Have you ever thought to yourself: What’s the least amount or minimum retirement savings I could get away with?

Don’t be bashful about asking it. It’s a perfectly valid question to consider; especially when you think how little retirement savings most people actually have.

(In case you’re wondering, its $107,000 for Americans between the ages of 55 and 64 according to data from the Government Accountability Office (GAO).)

While the major media outlets would have you believe that you need somewhere between $2 and $3 million dollars, you might be pleasantly surprised to learn that you could possibly become financially independent and consider leaving full-time employment for a whole lot less.

In fact, if there’s one thing I’ve learned from reading the success stories of so many real-life early retirees (some of which you’ll meet in a minute), it’s NOT that you need millions of dollars, insider investment knowledge, or even a big-time high-paying job.

The real trick achieving financial freedom is to simply work on reducing your everyday living expenses.

In this post, I’m going to show you why minimizing your lifestyle costs could be the key to retiring on much, much less retirement savings than you think. You’ll also get some practical advice for how to reduce a few select expense categories, examining a few areas where you could be potentially saving more, and then look at how much that could possibly shave off of your nest egg target.

Disclaimer: Some of the links in this post to useful tools we recommend are affiliate partners. This is at no additional cost or risk to you. To learn more, check out our Privacy Policy

How to Calculate the Minimum Retirement Savings You Need

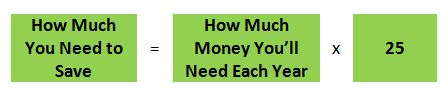

In its simplest form, figuring out how much money you’ll need in order to retire can be reduced down to the following equation:

Your living expenses.

Every solid retirement plan starts with asking the individual: When I retire and no longer have employment income, how much money will I actually need to live on?

Close your eyes for a second and imagine what that life will be like. At the core, there will be your basic expenses for things like:

- Housing

- Driving

- Eating

- Medical coverage

- Utilities

- Taxes

- Etc.

But on top of that there will also be “other” flexible expenses for things like:

- Hobbies

- Entertainment

- Travel

- Other ways you like to have fun. (… After all, what’s the purpose of retirement if you’re not going to enjoy yourself, right?)

From just one brief look at this equation, we can quickly see: The size of the nest egg you need to save is in direct relation to your living expenses. Therefore, if your goal is to minimize the size of your nest egg, then a good strategy would be to start by simply lowering your living expenses.

For example: Let’s say you believe your living expenses will be $60,000 per year. Using our equation above, you’ll need to save a nest egg of $60,000 x 25 = $1.5 million. But if you can change your habits and live comfortably on $50,000 per year, then you’d only need to save up a nest egg of $1.25 million.

Not sure if that’s really true? In just a minute, I will show you a few examples of some people who have leveraged this living expense – nest egg mathematical relationship to make their financial independence a reality.

25X (a.k.a. the safe withdrawal rate you choose).

In case you’ve never heard this one before, an easy way to calculate your retirement savings nest egg target is to take your living expenses and simply multiply it by 25. You can read all about why that is at this article here.

The 25X comes from something called the 4 Percent Rule safe withdrawal rate (SWR). This is a widely accepted rule of thumb in financial planning that says you should be able to safely withdraw 4 percent from your nest egg safely every year to cover your living expenses for at least 30 years.

(By the way, if you’re wondering how the number 25 and 4 percent are related, multiplying a number by 25 and dividing it by 4 percent (0.04) is mathematically the same thing.)

On a technical note, there are dozens of factors that could either increase or decrease the safe withdrawal rate you choose. For example,

- If you plan to retire very young, you may want to drop your safe withdrawal rate down from 4.0% to 3.5% (or 28.6X). Here is some evidence why.

- Or adversely, if you retire when the investment market is under-valued, you might be able to get away with a higher safe withdrawal rate of 4.5% (or 22.2X).

If you really want to know more about the 4 Percent Rule and how to interpret it, feel free to check out this mega-article I wrote here for all the details. For the sake of simplicity, throughout the rest of this article we’ll use the 25X or 4 percent safe withdrawal rate in our examples.

Does This Equation Actually Work – For Real?

Yes! There are lots of real-life examples of early retirees who have reduced their living expenses and been able to successfully retire early using this simple strategy. Here are a few notable ones:

- Jacob Fisker from Early Retirement Extreme (both the blog and the book) was able to retire in his early 30’s after get his living expenses down to just approximately $7,000 per year. This allowed him to save nearly 75% of his income and accomplish his goal in just 5 years. If we use the 4 Percent Rule to estimate how much his nest egg was at the time, we can conclude that with such low living expenses he only needed approximately $200,000.

