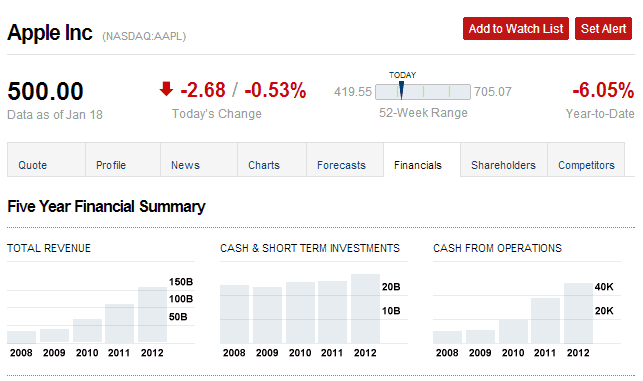

Take Apple for example. One of the reasons they did so well during 2011 to 2012 was because they had comparatively more cash on hand than any other company out there. This was a strong and extreme change from almost a decade ago when the company was nearly bankrupt. How much cash on hand would YOUR company have?

So while you may not be selling iPad’s, you do sell something even more valuable: Your time. And because I consider this to be so valuable, I want you to study the ways of the giants and learn how to manage money better.

So from this point forward, you will no longer think of your household finances the way that everyone else does. Instead, you are now the chief financial officer (CFO) of a big corporation: YOUR house!

The goal of your household corporation is to reach financial freedom as soon as possible! Each of us will have a different definition as to what that statement means and what goals it will include. But it is my belief that overall, we’d all like to see our finances reach a place where we’re no longer worried about them.

So now that you’re a big time CFO, let’s get to work! Here’s how doing so is going to help us learn how to manage money better:

Setting the Direction:

Your first order of business as the household CFO is to set the direction for the finances. This should be a decision that everyone in your company (i.e. your family) can agree with. What kind of specific goals does your company want to hit?

- Paying off your debt?

- Making an upcoming large purchase (i.e. car, new roof)?

- Saving for or paying off a mortgage?

- Saving for college?

- Early retirement?

- A special gift?

- Traveling for a year abroad?

We all have a general idea that we want to be rich, but part of learning how to manage money better is knowing specifically which direction we want to go and why. Once we have these destinations in mind, we can then turn our attention towards the more short term goals.

Milestones:

Call them milestones. Call them short term or long term goals. The idea is the same: The CFO needs to layout a very specific path with measurable accomplishments.

For example, if you plan to retire early, then you might set a milestone to be maxing out your 401k and IRA by the end of the year. The plan would then include some steps on how to get there. This might include things like saving more of your paycheck, cutting back on one expense to free up more money that can be saved, or maybe even getting some help from a company to handle the investing for you.

Keep in mind that plans are never set in stone. Sometimes our goals change as our lives change. Sometimes we find out that the steps we thought we needed to take are wrong, and we need a different set of steps. Big companies experience the same sort of thing. Remember not to get hung up on getting it right the first time. The important thing is to TRY SOMETHING and then adjust the course as you go.

Annual Budget:

Preparing an annual budget is a small but yet important difference in managing money better for two very significant reasons:

First of all, I can’t think of a well run company that DOESN’T use some sort of budget. Can you? How long do you think you’d be able to stay in business if you didn’t keep track of what money is going in versus how much money is going out? Why in the world would you run your house any different?

The second is the way in which the annual budget is prepared. Common financial advice tells you to make a budget for the month and then live by it. But this monthly setup is flawed.

- You’ll have major onetime expenses throughout the year that don’t get reflected in the monthly one. Maybe in the Summer you take a big family vacation. And how about at the end of the year when you spend money for Christmas?

- You might be expecting some significant one time income. How about an income tax refund?

- If you get paid every two weeks, you’ll have 2 extra paychecks throughout the year that you need to account for

- You might be okay for one month, but wouldn’t it be more powerful to know how your finances are going to do ALL YEAR?

Large companies also generally prepare their budgets across a whole year, for the same reason. Usually management wants some level of confidence that the fiscal year is going to be a success. That’s why they ask (i.e. force) management to project things like revenue, expenses, personnel, capital purchases, etc.

Don’t you want complete confidence for the year too? When you prepare your budget for the whole year, you can capture all the incoming and outgoing finances, and then see if at any point throughout the year if you will be in trouble.

Guess what? As the CFO of the house, if at any time this budget doesn’t equal out to green (positive), that budget needs revision! No matter if it’s your house or company, there is no way it can continue to go on losing money for very long.

You don’t have to go far to get a great annual budget template. You can download my free Excel spreadsheet here.

Innovation:

One of the greatest tips I think we can take from large companies in terms of how to manage money better is the characteristic of innovation.

