If you had a really large sum of money, would you know what to do with it? Would you really?? This might seem like one of those “pass the time” type of discussion topics, but I’m afraid that sooner rather than later a great deal of us are going to need to know how to invest a million dollars or so. It will be kind of like handling a bazooka and not really being sure what to do with is. Why do I think this will be happening? … [Read more...] about How to Invest a Million Dollars and Why You’ll Need to Know How Someday

Stocks & Investing

Rethinking My Strategy for What Stocks to Buy This Year

One thing you will learn in investing is that nothing is ever absolute and that rules are made to be broken. With that said, I’ve been giving a lot of thought as to what stocks to buy this year and my previous declaration to use the Dogs of the Dow strategy. As I get closer to actually making a purchase, I’m starting to reconsider my initial plan and may have an alternative solution that would make more sense. Here’s is where my mind is at: … [Read more...] about Rethinking My Strategy for What Stocks to Buy This Year

P2P Investing Denied! What Should be My Next Passive Income Ambition?

And so it was over before it even began … The tires on my P2P investing (peer to peer) efforts quickly went flat last week when I discovered some very important information. To bring everyone up to speed, I had wanted to start off 2013 by adding a new form of passive income to my money design. Last year blogging income and dividend stocks were valuable additions. This year out of the available choices I had listed, P2P investing was the one that stood out. It intrigued me in a number of ways: • Potential higher net rates of return than a stock market index fund • A steady stream of interest income • Access to the earnings before retirement age (helping the early retirement efforts) • Potentially lower risk (if you pick borrowers … [Read more...] about P2P Investing Denied! What Should be My Next Passive Income Ambition?

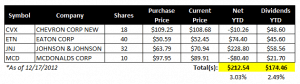

My Stocks with High Dividends Income Report – December 2012

What a great time of the year to receive the next installment of my “truly” passive income. By luck, it just so happens that my next series of payments from my dividend paying stocks was scheduled to be paid in December. Couldn’t we all use a little extra cash right before Christmas as the bills start rolling in? Over on the left are the results of my third batch of quarterly dividend payments received for Quarter 4 (Q4). … [Read more...] about My Stocks with High Dividends Income Report – December 2012

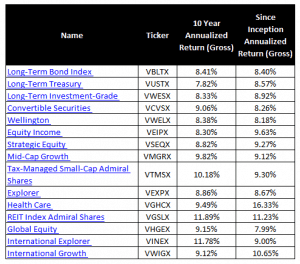

My Picks for Vanguard Mutual Funds for Our Roth IRA

The end of the year is full of things to do: Celebrate the holidays with family, prepare for the winter, get your tax information together, etc. But one very important chore we often forget to perform is re-evaluating our investment portfolios. Unless you review them, how do you know if the investments you own are performing well? Are they still helping you to reach your goals? Are there better choices out there? This is exactly what I’m looking to do with our Roth IRA funds. Both my wife and I both have a Roth IRA through Vanguard which we max out every year. Our belief is that these Roth IRA’s will help us to get tax-free income during retirement or possibly serve as a vehicle to help us fund our early retirement. To a new or … [Read more...] about My Picks for Vanguard Mutual Funds for Our Roth IRA

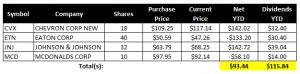

My Dividend Payment Income Report – September 2012

As many of you know, 2012 is the first year that I have really overhauled my stock investment strategy and changed my focus to simply collecting high-quality dividend paying stocks. Just like any dividend investor can tell you, dividend payment income is a pretty remarkable source of “truly” passive income. I prefix passive income with “truly” because the income they generate literally requires no effort on my part. I simply collect the payments each quarter! As of this month, I am happy to report the second installment of my quarterly dividend payments received. Please see the image on the left for the total. … [Read more...] about My Dividend Payment Income Report – September 2012

Getting the Highest Dividend Stocks Using the Dogs of the Dow

Finding the best, most reliable, and highest dividend stocks the market has to offer doesn't have to be a chore. Let the winners step forward and do all the work! All you need is to use a well-known stock picking method known as the Dogs of the Dow investment strategy. The Dogs of the Dow is based on two simple premises: 1) Out of all the dividend stocks out there to buy, the top performing blue chip companies from the Dow Jones Industrial Average will be your best bet for producing stable returns. 2) By buying the highest dividend stocks while the yield is high, you’ll likely be buying them at a time when the price is low and likely to go higher (the old buy low, sell high mantra). Sounds good so far! But how exactly … [Read more...] about Getting the Highest Dividend Stocks Using the Dogs of the Dow

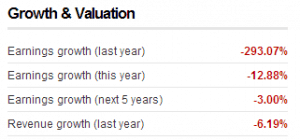

How to Read Stocks and Evaluate Their Basic Metrics

One of the biggest things that separates individual stock investors and mutual fund investors is how to read stocks and evaluate them on an individual basis. Unlike most mutual funds, individual stocks can carry a great deal more of risk. Pick the wrong ones and there goes your hard-earned money! So how do we evaluate a company's stock metrics to know if it will be a good investment? Fortunately, all this basic information you need to understand a potential prospect has been summarized by most major news outlets into single, bite-sized profiles that are convenient for you to access and are constantly updated. The goal of this post will be to walk you through one of these pages of metrics and explain how to read stocks. For this … [Read more...] about How to Read Stocks and Evaluate Their Basic Metrics