- Mr Money Mustache (aka Pete Adeney) famously preaches frugality and claims to only live off of $24,000 per year. This allowed him to retire by age 30 after only saving up $600,000 (25 x $24,000).

- One of my favorite early retirement stories comes from the book “How to Retire Early” by Robert and Robin Charlton. It tells the tale of exactly how (in great detail) the two of them were able to go from almost no savings at all to a nest egg of $1 million in just 15 years by the age of 43! Again, using the 4 Percent Rule, this provides them with roughly $40,000 per year to travel the world and live freely.

- After a bad day at work, Carl (age 38) made a vow with his wife Mindy that the two of them would retire in 1500 Days (or 5 years). Hence, they became Mr and Mrs 1500 Days from the blog 1500 Days. The goal was to take their current savings and quickly ramp it up to $1 million target. This was based on an estimation that they would need to cover $30,000 per year in living expenses plus a little extra for their children’s college. Through frugality, a lot of saving, and down-sizing their house, they were actually able to accomplish their goal just 3 years later.

- Justin McCurry from Root of Good retired at age 33 after he and his wife reached a savings of just over $1 million. They continue to only spend between $32,000 to $40,000 per year (a little less than 4 percent).

What do we learn from these success stories?

In each of the examples we gave above, do you notice a trend?

[Minimal expenses]

= [Saving a lot more]

= [Accelerated early retirement timeline!]

In other words, focusing on reducing your living expenses is almost like a double-ended benefit to helping you to reach financial freedom.

On the far end of the plan, you’re reducing your lifestyle costs which leads to lower needed costs in the future and a lower nest egg total.

But in the present, it also gives the ability to save substantially more of your income each month. You’ll be able to go beyond your peers who save only 10% and work your way up to a more impressive 25% or even 50% savings rate. And as you do, your nest egg will build up more rapidly helping you to reach financial freedom even sooner than might have originally planned.

One good thing really does lead to another!

How to Reduce Your Living Expenses

Okay! So if reducing your living expenses really is the key, the next question we should be asking ourselves is:

- How low can we go? What kinds of things could we be doing right now to get our expenses as low as possible so that we would not need so much money for retirement?

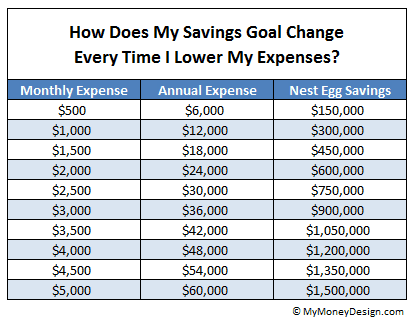

Keep in mind that even amounts as low as $500-$1000 per month could translate into hundreds of thousands of dollars less that you need. Here’s a chart you can use to follow:

Therefore, to figure out where we can squeeze, let’s run through some of the typical expense categories and see where we can optimize and improve.

Mortgage:

Killing off your mortgage is one of the most sought-after goals you can achieve in the personal finance community.

Why? Because as you can see from the chart above, eliminating an expense of this size works out to hundreds of thousands of dollars you don’t need to save in the future! Consider if your mortgage is $1,000 per month. By paying off your house and not having this expense any longer, that works out to $300,000 less you need in your nest egg. Not to mention the fact that you can now declare freedom from the mortgage lender and the house is finally all yours!

So what’s the best way to pay down your mortgage?

- Send in an extra $100 or $200 per month on top of your principal. Just that little bit extra can knock 5 to 10 years off the typical U.S. mortgage. Use this calculator to find out exactly how many years it could knock off of yours.

- Refinance your house from a 30 year to 15 year fixed mortgage. You’ll save a TON in interest and greatly accelerate your payment timeline. I refinanced after one year and saved almost $100 per month.

- Fight your property taxes. If they start to creep beyond a reasonable level, challenge them! I did and WON!

- Consider moving to a more affordable house. Tired of cleaning your 2,500 square foot interior every week? Had enough of mowing your 1 acre lawn? Though it might seem kinda exciting at first to get a big house or car, after a while, it just becomes more work to keep up with – plain and simple! So why not consider down-sizing to something more comfortable with less maintenance? Not only will this likely cut down your mortgage costs, but it will also reduce your household expenses (as well as your time).

