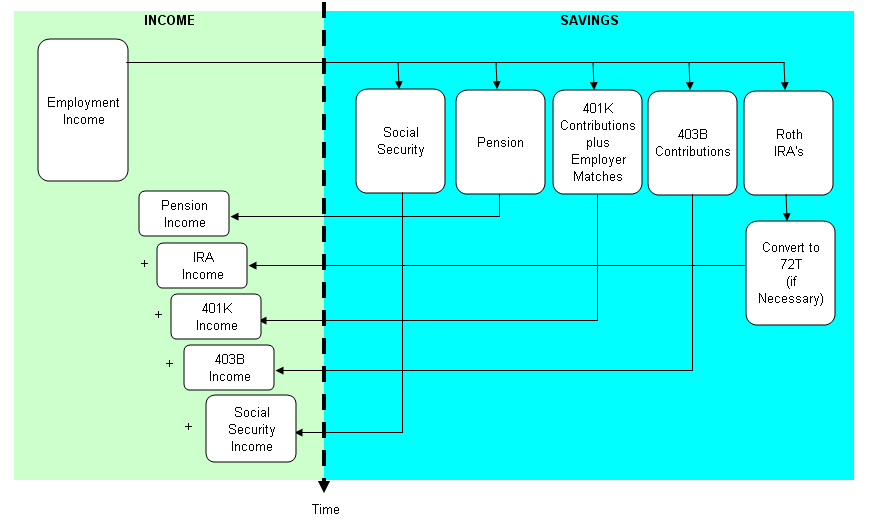

As part of my annual financial checkup, I have updated my “Money Design” for financial freedom. This is my plan to one day automate my income rather than rely solely on employment income. My plan can be summarized by the flow chart below:

The basis of my design is to contribute the maximum amount possible to each of my retirement plans. Once my wife is eligible for her pension, we will begin to accept withdrawals from it as well as consider withdrawing from our Roth IRA and possibly taking out a 72T. As each of the other retirement accounts becomes eligible for withdrawal, I will begin taking money out and adding it to the overall cumulative income.

Assumptions and Safety Factors:

To ensure my Money Design will work, I have built in the following assumptions and safety factors into my plan:

• Maximize Savings: I plan to contribute the maximum amount possible to each of my private retirement accounts: Roth IRA, 401(k), and 403(b). This will purposely not include an employer matches or contributions. Those will be considered icing on the cake.

• Live Off of Less. I predict that I’ll need about 60% of my current income in retirement. Major subtractions include no more FICA taxes, retirement savings, mortgage payments, and Social Security. Major additions include Medicare expenses, possible travel, and inflation.

• Lower Returns. My model will assume that my portfolio will have an average 6% annualized return. This is purposely set lower than the usual 8% to 10% that is often quoted by financial experts. If the markets perform normally, then that will mean more money for me. If the markets do less than normal, then I won’t be too far off from my predictions. Also, if I decide to invest more conservatively, I won’t have to change my expectations.

• Lower Withdrawal Rate. I plan to only withdrawal 3% per year from my retirement accounts. This is purposely set lower than the usual 4% to 5% withdrawal rate that most people assume they will use. The extra 1% lower better ensures that I will not run out of money during retirement which is a powerful tool to combat against inflation.

• Same Tax Rate. I’m assuming I’ll be paying an approximate 25% income tax rate.

• That Social Security Will Still Exist. I haven’t given up on Social Security and it is still a part of my design. However, as my last Social Security statement noted, my benefits will only be worth 76% of the amount I’m entitled to. Plus, I’ll be paying taxes on what I do receive.

Criticisms of My Own Money Design:

I know my design is far from perfect. Here are some of the things I would like to work on to improve my plan:

• No Passive Income. “Rich Dad, Poor Dad” author Robert Kiyosaki would frown upon my flow chart, and I would agree with him. Right now, my design has no passive income. It is completely dependent on employment income and the eventual retirement savings I accumulate from it. Although there is nothing wrong with a plan such as this, it does have its limitations. By adding a few streams of passive income, this design could have infinite potential. Some of the streams I will focus on this year will be dividend stocks, rental property, and this blog.

• The Dangers of Average Return Assumptions. Simply assuming an average annual rate of 6, 8, or any percent is a dangerous assumption (and becoming widely frowned upon). You can’t just say that every year your savings is going to go up by 8%. If you don’t believe me, just look at how the S&P did over the last decade (spoiler – it wasn’t 8% each year). A more appropriate approximation would be to use random numbers (called a Monte Carlo analysis) to capture the ups and downs of the market. The variance in ups and downs in your portfolio value will make significant differences in how long your money will last when it comes to taking withdrawals.

• No Personal Savings. Unfortunately, this plan also does not include any personal, taxable savings. This is mostly because the focus has been on building up my tax-sheltered savings plans. When the opportunity presents itself, I will start devoting portions of my income into personal savings.

• No Annuities or Life Insurance. I don’t have any annuities built into my design because I have not decided how I feel about them yet. I understand how they work and what they do, but I need to know more about the fees and returns they offer. As far as life insurance goes, I do not view it as an investment but rather what it is – insurance.

Searching the web for ideas on how to become financially independent is how this blog got started. I’d love to hear your ideas. Please feel free to share your comments.

Leave a Reply