One of the biggest mysteries the average working adult faces when it comes to their personal finances is knowing what the right answer is when it comes to the question of HOW much they should be saving every paycheck for retirement? We’ve all seen generic articles that say to save 10% or whatever, but how do we know that percentage is really the right number to plug into our personal retirement formula? Even if you did take the time to figure out how much money you’d need and what size nest egg to save for, how do you know what chances your savings target would have of surviving another economic downturn like we had this past decade? What confidence do you have that the number you pick will result in your savings being able to last … [Read more...] about Finally a Safe Savings Rate for Your Retirement Formula

Retirement

The Roth IRA Basics and What You Need to Know to Get Started Today!

Allow me to be your Dad for a minute and tell you that if you haven’t setup a Roth IRA yet, then what are you doing?! Seriously, if you’re trying to figure out what to do differently with your money this year, how about putting in something that will grow tax free! Whether you know much about investing or money, read on as I explain all the essential Roth IRA basics and what you need to know to make the most of them. … [Read more...] about The Roth IRA Basics and What You Need to Know to Get Started Today!

Is the Conventional System to Create Wealth Rigged?

I’ve got a confession for all of you: I’m getting impatient! It was approximately 10 years ago that I first learned what a 401k was (I had never even heard of one before) and began my first steps towards saving for retirement. Like many of you, I knew the path to create wealth would be lined with hard work, lots of saving, and choosing the right investments. I took the conventional financial advice and began with a modest 10% savings rate. It wasn’t until the last few years that I’ve tried to accelerate my results by bumping my savings rate to extremely high amounts. So is it any wonder that when I look at my 401k balance and see how long I have to go that I feel I’m playing a rigged game? Sure if I stay the course I might have a … [Read more...] about Is the Conventional System to Create Wealth Rigged?

Why You Need to Get Your Full 401k Matching as Early as Possible

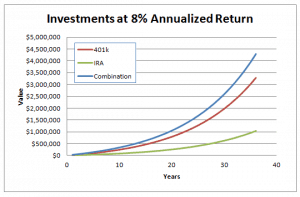

Not too long ago, I was trying to demonstrate how NOT taking full advantage of your 401k matching contributions offered by your employer was causing you to lose out on more money over the course of your career than you probably thought! While it’s never too late to get your personal finances in order, one simple mistake I see people making all the time that kills me is when they wait as late as 5 to 10 years before they finally get with the program and start contributing enough to their retirement plan to get the full 401k matching from their employer. I beg you - Please don’t waste another year! Remember time is one of your greatest assets as an investor, so don’t squander it! In this post, I’ll show you just how powerful taking … [Read more...] about Why You Need to Get Your Full 401k Matching as Early as Possible

New IRS Contribution Limits for Retirement Accounts in 2013

If you are somehow managing to diligently contribute the maximum amount to your 401k and IRA accounts, then there's good news for you in 2013. The IRS contribution limits for the major U.S. retirement accounts will be increased next year! This is exciting news for anyone looking to invest more of their money without the burden of paying taxes on their returns. The Money Design November Update plan I proposed recently will get a big boost from these new increases that will help me to achieve my goals much more quickly and safely. … [Read more...] about New IRS Contribution Limits for Retirement Accounts in 2013

My Money Design for How to Achieve Financial Freedom – November 2012 Update

I was very pleased with the level of interest and positive reaction I received for my previous post on how I plan to retire early in Money Design update in October. However, that update was only merely a sketch of where I wanted to be. As I’m sure any designer can tell you, no blueprint is ever really complete until you put numbers to it – even if it’s a blueprint for your plan on how to achieve financial freedom. In this update, we’ll seek to build upon my earlier retirement income strategies by making some assumptions about how much money my family could expect to take in from our multiple developing income sources. Please feel free to compare my decisions and estimations to what you think would be reasonable for your own … [Read more...] about My Money Design for How to Achieve Financial Freedom – November 2012 Update

SCARY Retirement Statistics – Don’t Let Lack of Planning Haunt You!

Happy Halloween everyone! Since most people will be out celebrating Trick or Treating tonight, I thought we’d do a very brief post of something truly alarming! No, it’s not about ghosts, monsters, or anything else from the paranormal. This is something much more frightening - These are scary retirement statistics! The reason these should terrify you is because, unlike a superstitious ghost story, these statistics tell a very real story. And if they are any indication of things to come, reality is going to be pretty grim for a lot of people. Read these numbers and tell me they don't paint a pretty chilling picture of the future to come! The following figures are from Statistic Brain and are overwhelmingly alarming: … [Read more...] about SCARY Retirement Statistics – Don’t Let Lack of Planning Haunt You!

My Money Design – October 2012 Update

The website isn’t called My Money Design for nothing! It’s been almost 10 months since my last Money Design update and a lot has changed. Not only have I learned a ton of new tricks from my fellow personal finance bloggers on making and investing money, I have also taken a number of important steps at home and at work that I believe will further benefit my family's efforts to reach financial freedom. So with that in mind and in anticipation of my usual Money Design update, I have decided to get to work early with the revisions to my plan. … [Read more...] about My Money Design – October 2012 Update