- Move to some place with lower property costs. I live two county’s away from an area where a house the size of mine could easily cost double what I’m paying right now. Hence why I don’t live there!

Of course keep in mind that your housing costs never truly go down to zero. Even if you do accomplish that wonderful goal of paying off your mortgage, you still have to pay your property taxes and home owners insurance every year.

Note: Not sure if you should pay off your mortgage early or invest the money instead? Check out this article I wrote here.

Vehicles:

Like them or not, vehicles are one of the fastest depreciating things we own. According to The Nest, over the first three years of car ownership, a new car will typically depreciate about 45 percent. Ouch!

The only real way to win financially when it comes to cars is to:

- Buy them with cash (or at least finance a portion of them for as little as possible)

- If financed, pay them off quickly

- Don’t lease

- Keep up on the maintenance so that they don’t develop bigger, more costly problems

- Shop around every two years or so for the best and most affordable auto insurance.

Travel:

Our family loves to travel! And we used to pay between $4,000 – $5,000 to do so … but not anymore! Since 2016, I entered into the world of travel hacking where I now use credit card rewards points to pay for almost every aspect of our travel.

I absolutely can not believe how many great deals are out there for regular people like you and me to take advantage of! Here’s just a taste of the trips we’ve taken and how much we’ve saved:

- Orlando, Florida – saved nearly $2,500

- Los Cabos, Mexico – saved nearly $2,000

- Maui, Hawaii – saved over $5,000

And we’re no where close to being done. My gears are always turning for the next big trip!

Medical Insurance:

This is the tricky one. It seems like every time you turn on the news there is always some new debate about how and when medical care coverage will change.

Regardless, there will most likely be some cost associated with this topic. But remember: If you’re 65 or older, you can file for Medicare. If you’re younger than that, then check out this page for ideas on where to find good coverage.

Power / Heating:

Keeping an eye on the thermostat and not running the heat or air conditioner all the time are your best bets here. If you don’t already have one, install a programmable thermostat and set it so that you don’t use heating or cooling while you’re away at work or school. You can also lower the temperature a few degrees at night while you’re sleeping.

In addition, don’t use electric space heaters or gas fireplaces excessively since they will also drive up your power consumption costs.

Side note: Moving to a smaller house is one sure way to reduce your energy costs!

Phones:

An inexpensive family cell phone plan can be purchased these days for less than $100 per month. It can be even lower than that if you don’t upgrade your phone every time a new one comes out.

If you really want to get frugal, FaceTime Video / Audio and other WiFi calling options are free over your Internet connection.

Oh, and one more little money saving nugget of advice – feel free to skip the insurance plan.

TV / Internet:

Traditional cable is a thing of the past …

Ditch it and step into the future with the world of streaming TV instead.

What’s that? It’s where you use your internet connection to watch local and regular TV channels as well as movies and other premium shows (through Netflix, Amazon Prime, YouTube, or any number of cool apps).

We made the switch and have been saving a TON of money on cable ever since! Plus, we have more options to choose from!

What do you need to get started? For starters, a TV and a reliable Internet connection. If your TV is already Wi-Fi ready, then lots of these apps will already be available to you. But there are also any number of inexpensive streaming devices that can help you to do the job. Click here to read more about it.

Food:

When it comes to groceries, the key here is planning. If you throw things away every week, then something is wrong. Sit down and make a list of all the meals you’re going to make. Then go out and buy only those items that you need.

As for eating out, keep it to once per week. Set a limit for yourself; such as no more than $10-15 per person. Order a sandwich instead of an entree, and water instead of a soft-drink. Also consider foods that you can share, such as pizza or a family size salad!

Entertainment:

Being entertained doesn’t always have to mean spending money. Some of my favorite times are when we go for walks, play a sport with the kids, exercise, or do a local activity within our community.

Are There Other Ways to Retire on Even Less Savings?

Yes!

So far we’ve only assumed that all of your retirement income is coming straight from your nest egg. But that’s not always necessarily the case.

In reality, your retirement income could come from any variety of sources. As long as its reliable, then it means you could shave your nest egg down even further.

Example:

Let’s say you believe your retirement income will be $40,000 per year. But you’ve got other sources of income that will provide a steady, reliable $10,000 per year. Now your nest egg target only needs to be $30,000 x 25 = $750,000.

Great! So now we have another variable we can add to our equation that will reduce our retirement savings down even further.

But what might these other source of income be?

