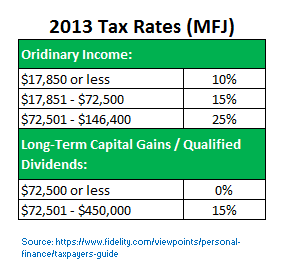

How incredible would it be to have a completely tax free retirement? I’m serious. You would owe no taxes. No, you won’t have to live in poverty. In fact if you’ve got enough savings you could withdraw over $100,000 and still not owe the government any money. Is that even possible? Of course it is. Lots of wealthy Americans take advantage of tax loop holes every day to pay a lower tax rate than their peers. There’s even a famous statement from Warren Buffett where he says that he is paying a lower tax rate than his secretary. Fortunately for you, we’re going to do a little better than that in this post. We’re going to see if we can’t find a way to pay NO taxes at all! All we’ll need is to be creative with how we plan to … [Read more...] about The Ultimate Guide to How to Have a Tax Free Retirement

Retirement

Did I Just Find Another Great Retirement Saving Strategy? Understanding the SEP IRA Rules

I think I may have found another good one. A few weeks ago when I laid out my ultimate plan for becoming financially independent, I thought I had really done a pretty good job of optimizing every single angle of my retirement savings options. My 401k. My IRA. Is there anything else I’m possibly missing where I could find even MORE tax-deferred savings? Apparently there is! And as it turns out it has a lot to do with this blog. So all of my blogging friends or people earning any kind of side income may want to listen up … … [Read more...] about Did I Just Find Another Great Retirement Saving Strategy? Understanding the SEP IRA Rules

Traditional vs Roth 401k – Is the Roth Really the Better Deal? Maybe Not!

Check this out. Recently my employer made a big announcement to our 401k plan: We now have the choice to save our money under a Roth option if we want to! If you already have a Roth IRA, then you’re probably already familiar with how this would work. As a quick refresher, the Roth option basically means that: Your contributions to the 401k will be invested using after tax money (i.e. you’ll pay your taxes now rather than later) Your money still grows tax free just like it did in a regular 401k When you finally retire, you DON’T pay any taxes. When you weigh a traditional vs Roth 401k, the Roth is considered to be a good thing for you and your money for a lot of reasons. By paying your taxes now, you’ll enjoy a tax free … [Read more...] about Traditional vs Roth 401k – Is the Roth Really the Better Deal? Maybe Not!

My ULTIMATE Plan for Becoming Financially Independent – December 2013 Update

For weeks I’ve been hinting at it, and at last I’ve finally put it all together! The end of the year and the beginning of the new one is the perfect time to sit down and revise your goals. So what better time than now to publish the latest edition of my ultimate plan for becoming financially independent! This is not a retirement plan you will find anywhere else. How can I make such a bold claim? Because my plan for financial independence does what no other plan on the web does – use real numbers to show just exactly how much money I plan to generate and how I will get there! … [Read more...] about My ULTIMATE Plan for Becoming Financially Independent – December 2013 Update

Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

One of the great things about running a personal finance blog like mine is that sometimes you think you’re right about something. So you publish it. And then you find out very quickly from your audience that you could have done a much better job! Just before Halloween, I published what started out as my valiant attempt to challenge the belief that investing in a 401k plan is the better of the retirement income strategies when you compare it to a regular taxable stock-based account. In case you haven’t read it yet, please feel free to check it out here. While I thought I had put forth a good effort, I was humbly delighted to receive a number of comments that pointed out several flaws with several of the assumptions I used to reach … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

Could Early Retirement Planning Be Ruining Me?

In a lot of ways I think that I’m so much better off for being so active in my own finances and early retirement planning. All around me I see people who have not taken control of their financial future - and it devastates them. They are stuck working at jobs they hate until well into their golden years. They have to miss family engagements. They are under the servitude of others until their health no longer allows them or qualifies them to be. It’s a sad way to go out, and it’s not something that I will ever allow for myself or my family. But despite my best intentions to achieve what others feel is unachievable, Is there a dark side to my obsession with planning for an early retirement? … [Read more...] about Could Early Retirement Planning Be Ruining Me?

Tax Deferred vs Taxable Retirement Income Strategies – How Big Are the Differences Really?

Pop quiz: If you could choose to save $10,000 using one of two retirement income strategies, either a 401k or a regular taxable stock brokerage account, which one would you choose? If you said “401k” (or really any other tax deferred savings account), then that’s what I would have expected you to say. Why? Because that’s what conventional financial planning advice teaches us. We all know that if we want to have a solid retirement income, then we need to max out our tax-deferred savings, let it grow, and then worry about paying the taxes later. And why not? Things like 401k’s and IRA’s are perfectly valid strategies for saving as much as you can and building up your nest egg. So you can imagine my hesitation and apprehension as … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies – How Big Are the Differences Really?

Your Plan for How to Become Financially Independent

If you don’t think you’ll be able to retire early, then YOU are your own biggest problem. The fact that millions of Americans out there are only saving 2% of their income and holding 401k balances less than $100,000 is not an average retirement savings target that you should strive for. That’s just a financial epidemic that you won’t want to have anything to do with. You can do better! In this post we’re going to walk through a step-by-step plan for how to become financially independent with the honest hopes that you will be able to copy of my method and decide for yourself what parts of it will work for you. … [Read more...] about Your Plan for How to Become Financially Independent