Who’s ready for some financial smack-down? If there’s any two groups of investors I can think of that are more divided, it’s those who invest in real estate and those who invest in stocks - like a North and the South of financial planning if you will. So the question here is this: Which one actually has a better chance of making you more money in the long run? This may be a controversial debate, but we’re going to settle this argument the MyMoneyDesign way – by running the numbers! So let's see what we come up with ... … [Read more...] about Which Is Better – Rental Income or a Stock Market Index Fund?

Stocks & Investing

What Is A Stock?

Do you actually know what a “stock” is? Don’t be afraid to admit that you don’t. I would bet that a lot of people who say they do (or think they do) do not in fact actually understand what one really is. One of the fundamentals I preach on MyMoneyDesign is to know what it is that you’re putting your money into when you invest. So if you invest in stocks, let’s explore of the introductory basics of what they are. … [Read more...] about What Is A Stock?

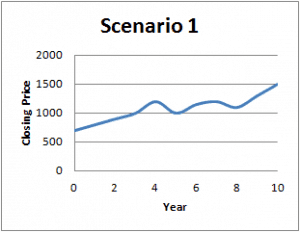

What Does “Stocks Return 8 Percent Each Year” Actually Mean?

Pop quiz: Pretend your investment portfolio looked like one of these three graphs. Which of these represents an 8% average annualized return each year? The answer: … [Read more...] about What Does “Stocks Return 8 Percent Each Year” Actually Mean?

Protecting Yourself with Dividend Stocks

Darn! The year was off to such a great start for us investors! But then worries about Greece and the Euro spoiled the party. If you were following conventional wisdom and investing in Index Funds, then you’ve basically lost about 6% in May (following the S&P 500). Don’t worry – I’m not trying to bum you out. But it is times like this that you need to ask yourself “What am I doing to hedge myself? If buying stocks is offense, what am I doing to play defense?” … [Read more...] about Protecting Yourself with Dividend Stocks

How to Buy a Stock Market Index Fund

If you're wondering how you can buy an index fund, then you're in the right place! Index funds have become a favorite investment choice for people from all walks of life. Thanks to their simplicity and performance, you could easily grow all the money you'll ever need by consistently investing in an index fund. Even legendary investment guru Warren Buffett famously bet (for charity) a group of hedge fund managers that they could not outperform a simple index fund. And you know what? He was right! Even though these guys were supposed to have all the right connections and information to beat the market, they still managed to lose to an index fund. 10 years later, the index fund gained a 94% return while the hedge fund only … [Read more...] about How to Buy a Stock Market Index Fund

Why I Finally Sold My Apple Stock

Admit it. You saw the title of this post and thought what the #@&! is this guy thinking! Is he insane? Who goes and sells one of the world’s most profitable and admired companies? The truth is that this was not an easy post to write. Having watched the price of Apple stock (AAPL) rise above $600 (about $50 more than what I sold it for) left me wondering the same thing about my decision. But isn’t that the problem when we invest? We let our imaginations run the show. If we sell, we’ll kick ourselves if stock goes up, but we’ll pat ourselves on the back when it goes down. … [Read more...] about Why I Finally Sold My Apple Stock

What is Shorting a Stock?

The first time I watched the Oliver Stone movie Wall Street 2, I was confused about something: Josh Brolin’s company, Churchill Schwartz, makes a ton of money when the company that Shia LaBeouf works for, Kellar Zabel (KZI), starts to dramatically fall in stock price. Contrary to conventional investing, how is it that someone gets “rich” from stock prices going down? How Shorting a Stock Works: Although there were a lot of factors at play in the movie, the basic answer to this question is that Schwartz was “shorting” the Kellar Zabel stock. What does that mean? Let’s look at a simple example: … [Read more...] about What is Shorting a Stock?

Browsing for Stocks – January 2012

It’s a new year and I’m optimistic that new opportunities are out there. In keeping with that enthusiasm, I’d like to add a few more individual stocks to my portfolio. Traditionally, I stick with mutual funds to stay diversified, keep my costs down, and avoid the turbulence of the market. However, last year I had a great time with Apple (AAPL) (up 26% from my initial purchase) and I’m hoping I can use the same care and attention to pick another winner. Going After Dividends As part of my ongoing initiative to add passive income streams, I’ve decided that my next set of stocks should be dividend stocks. There are a lot of reasons why to look at dividend stocks for my next purchase: … [Read more...] about Browsing for Stocks – January 2012