Part-Time Employment:

Just because you’re “retired” doesn’t mean you have to sit on your butt and never work again.

Perhaps you worked in an office most of your career, but you really loved playing music. Maybe now in retirement you could teach music on the side!

That’s the beauty of retirement. You CAN work if you want to – especially doing something in a field that you really enjoy. And if that part-time work produces even just a little bit of extra income, that can have a really powerful reduction on your retirement savings needs.

Social Security:

Are you expecting to receive Social Security right around the time you plan to retire? If so, let’s say that you plan to need $4,000 per month for living expenses and $1,000 per month will come from Social Security. In that case, your retirement savings only needs to produce $4,000 – $1,000 = $3,000 each month (or $36,000 per year). That drops our retirement savings target down from $120,000 to $900,000; a reduction of $300,000!

Other ways to make money on the side:

Additional retirement income could come from any number of legitimate sources. Another common example are folks who own rental properties. Again: $500 in net rental income could equal out to $150,000 LESS that you need to save for retirement!

We’ve got a ton of other cool ways you could be earning money on the side on this page here. Check them out for yourself and find one that suits you the best!

Build Your Own Retirement Savings Plan

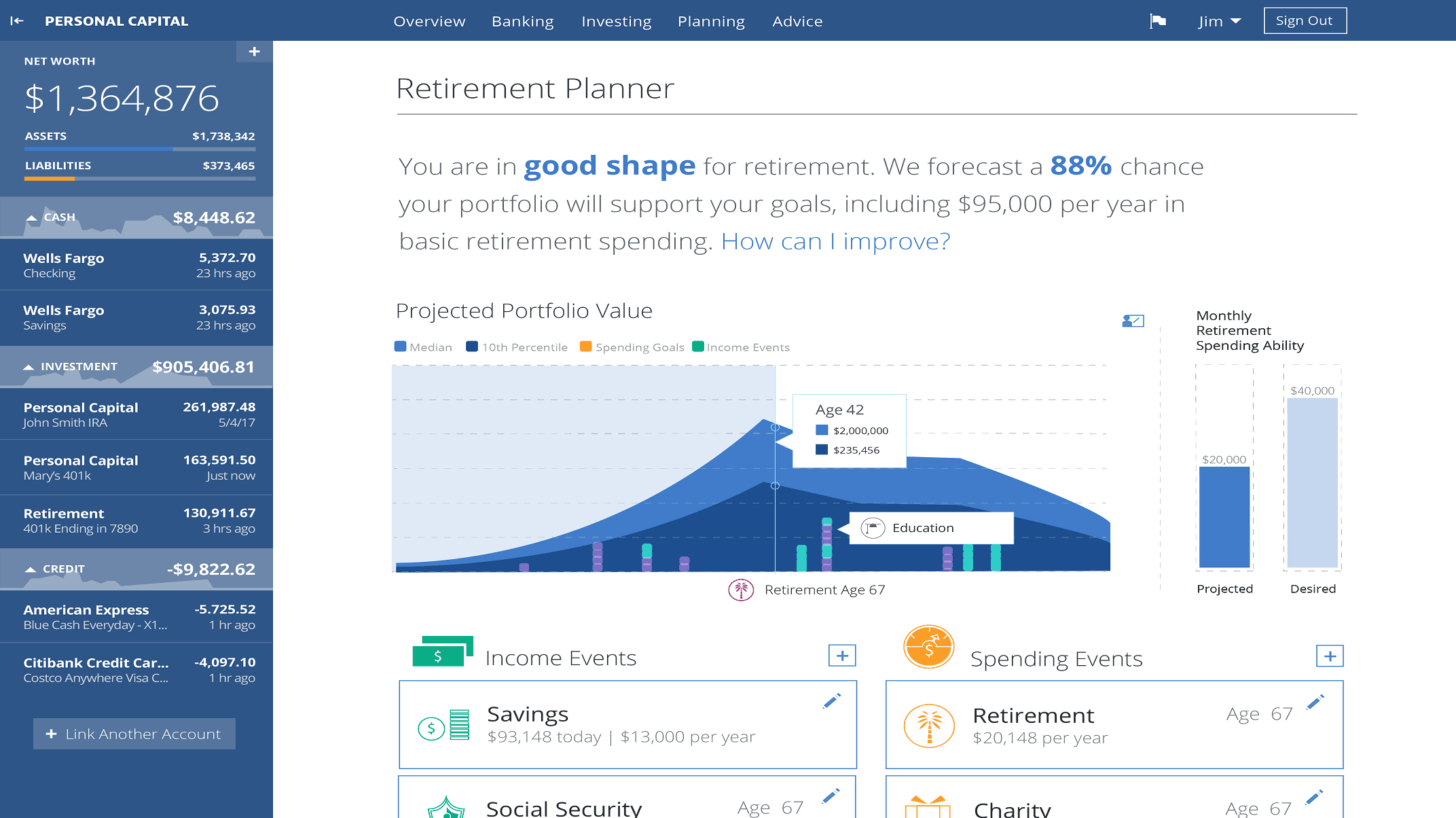

Want to really see how your expenses relate to your retirement savings? More importantly, want to get an idea of how long your retirement savings will last? You can do both (as well as a whole lot more) using a free retirement planning tool like the one from Personal Capital.

The thing I like about this calculator is that it goes beyond just crunching some nest egg savings target. Instead, it gives you a forecast based on thousands of Monte Carlo simulations to let you know how solid your plan is. Furthermore, because you link it to your actual retirement accounts, the values that it uses are your REAL savings which are always being updated in real-time. It’s one heck of a tool for being free to use – I’d recommend to definitely give it a try!

Take-Aways

If you’d like to explore any of these topics on retirement planning more thoroughly, then please check out my book “How Much Money Do I Really Need to Retire & Achieve Financial Independence?”, available in both digital and paperback.

In this book, we cover the topic of retirement planning from a variety of angles. We’ll look at everything from reducing your living expenses to how safe withdrawal rates can be leveraged to help you need less savings.

Regardless, the take-away should be clear. If you truly want to be financially independent, don’t chase after the illusions of earning as much as a VP or becoming some kind of investment wizard. These are talents acquired by only a very select minority of the population.

For the majority, there is a much, much more attainable goal sitting right in front of you. If you learn how to do more with less, then financial freedom is an option at any income level. The math works out the same whether you are a high income or low income earner.

