If you have any hopes and dreams at all of retiring early, then you know that one of the biggest challenges you face is the fact that there are penalties for withdrawing your money too early from your retirement accounts. For most of them, this will be age 59 ½ (click here for a complete list). So one of the re-occurring questions that we keep asking on MyMoneyDesign is: • How do I bridge the gap between early retirement and age 59 ½? In previous posts, we’ve reviewed the following non-employment, investment-style options available: • File for a 72t or “SEPP - Substantially Equal Periodic Payments” to get penalty free portions of your nest egg money out. • Quit working at age 55 to get your 401k’s and 403b’s, but NOT earlier. • … [Read more...] about Will Dividend Stocks Help Me Retire Early?

Personal Finance

Which is Better – Term or Permanent Life Insurance? – Part 2

In Part 1, we reviewed the fundamental differences between Term and Permanent Life Insurance. Basically Term is cheaper but it expires and gets more expensive as time goes on. Permanent life is way more expensive, but it lasts forever and has the potential to build up cash value. We concluded with me learning a fact about life insurance that made me question my Variable policy. I’ll explain below what exactly that was and how it caused me to request two new quotes so I could crunch the numbers to determine whether the Term or Variable Life Insurance policy was truly the better deal. … [Read more...] about Which is Better – Term or Permanent Life Insurance? – Part 2

Which is Better – Term or Permanent Life Insurance? – Part 1

Some of you may wonder “What in the world does life insurance got to do with my personal finances?” The truth is that it plays a more significant role in your money than you think for 2 reasons: 1) Life Insurance is about taking care of those you leave behind. Do you have a spouse? Children? Dependents? If something were to happen to you, who would take of the bills? Pay the mortgage so they can stay in their house? Pay for your kids’ college? Life insurance is part of your safety net for protecting those you love. 2) Choose poorly and you can significantly over-pay! There are thousands of life insurance products available, and the costs can vary dramatically. If you learn about what the differences are, then you can select the … [Read more...] about Which is Better – Term or Permanent Life Insurance? – Part 1

Why I Finally Sold My Apple Stock

Admit it. You saw the title of this post and thought what the #@&! is this guy thinking! Is he insane? Who goes and sells one of the world’s most profitable and admired companies? The truth is that this was not an easy post to write. Having watched the price of Apple stock (AAPL) rise above $600 (about $50 more than what I sold it for) left me wondering the same thing about my decision. But isn’t that the problem when we invest? We let our imaginations run the show. If we sell, we’ll kick ourselves if stock goes up, but we’ll pat ourselves on the back when it goes down. … [Read more...] about Why I Finally Sold My Apple Stock

Would Dollar Cost Averaging and Bonds Have Saved You From “The Lost Decade”?

In the first part of this series, I wanted to test the claim that dollar cost averaging (DCA) was an effective strategy for protecting your investments. Too often I’ve heard claims against investing within the media saying that if you had bought stocks (particularly) during “The Lost Decade” between 2000 and 2010, then you would have had a -23% return on your money. After crunching the numbers, we determined that dollar cost averaging would have beat a static investment in the S&P 500 and returned a -6.8% return instead of a -23%. That’s great, but who wants a negative return?! Why didn’t we just hide our money under the mattress and do nothing? Unfortunately, that may be true. But remember that when it comes to investing: Defense … [Read more...] about Would Dollar Cost Averaging and Bonds Have Saved You From “The Lost Decade”?

Another Expense Reduced – Refinancing Your Auto Loan

It wasn’t one week after we closed on our mortgage refinance that my wife and I got our next “big break” on our expenses. As I’ve spoken about before, part of my annual budget is to pick a handful of expenses each year and see what I can do to reduce them. Sometimes this takes a fair amount of work and research as was the case with the mortgage refinance. But ironically, this next one came from an unlikely source: Junk mail. … [Read more...] about Another Expense Reduced – Refinancing Your Auto Loan

Would Dollar Cost Averaging Have Saved You From “The Lost Decade”?

From time to time when I get my 401k statement, there is a small newsletter mixed in with my financial statement. It usually presents some very introductory information about retirement, investments, etc. In this issue one of the topics was dollar-cost averaging. For those of you who don’t know, dollar cost averaging (DCA) is a strategy where you invest the same amount time after time. During the good times when shares are higher, you buy fewer shares. During the rough times when shares are lower, you buy more shares. This strategy prevents you from buying at the wrong time and over-spending or under-spending on your investments by “averaging” your price over time among these periodic investments. Sound familiar? That’s exactly what … [Read more...] about Would Dollar Cost Averaging Have Saved You From “The Lost Decade”?

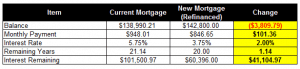

Adventures in Refinancing, Chapter 5

I’m very proud to announce that this chapter will end our story on getting a refinance. As of Monday, we finally closed on our new mortgage under the Home Affordable Refinance Program (HARP)! Here’s what has been going on since last time: Our Home Appraisal: So after the initial consultation and deposit, there was not a lot to do except wait until the estimator came back with his appraisal of our house. And so we waited, and waited, … And after 8 years of not “really” knowing how much our house was worth, we finally received an official home appraisal as part of the process. How did we do? Bum-badda-baaa (victorious trumpets sounding ….): … [Read more...] about Adventures in Refinancing, Chapter 5