It will happen to all of us at some point or another. You’re flying high. Things are going great; better than ever in fact! Sales are good. Orders are pouring in. Your customers are happy. Your colleagues are also just as happy. Believing in yourself has never been something you’ve questioned. Work is a terrific place to be right now. But brewing in some dark corner is conflict. Unrest. As it turns out, at least one person is not excited with the way you do things. This will not be anything tangible. You will not have committed any crimes. No, the problem will be intangible - what this person believes you can or can’t do in the future. Whether or not you’re really doing things according to the priorities as they see it. Ordinarily … [Read more...] about Believing In Yourself After Finding Out That You Suck

Overestimating the Ideal Keyword Density and How I May Have Sabotaged My Own Blog

Probably one of the biggest challenges I’ve had to blogging is that there isn’t really someone to tell you when you’re messing up. You can ask your friends, you can read articles, but even sometimes that’s not always accurate. Ultimately there’s a lot of trial and error, and you don’t really know you’ve blown it until you actually are. It’s quite possible I may have done that very thing with trying to follow the myth of the ideal keyword density. … [Read more...] about Overestimating the Ideal Keyword Density and How I May Have Sabotaged My Own Blog

Is the Conventional System to Create Wealth Rigged?

I’ve got a confession for all of you: I’m getting impatient! It was approximately 10 years ago that I first learned what a 401k was (I had never even heard of one before) and began my first steps towards saving for retirement. Like many of you, I knew the path to create wealth would be lined with hard work, lots of saving, and choosing the right investments. I took the conventional financial advice and began with a modest 10% savings rate. It wasn’t until the last few years that I’ve tried to accelerate my results by bumping my savings rate to extremely high amounts. So is it any wonder that when I look at my 401k balance and see how long I have to go that I feel I’m playing a rigged game? Sure if I stay the course I might have a … [Read more...] about Is the Conventional System to Create Wealth Rigged?

How I Made $1,200 with One Phone Call

Ask and you shall receive, right? Anyone who has never experimented with this mantra is missing out. It never ceases to amaze me how often I receive things at a discount simply because I asked for it. (Making deals with customers at my job has taught me that pretty much the price on anything is negotiable). Well … this one has got to be up there as a shinning example of why you need to try this. … [Read more...] about How I Made $1,200 with One Phone Call

What is Financial Freedom – The Easy to Follow Explanation

The tagline to My Money Design has always been designing financial freedom. For as long as I’ve been into reading financial books and blogs about money, I’ve seen a lot of them try to answer the question of what is financial freedom. However, I feel as though the weight of this term often gets lost or trivialized. In this post, we’re going to layout a definition for financial freedom and explain where we need to focus in order to achieve it. … [Read more...] about What is Financial Freedom – The Easy to Follow Explanation

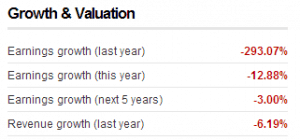

Rethinking My Strategy for What Stocks to Buy This Year

One thing you will learn in investing is that nothing is ever absolute and that rules are made to be broken. With that said, I’ve been giving a lot of thought as to what stocks to buy this year and my previous declaration to use the Dogs of the Dow strategy. As I get closer to actually making a purchase, I’m starting to reconsider my initial plan and may have an alternative solution that would make more sense. Here’s is where my mind is at: … [Read more...] about Rethinking My Strategy for What Stocks to Buy This Year

Doing a Better Job Tracking My Passive Income Streams and Retirement Savings

I’ve got to admit: 2012 was not a bad year as far as my passive income streams go! Before blogging and investing, I was relying on sign-up bonuses, credit card rewards, and small stuff like online surveys to make a little side cash. A lot can change in a year and half … Since taking a leap of faith on blogging and investing, I’ve made a lot more money than I ever thought I would from passive income. Blogging has by far been the front-runner with its endless possibilities of advertising, affiliate sales, writing, etc. After a lot of research, I also laid the first brick of my soon-to-be castle of dividend paying stocks – an effort I expect to cross $100 per month mark in no time. But one thing I regret not doing since the beginning of … [Read more...] about Doing a Better Job Tracking My Passive Income Streams and Retirement Savings

P2P Investing Denied! What Should be My Next Passive Income Ambition?

And so it was over before it even began … The tires on my P2P investing (peer to peer) efforts quickly went flat last week when I discovered some very important information. To bring everyone up to speed, I had wanted to start off 2013 by adding a new form of passive income to my money design. Last year blogging income and dividend stocks were valuable additions. This year out of the available choices I had listed, P2P investing was the one that stood out. It intrigued me in a number of ways: • Potential higher net rates of return than a stock market index fund • A steady stream of interest income • Access to the earnings before retirement age (helping the early retirement efforts) • Potentially lower risk (if you pick borrowers … [Read more...] about P2P Investing Denied! What Should be My Next Passive Income Ambition?