The challenge, however, is all in how you get there. Just like taking care of our bodies and becoming more healthy, exercising some discipline when it comes to our spending is the first step to a successful path towards financial independence. Master this and you will have overcome the hardest part of the journey!

Readers – What’s the least amount of money you believe you could comfortably live off of? How much does this reduce your retirement savings goal by?

Photo credits: Unsplash, Pexels

I honestly have no idea. I don’t know how much things will cost by the time we retire- especially important things like healthcare. I do know that our house will be paid off! Our plan is to be FI in 12 years then retire at 50- that is a pretty rough guess though.

For sure you guys had to have thought of a number! Pretend you retired tomorrow – what do you think it would be? $2,000? $5,000?

Part of my goal of reaching financial freedom is to enjoy life through travel and fun experiences with family and friends. To do this requires income beyond the basic necessities of life. If I can reach the $2M mark in savings, then my passive income machine will generate all of the income I need to really enjoy life.

Thanks,

Deets

Nice! $2M would be a VERY comfortable retirement by many standards. Not at all what most people would consider to be a minimum figure. But if that’s what you’re saving for and you’re on your way, then good work!

The unknowns are what scare me. I know if you’re poor you can get on Medicaid if you have a major illness or accident, but I’ve seen what Medicaid covers and I might want more. Our plan is to have rental property to cover basic expenses and all the rest would be for extras or unknowns. If we really wanted to retire today, we could sell our house and move into a smaller place that would be paid for in full. We might even move to a lower taxed state, although Colorado isn’t that bad. I’d also make it a point to live in an area where we could walk or bike and we would’t need to drive. I kind of want it all, simplicity with that ability to splurge. so that’s why we’ll keep working well past our minimum retirement amount.

Good point – medical costs are a total wildcard. We could go over dozens of scenarios where different people would need different levels of coverage, and that would alter the numbers by quite a bit.

I do like the idea of using your rental properties for retirement income. I’ve read that there are a lot of tax advantages to doing that.

I’m not sure I could make the sacrifice to not have a car; even if I could live somewhere where its not really needed. When I was in college I hated walking everywhere. Driving is just so much more efficient.

Personally, I think the numbers you listed for the categories you mentioned are fine, but I think you are probably missing a lot of categories. That might account for the additional $2,000/month you were expecting to see.

I’m sure there’s a lot of extras I probably missed out on. For example: I didn’t factor in any expense for a vacation.

