Do you think it’s possible to save too much for retirement? That was the headline in an article from Yahoo Finance that seemed to think that you might. In it, the author was pointing the finger at the popular “80% rule” that suggests that retirement income planning is as simple as just estimating 80% of your gross (pre-tax) income.

Their criticism was that some academics think this commonly accepted retirement income planning tool may inadvertently cause some people to save for far more than they need. Consequently, this would cause those people to short-change themselves in the present.

Can You Really Save Too Much for Retirement?

Is saving too much for retirement REALLY a problem? Sure, you shouldn’t cut yourself short in the present by hoarding more money than you can bare. However, I’m also very confident that if you were to ask anyone in retirement (especially if they were working a part time job) if having too much money was a problem, the response would be an overwhelmingly unanimous “no”!

For me, I always think the more the better when it comes to retirement income planning. If I’m saving too much, then big deal! It will just strengthen my chances of making my savings last in case the stock market isn’t very optimistic. On top of that, think of all the great things I could do with the income for not just myself but my family members as well.

Targeting Your Retirement Income Planning Needs:

One thing I really liked about the Yahoo article was the comments. There were a lot of great suggestions by regular people (most of them retired) about various things they wished they had considered during their retirement income planning needs that would have helped them out today. (And by the way – None of them felt like you could save too much!)

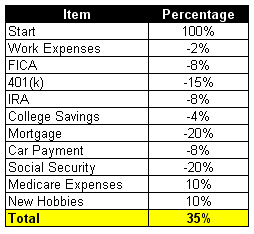

So rather relying solely on the 80% rule, let’s do our own unique retirement income planning by considering the following items below and crunching the numbers:

1) Start with 100% of your monthly gross (pre-tax) income.

2) Subtract a Percentage for:

• Work expenses: No more buying gas, lunches out, dry-cleaning, and other things that you would normally buy for your job.

• FICA (Social Security and Medicare taxes from your paycheck) – Without a paycheck, you no longer have to pay these taxes

• 401(k) contributions – You no longer make 401(k) contributions after you’ve stopped working

• IRA contributions – Like the 401(k), you usually no longer save with an IRA after you’ve stopped working

• College savings – If your kids are in college by the time you retire, then you should no longer have to save for their education. In addition, if the kids have moved out, then your overall expenses should be lower regardless.

• Mortgage payments – Before you retire, you may want to have your house paid off. If you do, congratulations!

• Car payments – Similar to your mortgage, try to eliminate any car payments before retirement.

• Potential Social Security income – Despite what you think, you will probably get some Social Security benefits after age 62. Therefore, you don’t need to count this as part of the money you’ll need to save.

3) Add a Percentage for:

• Medicare and other medical expenses – You don’t pay these now, but you will when you retire! There are a multitude of plans and options, so estimate high.

• New hobbies – If you plan to travel or pursue any other interests you never did before, you’ll want to plan for these new expenses.

Here’s a (drastic) example of what all this could look like when you’re done:

So in my hypothetical example, if you did some careful retirement income planning and carefully weighed all your needs, you could end up only needing about 35% of your current gross income! For the sake of round numbers, let’s say that if you’re making $5,000 per month ($60,000 per year), then you’d need to save up enough money to achieve an income of $1,750 per month (which would equal around $1,750 x 12 / 0.04 = $525,000).

Note that a few things should definitely build into your retirement income planning model are:

1) Some margin of error

2) Inflation (about 3% per year)

3) The fact that you will be paying taxes on most of your retirement income such as your 401(k) distributions, pension payments, social security income, etc.

Readers – What are you including in your retirement income planning model? Will you be closer to the 80% rule, or will you not have a mortgage payment, car payment, etc that will lower your needs even further down?

Related Posts:

1) How to Retire on 500K with the Greatest Potential

2) Six Easy Steps for Figuring Out How to Save for Retirement

3) My Money Design for Achieving Financial Freedom – November 2012 Update

Image Credit: Microsoft Clip Art

Leave a Reply