The following is a guest post by fellow personal finance blogger William Cowie from the site Bite the Bullet Investing. In the post Reader Debate – Would You Borrow Money to Invest in Stocks?, William commented with a great story about his experiences with borrowing against 401k funds to purchase stocks at what he believed was a critical opportunity. He has graciously volunteered to expand upon that story in this post. If you are interested in being a guest contributor for My Money Design, please feel free to contact me. Do you hate debt? I do, quite passionately. Few things suck the joy out of life more successfully than debt. I didn't always feel this way. Business schools do a great job extolling the virtues of using Other … [Read more...] about One Man’s Success With Borrowing Against 401k Funds for a Comeback

Personal Finance

When Can I Retire – It All Depends On How Badly You Want To!

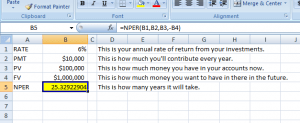

When it comes to planning for retirement, people both young and old always ask the same simple question: When can I retire? It’s a seemingly harmless question, but it is also one that can be ambiguous to find a direct answer for. The reason is because retirement isn’t something that simply comes with age. You could retire today or even ten years from now if you really wanted (with the proper plan in place). Unfortunately, I hate to answer a question with a question, but the response to “when can you retire” is simply “how badly do you want to”? When Can I Retire is All In Your Mind: I didn’t start the post out with this rhetoric to confuse you. I did it because I hate it when people feel isolated. I dislike the way they … [Read more...] about When Can I Retire – It All Depends On How Badly You Want To!

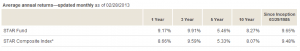

Can the Dividend Payout Ratio Help You Pick a Good Stock?

In this month’s issue of Money Magazine, I came across an article entitled “When the Wilder Ride is Worth It”. The article was addressing how sometimes a company’s stock and dividend payment can be a better prospect for stable income than its bond. To make this comparison, they looked at the return of the bond against the dividend appeal (which was largely based on it's payout ratio) and any inherit stock risk based on the company itself. Whenever I find an article like this about semi-guaranteed income, I tend to pay extra special attention to it - and with good reason. Strategies such as taking advantage of dividend payouts will be important to my financial situation because it will be one of the key elements that helps me to … [Read more...] about Can the Dividend Payout Ratio Help You Pick a Good Stock?

Reader Debate – Would You Borrow Money to Invest in Stocks?

I wanted to try something different on My Money Design and throw a question out to my readers to debate. I’m very interested to see what the outcome will be. The inspiration for this topic comes from a stellar comment that was left on my “How Much Money Would I Make If I Rented Out A House?” post. The commenter, Richard, laid out some great plans for how he was going to build his wealth empire. Essentially, he was going to borrow money to put together a real estate portfolio. This is the classic old mantra of using “other people’s money” to get rich, and it is certainly a path where a lot of people seem to have found great success. Unfortunately I’m far too much of a weenie to invest in real estate (… yet). I prefer to invest … [Read more...] about Reader Debate – Would You Borrow Money to Invest in Stocks?

Learn How to Manage Money Better – Like a Large Company CFO

Why do we struggle when it comes to handling our money? Some of us live check to check and barely save nothing. Others of us do okay. But then we never take full advantage of what’s out there to make the best financial choices. What is it about our methods that make us so deficient at knowing how to manage money better? Ironically, the answer you’re looking for might just be behind those large retail giants where we spend the most amount of money each month. While some people may scuff at the likes of Walmart or Apple with their anti-consumerism attitudes, I ask you to take a second look. Beyond the products they sell to us, what is about them that would cause us to stop and focus on them? The answer: They know something … [Read more...] about Learn How to Manage Money Better – Like a Large Company CFO

Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?

This post was a great suggestion from Alexa over at Single Moms Income. If you have a topic you’d like me to write about on My Money Design, please feel free to comment or send me an email. Read any article about money and what will it tell you? Start an IRA! You know the benefits. You know it’s good for your finances. But what if you don’t have a lot of money to put in one? Where can you find the best IRA provider without having to open an account with thousands of dollars? Never fear! You’ve got options. In this age of online accounts and competition, more and more IRA providers are willing to accept less money to get started. This just translates into more opportunities and options for you to choose from. In this … [Read more...] about Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?

Using Blogs to Learn Great Basic Financial Planning Skills

When I first became an adult with a family and mortgage, I knew that I would have both a responsibility and obligation to make sure that our household was always protected. That meant not only just working hard and earning a decent wage, but also making sure I at least understood basic financial planning enough that I would be able to engage in some of the many ways to grow your income. My ambitions started out with reading lots of the best money books. I would go through page after page trying to find the magic equation for getting rich. By purposely picking books that were written by millionaires themselves, I thought I would be able to learn from their methods and reproduce their success. … [Read more...] about Using Blogs to Learn Great Basic Financial Planning Skills

How to Clear Credit Card Debt By Clawing Your Way Out

This post was written by Kevin Donovan from financialupdate.org.uk. He often writes about how the decisions made by politicians and bankers affect our daily lives and the ability to cope with the economic stress of an ever more debt ridden world. Every day we see large companies take large substantial hits. This one to wonder: If they can’t survive this bleak economic climate, how can we? … [Read more...] about How to Clear Credit Card Debt By Clawing Your Way Out