The $5000 figure is a rough estimate of what our current expenses are now and is why I always tend to gravitate towards it when doing any sort of retirement planning. Part of this whole exercise was really inspired by that $2K figure that MMM claims to live on. And so I wanted to paint a picture of just what that would look like or mean for my spending. It turns out its not that easy to get your expenses that low (despite what others would have you believe).

I think once your house is paid for retirement starts to become a reality. Health care will be the biggest factor for anyone planning to retire. When you retire your expenses should decrease. If there not, you are doing something wrong.

I agree – I think if I were to get our house paid down I would start to see the light at the end of the early retirement tunnel. During that first year of retirement I’m looking forward very much to not having to fill my gas tank up every other day or spend so much for food.

When I worked for a financial planner, it amazed me how many retirees still were making a mortgage payment. My wife and my goal is to have our mortgage paid off before we retire so that we need less to live off of each month. We are also keeping in mind property taxes too. We are looking to move in a few years and we know that taxes are going to influence where we buy. We don’t want to be paying close to $10K a year just in property taxes;

Wow, $10k per year in taxes is quite a bit more than we pay!

Nice mention about the retirees. I’m actually shocked by how much you read about people who live off of their measly Social Security paychecks alone with little to no retirement savings whatsoever. How do they do it?

We live on 26,000 a year. Yes we do go on vacation. Our house is paid no car payment no credit cards.. By having all these things paid we can save 1000 a month. We live on the Oregon Coast

My approach is to create income off of my investments by not withdrawing 4% every year. I do not believe in this approach. I actually believe that in today’s volatile market, it can be a dangerous approach and you can outlive your investments. A few bad years in the market can seriously damage your account with no way back.

So I use dividends and options (still learning options) to create a stream of income no matter what the principal looks like. If I can generate $5000 monthly on a $60,000 account, so be it. I can retire. If I need 120,000 to generate $5,000 monthly, fine, I am going for that number.

So, I do not look at the final number, but at income I can create. This year, I managed a $100,000 account for my friend. I generated $60,000 income out of it. He can use it next year and live off of it or reinvest it (if he decides letting me continue managing his account).

True my own personal account got hit by being greedy, but I am confident and optimistic.

So, I do not have a final number in terms of a total value, but a number which can replace my monthly expenses and then I can retire.

I also have a plan how to manage my account so I will not get stressed by trading or being forced into trading by circumstances such as bills. Before I retire, I want to make money for the next year. Once I have the money, I continue trading and making money for the following year, while living off of the money I already made. And of course, I still can use 4% principal if needed (in case I won’t make enough for the next year).

Hope this will work 🙂

I computed my minimum retirement savings. I just couldn’t believe that I couldn’t reach my goal of having financial stability in 25 years with only my job and paying these expenses of mine. I gotta start looking for other means and cut down my expenses.

I often struggle with this one because I can never decide whether to pay off the mortgage first or not. Real estate is so expensive here in the UK that paying off your mortgage completely would take a good long time. I therefore an wavering, and thinking that it might be easier to build up larger investments, and let the interest here pay off the mortgage.

The problem here isn’t just financial – I know paying off a mortgage early saves on interest payments so makes sense in the long term. The problem is timing – just how long it’ll take to pay off a mortgage and that it might be quicker, in the UK at least, to focus on building up savings and investments if you want to retire early.

We’re looking at 2.2 million to accomplish what we would like to do. It seems like a lot, but in 30 years it’s hard to predict what that amount is going to be worth. Actually it isn’t that hard, we know the value should be about half. Go back 30 years and see what homes were going for and then jump ahead. Personally I think minimums are pretty dangerous unless you are amazing at predicting the future and if you can do that you should be able to retire much faster because you would be making millions off the market. I’d rather have the problem of too much money than not enough.

I agree. When I have 2 million I will consider retirement. But right now I am making good money, so the plan is when I am comfortable to retire, I will continue to work, but will be taking very nice vacations., I did a 6 week work-cation in Europe a few years ago and only had to burn 2 weeks of vacation. We hosted 5 exchange students while our kids were in High School and one of the exchange students grandmother let us stay in her upstairs apartment for free. I plan to do something similar again.

I tend to agree with Martin. While our net worth is a fun number to look at, we are focused on cashflow. We average $5000/mo in spending. So we need at least that much. I know we can cut expenses and live off less than $5000, but it really won’t take much longer to earn $5000/mo passively rather than $4000/mo passively. That is after tax income. We want our passive income to continue to grow in retirement, so we will need to keep investing, which means we need a surplus.

