Have you ever wondered how your 401k balance stacks up against the rest of the population? If you’re a devout saver, you may be surprised to find out just what the current average retirement savings for most Americans actually are. I first became somewhat curious about my own pace against those of other people after reading the book Your Money Ratios. The book offers you some suggested milestones for where you should be at with your savings given different age levels. In case you want to know but are too scared to “look under the bed”, your 401k balance is probably doing a lot better this year than you think. Despite some of the choppy financial news for this month, 2013 has been a pretty favorable year overall for the market on … [Read more...] about How Do You Compare to the Average Retirement Savings of Other Americans?

Retirement

There Are No Shortcuts to Early Retirement Planning

Even before starting My Money Design over two years ago, I was on what seems to be a never ending quest to find the secret to achieving true financial freedom or great key to early retirement planning. How is it that people my age, perhaps younger or older, are able to quit their jobs if they want and still maintain thriving lifestyles? I’d love to tell you that after all this time that I have all the answers. That there was some kind of easy solution or magic bullet. However, I’m still a long ways out and seem to have a lot further to go. The path to get there has been more of a puzzle than I originally thought. Each piece containing it’s own unique challenges and scarifies. Here are my observations on the various paths that … [Read more...] about There Are No Shortcuts to Early Retirement Planning

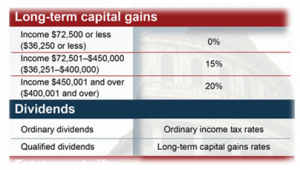

How the Lower Taxes From a Long Term Capital Gain Can Work Into Your Early Retirement Plan

You know what I love about blogging? It’s that you learn about important things that you probably weren’t going to go searching for on your own. That’s exactly what Matt from Mom and Dad Money did for me when he wrote an epic guest post for My Money Design about two weeks ago. Even though there were a lot of great points buried within the text, one of the things I took away from it personally was the mention about how a long term capital gain (much like your dividend income) is taxed at a lower and more favorable rate than your ordinary income. Taxes? Time to Stop Reading This Post … Wait! Don’t leave. I promise not to bore you too much with a bunch of technical jargon. … [Read more...] about How the Lower Taxes From a Long Term Capital Gain Can Work Into Your Early Retirement Plan

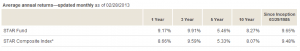

Exploring My 401k Alternatives – Maybe More Dividend Stocks?

So I’ve been thinking … Last year I wrote a post about how I was thinking about diverting some of the money we were contributing to our 403b retirement fund towards our dividend stocks instead. This was somewhat of a controversial move because traditional personal finance advice is to invest in your tax-sheltered accounts, not your taxable accounts! After all, why would you want to save your money in an account where you have to pay taxes? But it wasn’t that simple. There were several more alluring reasons why investing in dividend stocks would make more sense: … [Read more...] about Exploring My 401k Alternatives – Maybe More Dividend Stocks?

A Ponzi Scheme Example – An Illustrated Demonstration of How One Works

Over the last few years, the name “Bernie Madoff” and the term “Ponzi Scheme” have been used almost interchangeably. Obviously we all know that this man was a crook and that he committed a very serious act of fraud by stealing millions of dollars from trusted investors. But have you ever stopped to ask yourself just what one is or what a Ponzi Scheme example would even look like? Don’t be embarrassed if you don’t know exactly what one is. When Madoff was arrested and his wife was told about his crime, she replied “What’s a Ponzi Scheme”? As students of investing and diligent savers for retirement, it is very important that we protect our financial well-being by staying away from scrupulous investment opportunities After all, … [Read more...] about A Ponzi Scheme Example – An Illustrated Demonstration of How One Works

The Pension vs 401k – The 401k Did Not Kill Retirement

Every now and again when I read through the headlines on my favorite money news sites, I see the same desperate-for-attention headlines proclaiming that “retirement is dead” and that we basically have no hope of ever saving enough money. How do they draw those conclusions? The usual suspects cited are the decline of pensions, the deflating of Social Security and the rise in costs as reasons why none of us can save and why we’ll all need to work until we are 80. And then there is my personal favorite: The 401k. They talk about the 401k like it’s a James Bond villain. When they compare the pension vs 401k, they describe it as a horrible and inefficient means for retirement. Basically, their message is that the 401k killed … [Read more...] about The Pension vs 401k – The 401k Did Not Kill Retirement

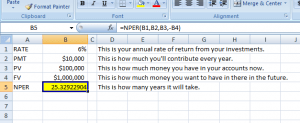

When Can I Retire – It All Depends On How Badly You Want To!

When it comes to planning for retirement, people both young and old always ask the same simple question: When can I retire? It’s a seemingly harmless question, but it is also one that can be ambiguous to find a direct answer for. The reason is because retirement isn’t something that simply comes with age. You could retire today or even ten years from now if you really wanted (with the proper plan in place). Unfortunately, I hate to answer a question with a question, but the response to “when can you retire” is simply “how badly do you want to”? When Can I Retire is All In Your Mind: I didn’t start the post out with this rhetoric to confuse you. I did it because I hate it when people feel isolated. I dislike the way they … [Read more...] about When Can I Retire – It All Depends On How Badly You Want To!

Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?

This post was a great suggestion from Alexa over at Single Moms Income. If you have a topic you’d like me to write about on My Money Design, please feel free to comment or send me an email. Read any article about money and what will it tell you? Start an IRA! You know the benefits. You know it’s good for your finances. But what if you don’t have a lot of money to put in one? Where can you find the best IRA provider without having to open an account with thousands of dollars? Never fear! You’ve got options. In this age of online accounts and competition, more and more IRA providers are willing to accept less money to get started. This just translates into more opportunities and options for you to choose from. In this … [Read more...] about Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?