One of the great things about running a personal finance blog like mine is that sometimes you think you’re right about something. So you publish it. And then you find out very quickly from your audience that you could have done a much better job! Just before Halloween, I published what started out as my valiant attempt to challenge the belief that investing in a 401k plan is the better of the retirement income strategies when you compare it to a regular taxable stock-based account. In case you haven’t read it yet, please feel free to check it out here. While I thought I had put forth a good effort, I was humbly delighted to receive a number of comments that pointed out several flaws with several of the assumptions I used to reach … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

You Got That Bad Investment Planning Advice From Dave Ramsey?

As much as we’d like to think that personal finance is a perfect science, it simply isn’t. To some degree there is an extent of art and skill that has to be applied. You have to look at certain metrics, past returns, and other intangibles to make some educated decisions about your investment planning prospects. At times the process can be very subjective. And when things are subjective, that can open us to being misguided or wasting time going down the wrong path. So if that were to happen, you would usually expect that kind of bad advice to come from some two-bit financial planner who doesn’t know what he’s talking about. Or it would come from someone pushing his own agenda. But would you have ever expected bad investment advice … [Read more...] about You Got That Bad Investment Planning Advice From Dave Ramsey?

Could Early Retirement Planning Be Ruining Me?

In a lot of ways I think that I’m so much better off for being so active in my own finances and early retirement planning. All around me I see people who have not taken control of their financial future - and it devastates them. They are stuck working at jobs they hate until well into their golden years. They have to miss family engagements. They are under the servitude of others until their health no longer allows them or qualifies them to be. It’s a sad way to go out, and it’s not something that I will ever allow for myself or my family. But despite my best intentions to achieve what others feel is unachievable, Is there a dark side to my obsession with planning for an early retirement? … [Read more...] about Could Early Retirement Planning Be Ruining Me?

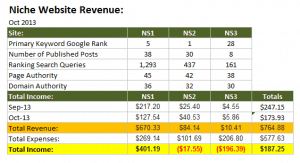

Niche Website Update 11 – Doubling the Size of NS1 and NS2

When they say “Rome wasn’t built in a day”, you can add niche sites to that assumption as well. All throughout October I spent the majority of my niche website effort getting content and uploading it to both of my sites, NS1 and NS2. As has been the goal for the past 2 months, I’m trying to build each one of these niche sites to be much larger than they are now – 50 or posts or more to be specific. My current theory (as observed in other people’s niche website developments) is that if I can build them up that high, they will rank for thousands of various keyword queries, attract far more organic traffic, and increase the potential for people to click through on the ads I have placed on them. So how is that assumption working out? … [Read more...] about Niche Website Update 11 – Doubling the Size of NS1 and NS2

Tax Deferred vs Taxable Retirement Income Strategies – How Big Are the Differences Really?

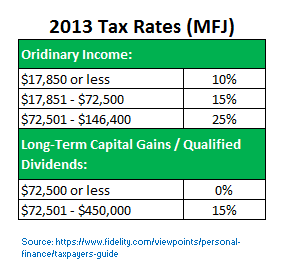

Pop quiz: If you could choose to save $10,000 using one of two retirement income strategies, either a 401k or a regular taxable stock brokerage account, which one would you choose? If you said “401k” (or really any other tax deferred savings account), then that’s what I would have expected you to say. Why? Because that’s what conventional financial planning advice teaches us. We all know that if we want to have a solid retirement income, then we need to max out our tax-deferred savings, let it grow, and then worry about paying the taxes later. And why not? Things like 401k’s and IRA’s are perfectly valid strategies for saving as much as you can and building up your nest egg. So you can imagine my hesitation and apprehension as … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies – How Big Are the Differences Really?

Great Recent Scary Movies to Watch This Halloween – 2013 Edition

It’s that time of year again to have some good, cheap fun and rent a whole bunch of great scary movies! In case you didn’t already know, I absolutely LOVE scary movies. I don’t know what it is about them, but I like watching ones that are well written or intriguing. So throughout the year I’ve collected the titles of a few of my favorite recent scary movies and thought I’d share them with you in time for Halloween. (Before you read on, make sure you check out Part 1 which was published last year. In that review, my scary movie picks were Trick ‘r Treat, Piranha, Drag Me to Hell, Silent Hill, The Ring, Saw I, House of a Thousand Corpses, The Devil’s Rejects, The Ninth Gate, and Donnie Darko.) My Favorite Recent Scary … [Read more...] about Great Recent Scary Movies to Watch This Halloween – 2013 Edition

How Being Successful Might Include Leaning Out From Work

What do you consider to be someone who’s “made it”? Does that phrase bring up images of young fit people in business suits smiling as they rush to the next meeting holding their cell phone to their ear and a Starbucks treat in the other hand? While this is often a popular stereotype seen on TV and the media, for those of us that actually make it there it can come with a lot of sacrifices that we might not even be sure (or even aware) that we’re willing to make. So ask yourself this: Why does being successful have to stem from only your job? Aren’t there other ways or other things you can participate in that would be just as rewarding or fulfilling? You may not realize it, but developing a healthy separation between work and … [Read more...] about How Being Successful Might Include Leaning Out From Work

Your Plan for How to Become Financially Independent

If you don’t think you’ll be able to retire early, then YOU are your own biggest problem. The fact that millions of Americans out there are only saving 2% of their income and holding 401k balances less than $100,000 is not an average retirement savings target that you should strive for. That’s just a financial epidemic that you won’t want to have anything to do with. You can do better! In this post we’re going to walk through a step-by-step plan for how to become financially independent with the honest hopes that you will be able to copy of my method and decide for yourself what parts of it will work for you. … [Read more...] about Your Plan for How to Become Financially Independent