I will say the benefit of a large net worth is the cushion. Should the passive income decrease for a bit, we still have money to fall back on until we right the ship.

Jason

Looks like a good start. Might help to go through your actuals for a year to see what you’re missing. Maintenance on the house and cars can chew up a lot. Doesn’t look like you have water and trash expenses. Any vehicle licensing and registration fees? Clothes? Hobbies? Pets?

I love this kind of exercise. I find that looking at other’s expenses helps me evaluate my own and see where I could cut back even more. I’m actually pretty happy with where I am now, spending-wise. Below is my budget:

$250.00 mortgage

$120.00 gas

$40.00 cell phone

$200.00 groceries

$80.00 electric

$45.80 water

$52.00 internet

$166.67 propane

$166.67 property taxes

$91.67 home/auto insurance

$20.83 pest control

$100.00 miscellaneous

= $1,333.63 Monthly Expenses

To put these numbers in perspective, I am a single woman, age 26, living in rural Indiana. I am college educated and make $45000 a year. The mortgage is so low because I bought a real fixer-upper of a house when the housing market was still depressed. My parents helped me put a lot sweat equity into it, and I’m on track to have my mortgage paid off in 3 years.

But I’m always looking to bring my expenses down even more. For example, in two weeks I’ll be renting an insulation blower from Menards and put another 6 inches of insulation in my attic to try and bring that propane bill down.

At this rate, I imagine $500,000 would be more than enough for me to retire on. I think all that most people need to do is actually look at where their money is going and when you look at it often enough it becomes easy to see where you can cut back.

I have no idea, I’d assume it’s a least $2,000,000, but you know what they say about assume. I’ve always felt weird about planning that far ahead in the future. There is so many unknowns at that point, it can be hard to tell what I’ll need or want at that point. I suppose the best I can do is save as much as possible and try to live within my means.

This is a great question, and it’s amazing to see how much the answers vary. I’m right there with Mr. Money Mustache, and I’m on track for that 600K.

Great post! I’m not exactly sure what I’d need in order to retire, I haven’t even thought that far ahead yet. I am saving about 15% of my annual salary in my 401k (this includes my employer match), but I still have a lot of debt to pay off before I can even think about how much I’d need to retire. I have been thinking of quitting my FT job sometime after my side hustles + a lower wage job that I actually enjoy could more than make up for my FT job’s salary. It’d have to be more than my take-home pay because if I leave my FT job I’d be losing health insurance, my 401K match, and some other nice benefits.

This is a good financial estimate to do when you have retirement in mind. It is imperative to avoid risk by paying off debt because the future is uncertain. How do we know dividend stocks will still pay dividends in 50 years? We dont so its important to diversify income from different sources. Finding those sources is the hard part: Online, Real Estate, Bonds, Stocks, REITS, a business? I feel building up the savings is a factor to help you reach retirement, but building passive income from non-related sources is the safest route to reach FI.

I have never been clueless. I know how much my possible retirement savings and still working on it to make adjustment and some increase. More importantly, I will have to go through those struggles like my loans and mortgage. I probably get to reach my ideal retirement savings over the age of 60.

Great detail on the expenses. Most people won’t need their full current expenses through retirement. You might want to do some traveling at first but its unlikely you will be as active into your 70s. Heading into your 80s and you’re probably spending most of your time at home with the family visiting. My plan starts at 90% of my expenses through 60s then reduces every five years by 5%

That makes a lot of sense. However don’t you think your medical expenses could potentially go up every five years by the same amount (or possibly more)?

I will feel super comfortable at 600K, which would be $30K per year at 5% withdrawal. I plan to continue to work part time seasonally after I hit FI and I won’t actually be taking any withdrawals for several years, allowing my nest egg to grow further, but at around 600K I will stop adding to it.

Hi John, $600K sounds pretty good when you combine it with part-time work. BTW – Hats off to you for including this in your plan. I think a lot of people forget that part-time work can be a very effective way to reduce your retirement needs. Though its not a perfectly clean break from employment income, I think it can definitely give you some leverage to have more freedom than those of us who still must work the standard 40 hours per week.

I’m curious about this 5% withdrawal rate. Can you expand upon how you arrived at this figure?

It’s wild to think that we could retire already if we had some other commenters’ low expenses. But we don’t. We will need a much higher retirement portfolio. Fortunately, we’ve been saving a while and are on our way. We’re more interested in location independence than retirement right now, though. We have two boys’ college educations to save for, and I think we’ll end up working for several more years than we actually need to, just to be extra safe.