No successful company has ever stayed the same for very long. While other companies fail, they ask what they could be doing differently so that they don’t make the same mistakes. They always challenge themselves to get better and out-do their accomplishments year after year. McDonalds always tries to get you through the drive-through faster. Apple keeps coming out with cooler and cooler gadgets.

As the household CFO, you need to do the same for your company. Ask questions like:

- Could you spend less money on things you already buy already? For example could you use a great service like Groupon Coupons to get free coupons from popular destinations like Sears or Walgreens?

- Could you be making more money at your job?

- Could we be making extra money on the side from passive income streams?

- Could we be saving more money if we did or didn’t do certain things?

- How can we accelerate our savings goals beyond what we’re doing now? Would we do better to keep our money in an online savings fund or investment portfolio?

The CFO may not have all the answers to these questions, but they SHOULD at a minimum be the one to pose them to the group for discussion.

Delegation and Respect:

CFO’s can’t do everything by themselves. They need the help of everyone in the company to make sure things stay on the path forward.

This means they need to have a degree of mutual respect with everyone they work with. Their goal is to put the company on a path towards financial growth and probability. So in keeping with this common goal, everyone should work cooperatively with the CFO to make this happen.

So to take a lesson in managing your money better, get everyone in your household on the same level. Put them in charge of certain aspects of the finances, and make them responsible for their part of reaching the goals. For example, someone may be in charge of picking the retirement funds while someone else may be in charge of making sure the bills get paid on time.

Having everyone work together is a situation where the value created is greater than the sum of the parts.

Don’t Forget – Learn From the Best:

Don’t hate the big retail stores. Learn from their success. Grow your own company – your household finances! There’s a lot that can be said from their examples that teach us about how to manage money better. You don’t need a staff of employees or fancy degree. You just need to have the hunger to make it work and the wherewithal to lead your family to success.

Readers – What have you learned from big companies that helps you manage money better?

Image courtesy of FreeDigitalPhotos.net

I used to actually be a CFO. And, just like a true corporate titan… a let my wife run our finances! 🙂 Paying bills on time is easy to overlook when “big picture” stuff dominates your thinking. My wife just ran our finances so much better than I did.

Behind every great man is a great woman – as the old saying goes. You are very wise to let your wife run the finances if you recognize that she can do a better job. They are really good at keeping us on track, aren’t they?

Great crossover from macro finance to micro finance. Important also to consider the limitations of this approach; great post!

Interesting point. What limitations do you see?

I love this post. I feel like you are challenging me lol Running a household like you would run a business is a great idea. If I could keep this in mind all the time I would be doing pretty darn good!

If that’s how the message came across, then you definitely read this post correctly right: I am challenging the reader. Not just to think differently, but to get better results.

Funny that you should post something like this now. In a book that I’m reading the author explains that in business we don’t worry about wants. Its about keeping expenses low. In our everyday budgets we have so many wants that it can distract us from our goals.

That’s right, and usually those goals pertain to acquiring assets and resources that will grow the top line. There are a lot of great parallels between the home and business when it comes to best practices, but its a shame that more people don’t take advantage of them.

By the way, what is the name of that book?

The minor act of thinking about the problem differently can change things so much. Hopefully that will finally answer the question I have of “why do otherwise smart people do such stupid things?” We could probably explain it through some psycho-analytical reasoning about habits and childhood relating to the way your father approached finances. However, it seems much more efficient just to find an answer to the problem.

Thanks Alice.

For years, my thoughts on my business and my personal finances were complete 180’s from each other. While my business always did well, my home finances were not great. I think I’m on the same page now, and it makes a huge difference.

Exactly my point! Most of us would never let our responsibilities at work slack, especially when it came to matters of money. So why don’t we do the same in our own homes? It is my belief that by just simply being balanced and not spending more than we take in, a lot of households could really be doing a lot better than they are now.

Everything else aside, I always though about keeping my household paper work like a business, but I still haven’t. Lease papers, receipts, warranty papers, and etc. are all over the place. I need to really get this started and move on to another area. Thank you.

Just like a business, you could delegate it to someone else in the office (i.e. the house). 🙂

We just started charting our assets and hope to put together a projection of our retirement fund expectations.

It really pays to have goals, to be well read in finance.

Every year we have a major goal as well as several minor ones.

Last year we paid off the house, 26 years early on our mortgage.

This year we plan on cash savings of $30k, while putting two kids through college.

A few years ago, we took the family to Europe for six weeks. (That was a huge expense and dream).

I know that we have been hugely blessed and try earnestly to be a blessing to others. The first things we do is tithe. That has made all the difference.

Nice work! It sounds to me like you guys are on the right track. I fully believe that setting a long term goal as well as several smaller short term ones will light the path to achievement. And a trip to Europe doesn’t sound too bad either! 🙂