I also agree that part-time work would be a great way to retire early and give you a bit of an income stream.

That’s great that you guys are willing to work a few extra years to help pay for college. I think this is a priority on a lot of parents’ minds. And with the power of compounding returns from our retirement savings already at our disposal, why not leverage them to our benefit?

I actually plan on using a 5% withdrawal rate. For variety of reasons mentioned in the below post. Basically my income will not be zero in “retirement” and we can adjust in down years.

Nice tips on attacking the other end of the equation besides just save more. Once daycare is done and the house is paid for we will be within striking distance of hanging it up.

https://www.lifeprepcouple.com/why-i-use-5-withdrawal-for-retirement/

If you feel comfortable with that rate, then you’re likely even closer to FIRE than the rest of us. A 5% withdrawal rate is effectively giving yourself a 20% discount on your nest egg savings target. That should make hitting your target a whole lot more achievable! Thanks for sharing your post and I’ll be sure to check it out.

BTW – I feel you on the daycare thing. The day we stopped paying daycare was glorious for our finances! We could practically have bought another house with all the freed up income!

Considering medical and long term care costs that are skyrocketing, Fidelity’s estimate is right around the ballpark if you want to survive retirement. I think most people outlive their retirement because they overlook the said expenses.

The cost of a private room in a nursing home, for example, costs $92,378 annually while a semi-private room costs $82,125. Around 70% of Americans 65 and above might move to a nursing home in the future. The risk is high, so it is imperative to prepare for this by building a big retirement income or by getting insurance.

This was a great article on retiring early I especially like the fact that you didn’t sensationalize “retiring in your 30’s.” Most websites will state that “so and so retired in their 30’s!!!” Yet these sites leave out the fact that unless you get really lucky its not going to be a 6 figure retirement no matter how hard or intelligently you plan.

I toyed with the idea myself mainly because I hate working in general. At my current pace I can retire at 36 with about $48K for life ((inflation adjusted). However, I realized that income will not let me experience life the way I want to in retirement. Therefore, I’m waiting until I’m 46. The point is anyone willing to put in the effort, discipline and hard work can retire on their terms if they choose to.

Thanks Alex and welcome to the site. I totally get you on the sites that sensationalize retiring in your 30’s. Even though that’s a great accomplishment for those who have done it, I don’t think its necessarily for everyone. Every person (or couple) needs to tackle the retirement question from the angle of how much money they think they will need and what kind of experiences they would like to have. That’s why I can identify with your decision to wait 10 more years to actually retire. I’m a big fan of building up the money you want to live the life you’d like to have, not just trying to reach FIRE as quickly as possible.

Good post. Staying healthy and active is the priority for me. I’m frugal by nature and enjoy simple activities -mostly walking and playing pickleball (very little equipment needed-cheaper to play than sports like golf or expensive gym membership).

Reading so many positive comments and and ideas have strongly encouraged our plans of retiring earlier. We are 52 and 50 respectively and our house has been paid off yeas ago. We are currently paying off the 2 investment properties we have and racking up on our 401(K). I hope we have the courage to take the plunge right now, but we’d feel more comfortable after at least, one of the properties is paid off. I think we can pay off both properties in about 5-6 years, at the most. That’s about $3200 a month. And by 62 I can take early Social Security and my wife can do the same 2 years after. All together should be about $6500-$7000 a month for the 2 of us. I think they are plenty.

Right now, I’m assuming I’ll need 25x my household income (rather than expenses). That means I’ll need $2.5 million since my wife and I make about $100k together.

However, we live on about half my take-home income. The rest goes towards savings/investments and debt. That’s about $16k, so we would only need $400k.

We got a baby on the way, so we’ll probably end up living on more than half my income. For now, though, we’re socking away as much as we can while we wait for baby.

I’m 55, single, and recently « retired ». I moved from New York City to Lisbon, Portugal and purchased a small, but comfortable, apartment in the historic center of the city.. At the same time, I bought a street-level commercial property, 10 minutes, walking distance, from my apartment, that I currently use as an art studio/workshop. I am living off $600,000 of cash savings and hope it will last….My living expenses, excluding clothing, travel and other small purchases, amounts to around $1,100’per month. Of course, I am generally frugal , but enjoy à good dinner out twice a week as well as my daily breakfast at the neighborhood cafe. Today, I live with so much less, but I don’t regret my decision.